Cash flow weakened as the VN-Index consolidated between 1,200 and 1,300 points throughout 2024. The index touched the 1,300 mark several times but failed to break through.

Meanwhile, foreign investors recorded strong net selling since the beginning of the year. On the HOSE and HNX exchanges, foreign investors withdrew a total of more than VND 12 trillion in November and nearly VND 91 trillion in the first eleven months of 2024.

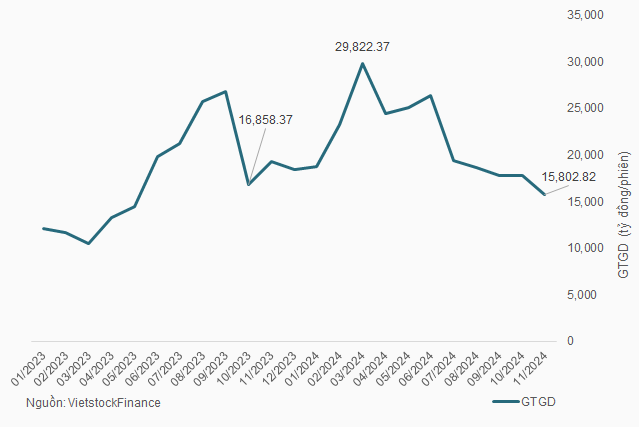

By November, securities trading on the three exchanges HOSE, HNX, and UPCoM reached just over VND 15.8 trillion per session, losing nearly half of its value compared to the most vibrant month of 2024. In March 2024, the average trading value of the entire market reached nearly VND 30 trillion.

This was also the month with the lowest average trading value in the market in more than a year, lower than the VND 16.8 trillion in October 2023.

|

Average Trading Value in the Vietnamese Stock Market

|

|

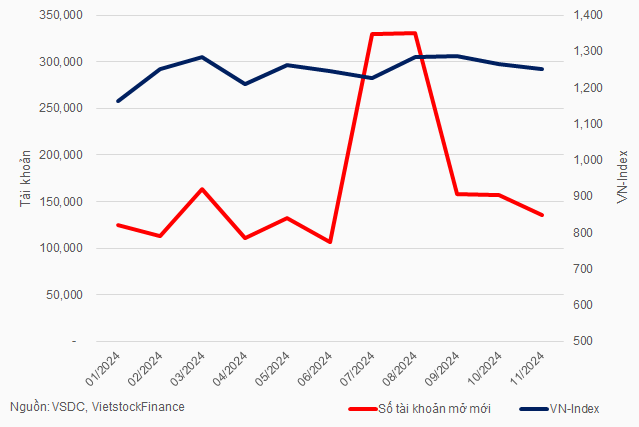

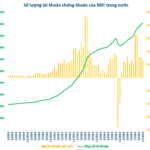

New Account Openings and VN-Index in 2024

|

The dwindling cash flow trend raised concerns about the lending business of securities companies.

At the Extraordinary General Meeting of Ho Chi Minh City Securities Corporation (HSC, HOSE: HCM) held on December 04, in response to a challenging question from a shareholder, CEO Trinh Hoai Giang provided forecasts for the lending segment in the coming period.

According to the CEO, liquidity could remain low in the near future, possibly dropping to around VND 15 trillion per session in the next year. With such market conditions, margin lending demand will likely weaken but won’t plummet as investors still hold expectations for the market. Mr. Giang emphasized: “The demand won’t explode, but it will remain high.”

Mr. Trinh Hoai Giang – CEO of HSC Securities

|

With this forecast, HCM has prepared for both scenarios of weak and strong margin lending demand. The company focuses on lending for fundamentally strong stocks, ensuring high-quality assets for its customers, and expects lending demand to continue growing.

Currently, customers are not afraid of a market collapse, unlike a decade ago. If the market faces risks, customers remain confident as most are professional investors. They can choose to short derivatives futures contracts instead of selling stocks. This allows investors to increase their leverage.

At the meeting, HCM shareholders approved the plan to issue shares to existing shareholders at a ratio of 50%, equivalent to offering nearly 360 million shares. The expected offering price is VND 10,000 per share. The proceeds will be used to supplement capital for margin lending activities (70%) and proprietary trading (30%).

The company’s management board considers capital raising to be essential and urgent. Instead of presenting it at the Annual General Meeting in April next year, the company decided to propose it in December of this year. There are two reasons for this decision: First, HSC is approaching the lending limit stipulated by law. Although the market is currently weak, investors’ capital demand is very high.

If the market experiences a strong uptrend, this demand will be even higher. Therefore, the company aims to raise capital as soon as possible.

Second, since November 2, a new service, non pre-funding for foreign investors, has been introduced, and HSC needs to prepare for this product. Although there have been no cases of foreign investors violating late payment regulations, there must be room for risk prevention.

The Stock Market’s Top-Tier Stocks: Attractively Priced, with a Strong Outlook for Q4 Profits

The analyst team handpicks industry-leading enterprises with reasonable valuations, anticipating positive Q4 and full-year 2024 financial performance.

The Stock Market Shakes: New Account Openings Hit 5-Month Low

As of the end of November, there were close to 9.1 million domestic individual investor accounts, equivalent to approximately 9% of the population. This highlights a significant portion of individuals actively engaging in the country’s financial landscape.