Extraordinary General Meeting of HSC Securities in 2024 was held on the afternoon of 04/12/2024

|

At the meeting, HCM shareholders approved the plan to issue shares to existing shareholders at a ratio of 50%, equivalent to offering nearly 360 million shares. The expected offering price is VND 10,000/share. The proceeds will be used to supplement capital for margin lending activities (70%) and proprietary trading (30%).

Sharing with shareholders, Mr. Trinh Hoai Giang, CEO of HCM, said that at the end of the third quarter, the company was in the bottom ten in terms of large shareholder equity but ranked fourth in terms of loan balance in the market. This indicates that HCM‘s lending capacity is very good. The need to increase lending capacity and offer new services such as non pre-funding transactions requires the company to raise capital.

In addition, with the proceeds from the offering, HCM will further participate in the bond market to provide asset management products.

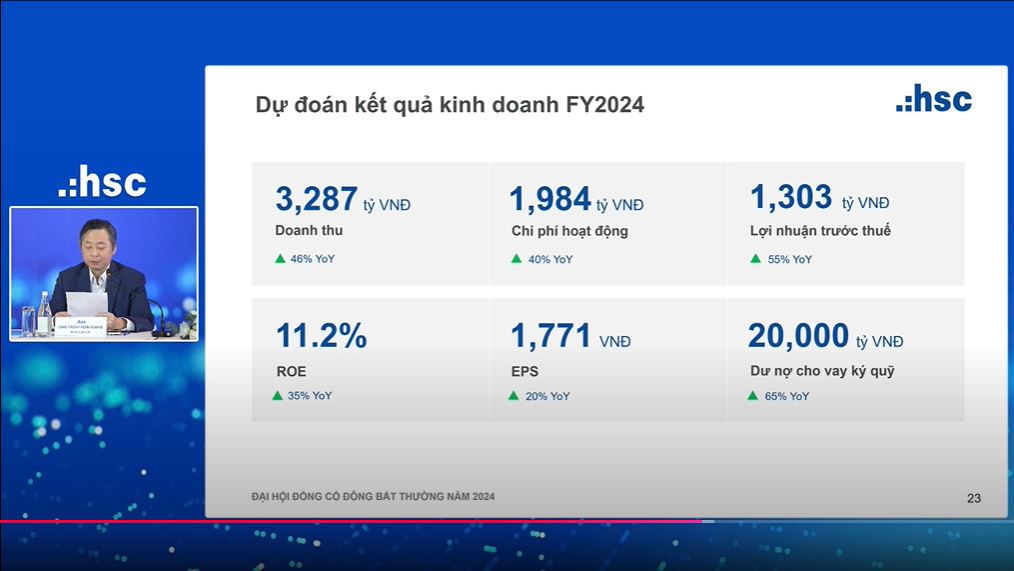

Mr. Trinh Hoai Giang, CEO of HSC, shared the company’s predicted business results for 2024

|

Answering shareholders’ questions about the capital increase, Mr. Trinh Hoai Giang stated that the capital increase is necessary and urgent. Instead of presenting it at the General Meeting in April of the following year, the company decided to propose it in December of this year. There are two reasons for this: first, HSC has almost reached the legal lending limit. Although the market is currently weak, investors’ demand for borrowing is very high. If the market experiences a strong upturn, the demand will be even higher. Therefore, the company decided to raise capital as soon as possible.

Second, since November 2nd, a new service, non pre-funding for foreign investors, has been introduced to the market, and HSC needs to prepare for this product. Although there have been no cases of late payment by foreign investors so far, there should be room for maneuver in case of risks.

Regarding future capital increases, Chairman of the Board of Directors, Johan Nyvene, shared that with the orientation of becoming a billion-dollar company, HCM needs to have a corresponding capital scale. Vietnam’s financial market will continue to develop, and this is also the focus of the government’s plan. Going forward, the stock market needs to be upgraded from frontier to emerging status, which poses challenges in competing with domestic and global institutions. Therefore, HCM will have more capital increases, with the timing depending on market conditions and business strategies.

HSC Securities Approves Plan to Increase Charter Capital by VND 3.6 Trillion

On December 4, 2024, Ho Chi Minh City Securities Corporation (HSC) successfully held an Extraordinary General Meeting of Shareholders to approve a plan to issue shares to existing shareholders to raise its charter capital by VND 3,600 billion.

MB Securities to Issue Nearly 26 Million MBS Shares

Investors will subscribe for over 25.7 million MBS shares of MB Securities from November 20, 2024, to 3:00 PM on November 28, 2024.