Asean Securities JSC (AseanSc) has announced that it seeks shareholder approval for its plan to offer shares to existing shareholders.

According to the plan, the list of shareholders participating in the opinion poll will be finalized on December 6, 2024, after which shareholders will provide their opinions and submit the poll forms to AseanSc no later than 4:00 PM on December 17, 2024.

Specifically, the Board of Directors proposes to the General Meeting of Shareholders to approve the plan to increase capital by offering 50 million shares to existing shareholders. The entitlement ratio is 2:1, meaning that for every 2 shares owned, shareholders will be entitled to buy 1 new share.

The offering price will not be lower than VND 10,000 per share, with a maximum expected offering value of VND 500 billion.

All shares offered to existing shareholders will not be restricted from transfer. Any remaining shares that are not purchased during this offering will be offered to other shareholders or investors and will be subject to a one-year transfer restriction from the end of the offering period.

The offering period is scheduled for 2024 – 2025, subject to the actual situation and approval from the competent state authorities.

If the offering of 50 million shares is successful as planned, AseanSc’s charter capital will increase from VND 1,000 billion to VND 1,500 billion.

Source: AseanSc

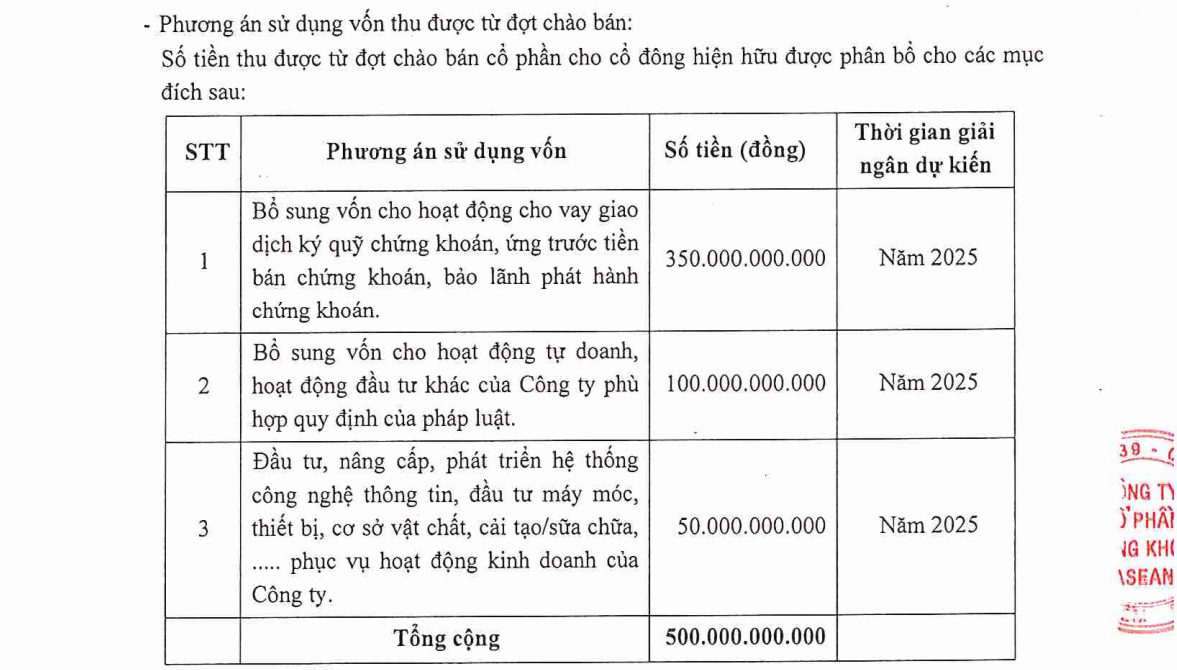

With the expected proceeds of VND 500 billion from this offering, AseanSc plans to allocate VND 350 billion to supplement capital for securities lending, pre-sale of securities, and underwriting activities. VND 100 billion will be used for proprietary trading and other investment activities in accordance with legal regulations, and VND 50 billion will be invested in upgrading information technology systems, machinery, equipment, and improving physical infrastructure to support the company’s business operations.

The disbursement is expected to take place in 2025.

Prior to this, AseanSc’s latest capital increase was in 2017, when its charter capital increased from VND 500 billion to VND 1,000 billion.

“MIG Shareholders’ Privilege: Exercising Share Purchase Rights at a 15% Ratio.”

The Military Insurance Joint Stock Corporation (HOSE: MIG) has announced a shareholder registration date for the renounceable rights issue, offering a 15% subscription ratio. The record date has been set for 9th December 2024, with the entitlement date being one day prior.

HSC Securities Approves Plan to Increase Charter Capital by VND 3.6 Trillion

On December 4, 2024, Ho Chi Minh City Securities Corporation (HSC) successfully held an Extraordinary General Meeting of Shareholders to approve a plan to issue shares to existing shareholders to raise its charter capital by VND 3,600 billion.