The ABI Board of Directors sought and received approval from the General Meeting of Shareholders via written consent on November 30th to adjust the 2024 business plan.

Specifically, ABI reduced its insurance business revenue target by 9% compared to the plan approved by the 2024 Annual General Meeting of Shareholders, from VND 2,634 billion to VND 2,400 billion (a reduction of VND 234 billion).

Source: VietstockFinance

|

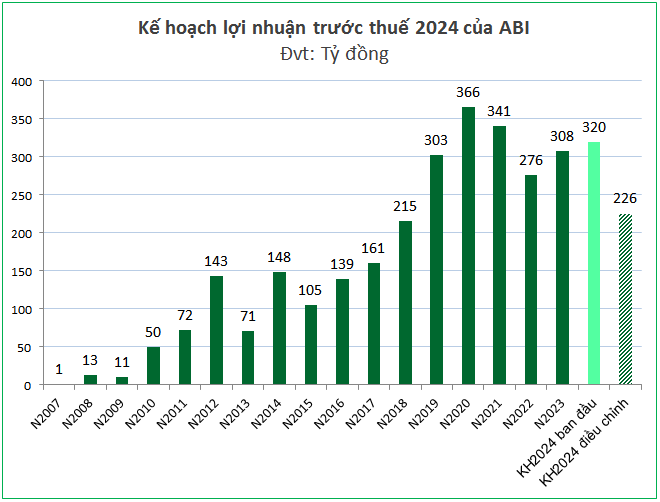

Consequently, the minimum 2024 pre-tax profit plan was decreased from VND 320 billion to VND 226 billion, a reduction of VND 94 billion, or 29.4%, compared to the initial plan. This adjusted profit plan is also 27% lower than the 2023 results.

The target for minimum ROE was thus reduced to 11.8%, down from the initially projected 15%. However, the 2024 dividend payout ratio remains unchanged at a minimum of 14%.

According to the ABI Board of Directors, 2024 has been a challenging year for the insurance industry’s operations in general and the Company in particular.

Specifically, the public crisis surrounding the insurance sector since 2023 shows no signs of abating, reducing society’s demand for insurance. Many insurance products have shown low growth or declined compared to 2023. The 2024 amendment to the Law on Credit Institutions has created difficulties in selling insurance products at the branches of credit institutions.

Furthermore, in early September 2024, Super Typhoon Yagi, considered the strongest storm in 70 years, caused extensive damage to lives and property in most northern provinces from Thanh Hoa province onwards (a region contributing 40% of the country’s GDP). It also disrupted and nearly paralyzed production for enterprises, households, and individuals in a vast area. The recovery process is expected to be challenging and time-consuming, taking a minimum of six months to several years.

The losses from Super Typhoon Yagi directly impacted ABI‘s business operations, making it challenging to achieve the 2024 revenue and profit targets.

| ABI’s Net Profit by Quarter |

Looking back at Q3 2024 – the quarter impacted by Typhoon Yagi, ABI‘s insurance compensation expenses increased by 93% compared to the same period last year, reaching nearly VND 294 billion. This pushed total insurance business expenses up to VND 466 billion, a 56% increase year-over-year. This was the primary reason for ABI‘s net loss of over VND 16 billion in Q3 2024.

| ABI’s 9-Month Net Profit Over the Years |

The setback in Q3 caused ABI‘s cumulative net profit for the first nine months of 2024 to decrease by 39% compared to the same period last year, reaching VND 130 billion. Against the initial minimum pre-tax profit plan, ABI has achieved 51% of the profit target after nine months. Compared to the adjusted plan, ABI has accomplished 72%.

Final Dividend Payout for 2023 Approved

In the resolution seeking written consent from shareholders, the ABI General Meeting of Shareholders also approved the plan to pay the remaining 2023 dividend in cash at a rate of 10%.

Following the approval of the General Meeting of Shareholders, ABI announced that the ex-dividend date for this cash dividend is December 12, 2024. The payment will be made starting from December 24, 2024.

With a payout ratio of 10% and 71.2 million shares currently in circulation, ABI is estimated to distribute over VND 71 billion for this final dividend, completing the total dividend payout of 20% approved by the 2024 Annual General Meeting of Shareholders. With two payment installments (the first installment of 10% paid on August 02, 2024), the total dividend payout for 2023 amounts to over VND 142 billion.

Source: VietstockFinance

|

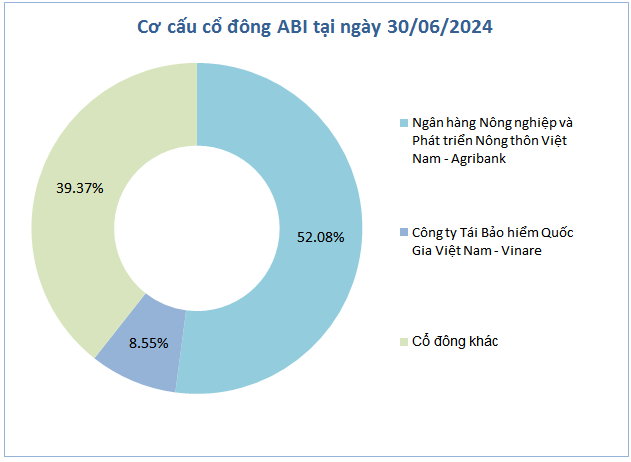

As of June 30, 2024, ABI had two major shareholders holding 60.63% of its charter capital. The Vietnam Bank for Agriculture and Rural Development – Agribank held 52.08% of the capital, while the Vietnam National Reinsurance Corporation – Vinare owned 8.55%. They are estimated to receive over VND 74 billion and VND 12 billion, respectively, in dividends for 2023.