On December 3rd, JSC Song Da 6 (SD6) announced a resolution approving the adjustment of the time frame for paying the remaining 5% cash dividends for 2015 and the first 5% for 2016.

Consequently, the company postponed the dividend payment deadline by one year. According to the previously approved plan, the dividend payment date was December 31st, 2024. The adjusted schedule for paying the aforementioned 10% is now December 31st, 2025.

The reason for this change is the company’s inability to arrange funds for payment as per the approved plan. SD6 is estimated to pay approximately VND 34.77 billion in dividends for the 10% stake.

As a result, after more than 8 years, SD6 has yet to settle the dividends from 2016.

JSC Song Da 6, formerly known as Hydraulic Construction Company, is a subsidiary of Song Da Corporation, established on May 1st, 1983. The company underwent privatization and transformed into a joint-stock company on January 1st, 2006. Currently, Song Da Corporation holds 65% of SD6’s charter capital.

SD6’s primary business is the construction of hydroelectric, irrigation, transportation, civil, and industrial projects, among others.

Some notable projects that the company has participated in include the Hoa Binh, Son La, and Lai Chau Hydropower Plants, the Ngang Pass Road Tunnel, the Cat Linh – Ha Dong Elevated Railway in Hanoi, and the 18T1 – HH6 Building in the Nam An Khanh Urban Area.

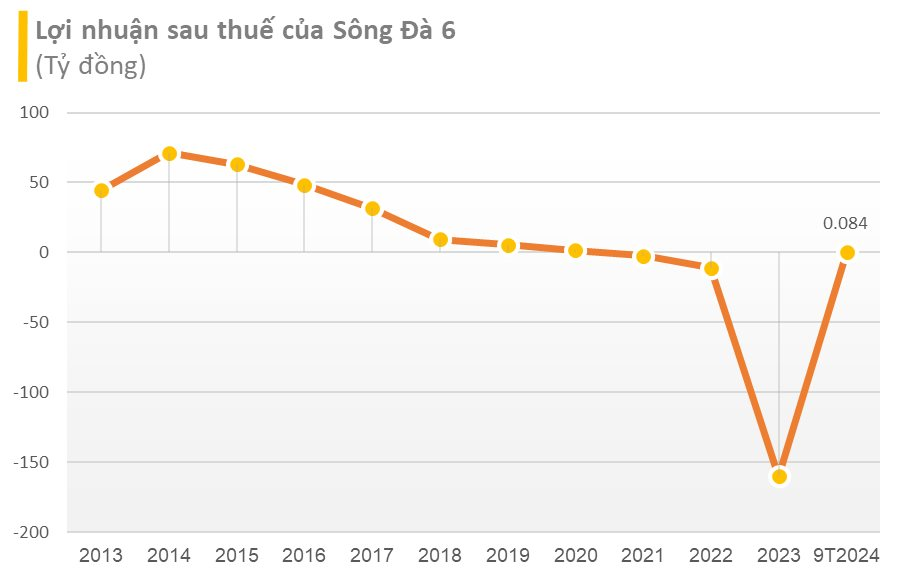

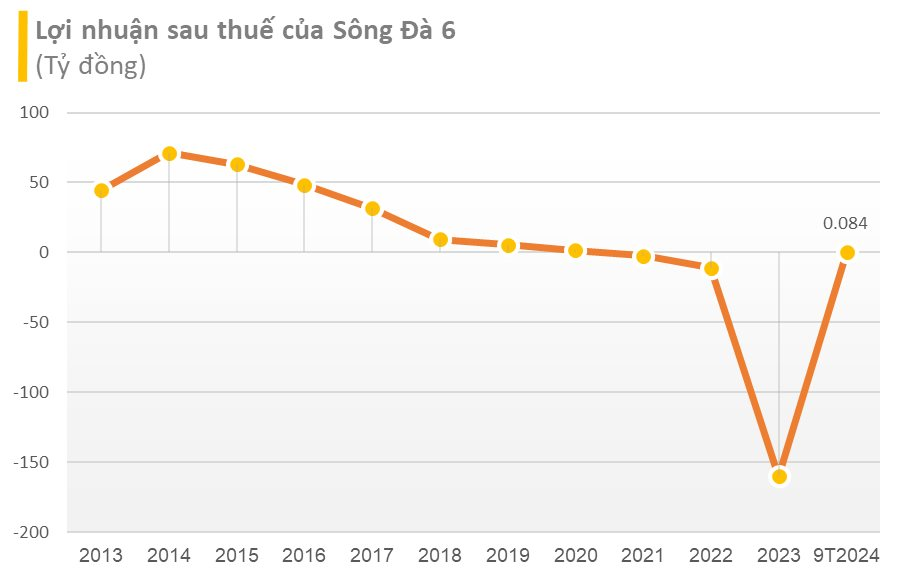

In terms of financial performance, after five consecutive quarters of losses, SD6 returned to profitability in Q3 2024. Specifically, the company’s revenue for this quarter was nearly VND 31 billion, a 31% decrease compared to the same period last year. However, a significant reduction in cost of goods sold, financial expenses, and management expenses helped SD6 achieve a post-tax profit of over VND 12 billion, while the previous year incurred a loss of VND 40 billion.

For the first nine months of 2024, the company recorded a revenue of VND 88.6 billion, a 10% decrease year-on-year. The post-tax profit for the nine months was VND 83.6 million, compared to a loss of over VND 75 billion in the same period last year. The accumulated loss as of Q3 was nearly VND 277.7 billion.

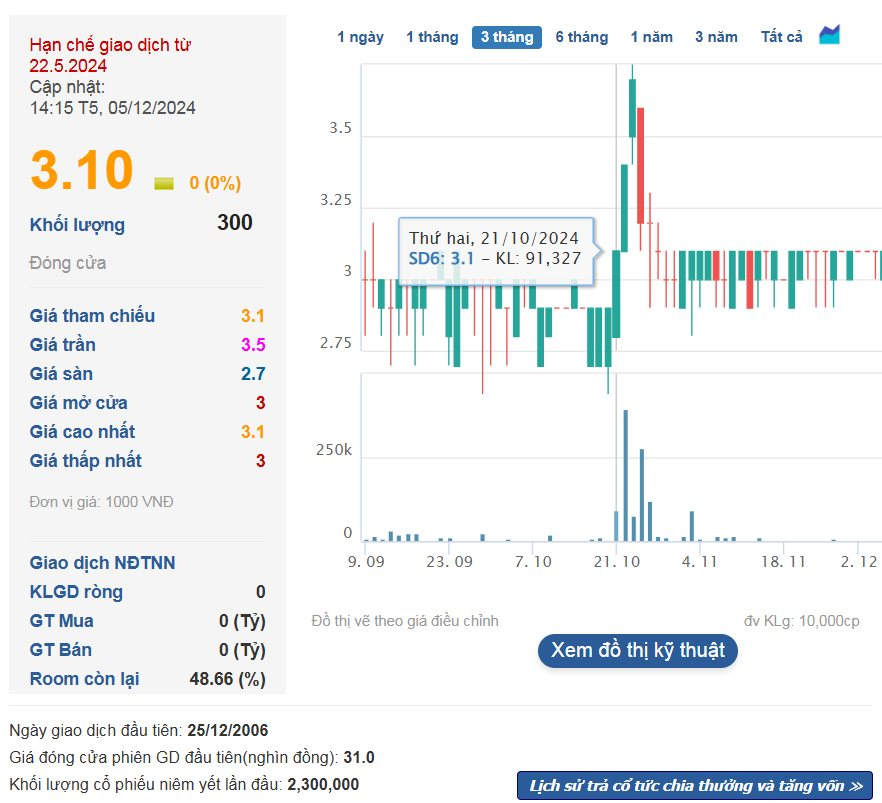

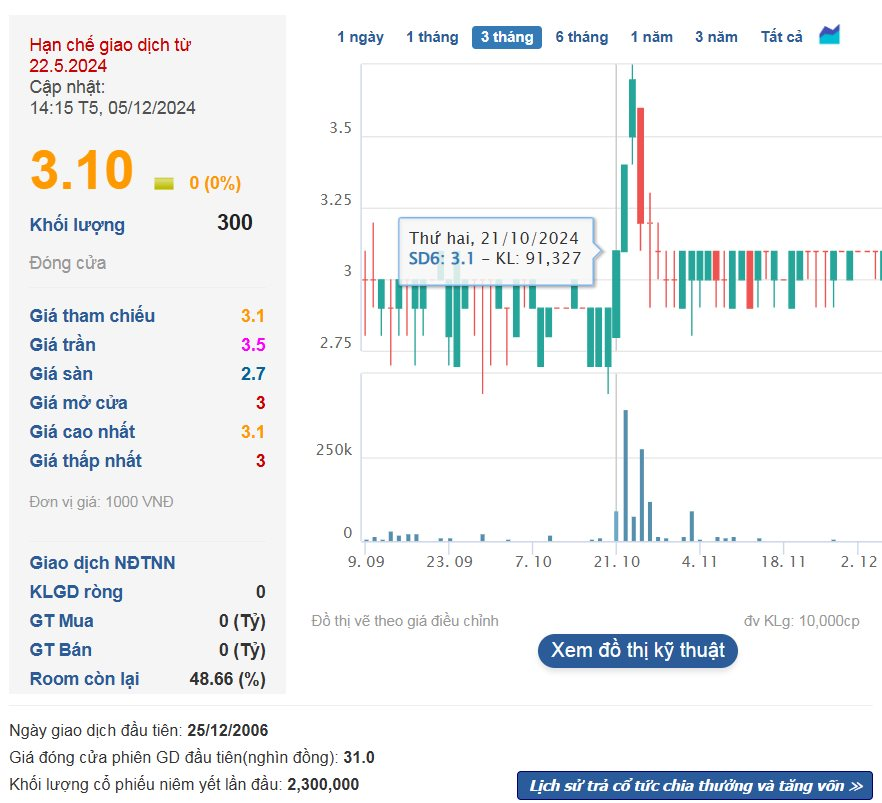

In the stock market, SD6 was delisted on August 23rd, 2024, due to consecutive years of losses in 2021, 2022, and 2023. Subsequently, in early September, more than 34.77 million SD6 shares were transferred to the UpCOM market for trading.

The company’s primary business is the construction of hydroelectric, irrigation, transportation, civil, and industrial projects.

Some notable projects that the company has participated in include the Hoa Binh, Son La, and Lai Chau Hydropower Plants, the Ngang Pass Road Tunnel, the Cat Linh – Ha Dong Elevated Railway in Hanoi, and the 18T1 – HH6 Building in the Nam An Khanh Urban Area.

In terms of financial performance, after five consecutive quarters of losses, SD6 returned to profitability in Q3 2024. Specifically, the company’s revenue for this quarter was nearly VND 31 billion, a 31% decrease compared to the same period last year. However, a reduction in cost of goods sold, financial expenses, and management expenses helped SD6 achieve a post-tax profit of over VND 12 billion, while the previous year incurred a loss of VND 40 billion.

For the first nine months of 2024, the company recorded a revenue of VND 88.6 billion, a 10% decrease year-on-year. The post-tax profit for the nine months was VND 83.6 million, compared to a loss of over VND 75 billion in the same period. The accumulated loss as of Q3 was nearly VND 277.7 billion.

In the stock market, SD6 was delisted on August 23rd, 2024, due to consecutive years of losses. Subsequently, in early September, more than 34.77 million SD6 shares commenced trading on the UpCOM market.