Inside a TNG Factory

|

The bonds issued in this tranche have a four-year term with quarterly interest payments. The interest rate for the first four interest periods is set at 9.5% per annum and will subsequently float, referencing the average savings rate of state-owned banks plus a margin of 3.5% per annum.

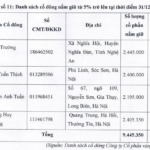

The collateral for the bonds is 10 million TNG shares owned by Mr. Nguyen Van Thoi, the company’s chairman.

Despite an increase in the debt-to-equity ratio, the long-term capital raised from the successful bond issuance can help balance the capital structure of the enterprise.

According to the offering registration statement, TNG plans to use the proceeds from the bond issuance to pay employee salaries and purchase raw materials and services. This implies an increase in current assets.

As of the end of the third quarter of this year, TNG‘s net working capital was negative, with short-term assets of VND 2,310 billion while short-term liabilities amounted to VND 2,570 billion. In addition to the bonds, the company, headquartered in Thai Nguyen, also has significant bank borrowings, mainly short-term.

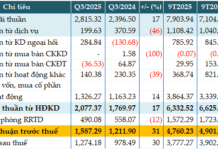

In terms of financial performance, TNG achieved record results in Q3 2024 in terms of both revenue and profit.

The Golden Exodus: A Mining Company’s Leadership Transition

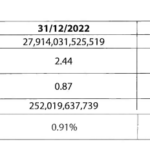

Despite a challenging economic landscape, Vàng Lào Cai has persevered through difficult times. From 2020 onwards, the company experienced a hiatus in sales and service revenue, culminating in a challenging year in 2023, with a loss of nearly 14 billion VND. As of the end of 2023, the cumulative loss exceeded 113 billion VND.

The Thuduc House CEO Steps Down

Mr. Nguyen Hai Long was appointed as the new CEO of Thuduc House JSC in mid-April 2024, succeeding Mr. Dam Manh Cuong.