Specifically, MIG plans to offer 25.9 million shares, equivalent to a 15% issuance rate of the total outstanding shares. Accordingly, shareholders owning 100 shares will have the right to purchase 15 new shares at VND 10,000/share. The shares offered to existing shareholders are freely transferable.

The remaining unsold shares after the offering will be decided by MIG’s Board of Directors to sell to other investors with demand (not excluding existing shareholders) at a price equal to the offering price to existing shareholders to ensure the full issuance of the offered shares. However, these shares will be restricted from transfer for one year from the end of the offering period.

| MIG share price movement from the beginning of 2024 to the morning session of 05/12 |

On the stock market, MIG shares are currently trading at VND 18,850/share (morning session), 89% higher than the offering price.

Assuming that the closing price of MIG shares on the latest trading day before the ex-rights date is also at VND 18,850/share, the reference price of MIG shares on the ex-rights date (09/12) will be adjusted to VND 17,696/share.

In the case that the closing price of MIG shares on the latest trading day before the ex-rights date is lower than the issuance price, the reference price of MIG shares on the ex-rights date will not be adjusted.

|

Source: VietstockFinance

|

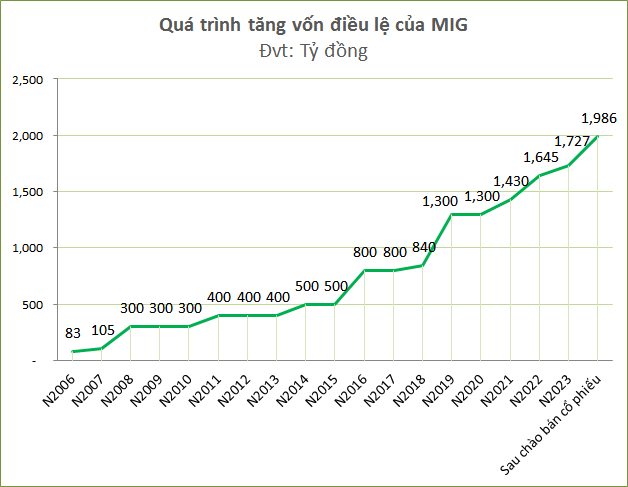

After the issuance, MIG’s charter capital will increase by VND 259 billion, from VND 1,726 billion to over VND 1,986 billion.

According to MIG, the increase in charter capital is important to help the company improve profitability. Specifically, according to Clause 4, Article 33 of Circular No. 67/2023/TT-BTC dated November 02, 2023, the maximum liability retention for each risk or for each individual loss shall not exceed 10% of the owner’s equity for the reinsurance business. Therefore, capital supplementation helps MIG increase the retention level for effective insurance contracts and businesses, thereby increasing profits.

Another reason for the capital increase is to enhance bidding capacity. Currently, MIG faces difficulties in competing for large-scale project bids. The capital increase creates a premise to improve the international credit rating and enhance MIG’s financial capacity, which are necessary conditions for MIG to meet the participation requirements and increase the chances of winning large and key projects.

Additionally, the capital increase helps MIG comply with the regulations on the solvency margin (the current capital scale is still low, not commensurate with the rapid growth target of original insurance premiums) and improve operational capacity (capital supplementation for investment in technology projects and transformation according to strategic initiatives for the period of 2022-2026).

Accordingly, the amount of more than VND 259 billion obtained from the offering to existing shareholders will be used by MIG for the following purposes, in order of priority: Investment in systems, technology, and assets (VND 100.5 billion); Investment of 100% in term deposits and certificates of deposit with a term of 06 months to a maximum of 24 months at eligible credit institutions, depending on market conditions (VND 158.5 billion). The disbursement time for capacity improvement investment is expected to be after the end of the offering period until the end of 2026, while the investment in term deposits is expected to be in 2024-2025 after the end of the offering.

|

Source: VietstockFinance

|

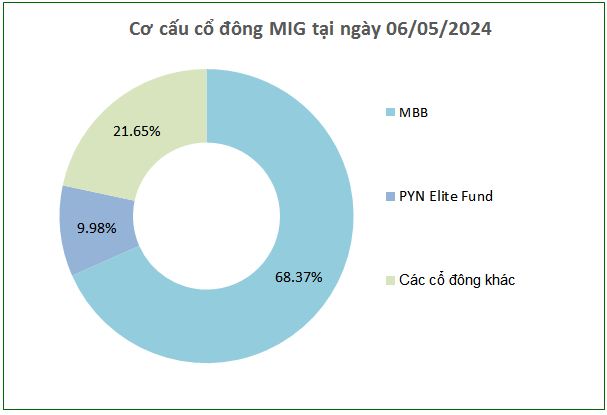

According to the list of major shareholders as of May 06, 2024, Military Commercial Joint Stock Bank (HOSE: MBB) is the largest shareholder of MIG, holding 68.37% of capital (118.06 million shares). Therefore, after the offering, MBB is expected to increase its minimum ownership in MIG to 135.8 million shares.

Regarding the second largest shareholder, PYN Elite Fund, a foreign fund, currently holds 9.98% (corresponding to more than 17.2 million shares). After the offering, the minimum number of shares will be 19.8 million.

| MIG’s net profit for the first nine months over the years |

In terms of business results, in the first nine months of 2024, MIG recorded an insurance business profit of over VND 349 billion, down 3% compared to the same period last year, while financial investment income increased by 18%, reaching nearly VND 235 billion. Net profit reached over VND 158 billion, down 7% year-on-year.

For the full year 2024, MIG set a pre-tax profit target of VND 440 billion, up 25% compared to 2023. The company has achieved 47% of its annual profit target after the first nine months.

NTH Approves 10% Interim Dividend

With two dividend payments of 10% each in 2024, the Water Power Joint Stock Company (HNX: NTH) is set to make one more dividend distribution to meet its 2024 dividend plan. The company aims to deliver a total dividend yield of 30%, as proposed at the 2024 Annual General Meeting of Shareholders.

HSC Securities Approves Plan to Increase Charter Capital by VND 3.6 Trillion

On December 4, 2024, Ho Chi Minh City Securities Corporation (HSC) successfully held an Extraordinary General Meeting of Shareholders to approve a plan to issue shares to existing shareholders to raise its charter capital by VND 3,600 billion.