DNSE Securities Joint Stock Company (code DSE, on HoSE) has just announced Resolution No. 22/2024/NQ-HĐQT-DNSE to amend and supplement Resolution No. 19/2024/NQ-HĐQT-DNSE dated September 5, 2024, on the plan to offer bonds to the public.

Specifically, DNSE Securities plans to offer 3 million bonds with the code DSEH242601, with a par value of VND 100,000/bond, thus mobilizing VND 300 billion. The bonds will have a term of 24 months from the date of issuance.

The bonds will have a combined fixed and floating interest rate. The first two interest calculation periods will have a fixed interest rate of 8.5%/year. For the remaining interest calculation periods, the floating interest rate will be calculated as the sum of 3.5% and the reference interest rate for that period.

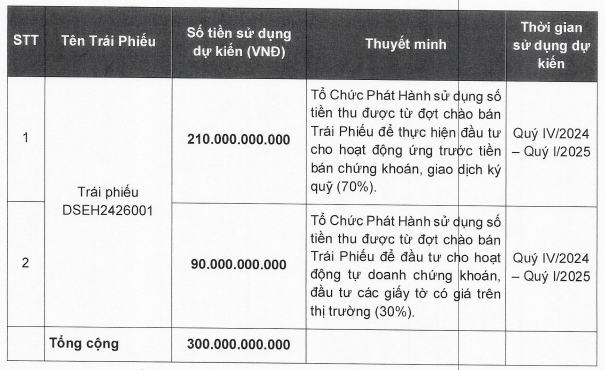

The expected offering and issuance time has been changed from Q3-Q4/2024 to Q4/2024 – Q1/2025, after obtaining the approval of the State Securities Commission. The time of using the proceeds from the offering has also been pushed back from Q3-Q4/2024 to Q4/2024 – Q1/2025.

Purpose of using proceeds from the bond offering. Source: DSE

In another development, on December 19, DNSE Securities is expected to pay an interim dividend for 2024 in cash at a rate of 5%, equivalent to VND 500/share. With 330 million shares currently in circulation, DNSE is estimated to spend VND 165 billion on this interim dividend payment to shareholders.

Earlier, at the 2024 Annual General Meeting of Shareholders held in April 2024, the Company approved a plan to pay a maximum dividend of 10% in cash (VND 1,000/share). This dividend rate is higher than the 5% rate in 2023 and 2% in 2022.

In terms of business results, in Q3/2024, DNSE Securities recorded operating revenue of over VND 193.7 billion, up 12% over the same period. Operating expenses were nearly VND 107.6 billion, up slightly by 4%, while enterprise management expenses were over VND 31.7 billion, up 76% over the same period.

As a result, DNSE Securities reported a net profit of nearly VND 44.4 billion in Q3/2024, up 10% over the same period last year.

For the first nine months of the year, DSE recorded operating revenue of VND 573 billion, up 14.5%. After-tax profit stood at VND 148.6 billion, up 13% over the same period in 2023.

The Ultimate Cash Flow: Vicostone Prepares to Dish Out an Impressive 320 Billion VND in Dividends

“Vicostone Joint Stock Company (HNX: VCS) has announced a cash dividend of 2/2024, with a record date of December 12, 2024. As the direct holder of over 84% of VCS’s capital, Phenikaa Group stands to benefit significantly from this distribution.”

The Ultimate Guide to F88’s 7th Bond Issue This Year: Unlocking the Secrets to Their Success

From November 21st to 27th, F88 successfully offered 1,000 bonds with the code F88CH2425007 at a par value of VND 100 million per bond, raising a total of VND 100 billion. This was the seventh bond lot issued by F88 since the beginning of the year.