As we reflect on 2024, the VN-Index largely hovered between 1,200 and 1,300 points. The 1,300-point mark proved to be a strong resistance level for the index, as it turned back five times amid increased selling pressure, which impacted investor sentiment and expectations. On the flip side, the 1,200-point region served as a solid support level, with consistent buying interest from domestic investors.

This market behavior wasn’t entirely unexpected, given the mixed bag of macro factors and investment flows. Globally, stock markets contended with geopolitical tensions in the Middle East, economic downturns in several major economies, a frozen Chinese real estate market, and monetary policy adjustments by central banks like the Fed and ECB, creating an air of uncertainty.

Carry trade strategies, which gained popularity this year, contributed to a sharp decline in Asian equities, indirectly affecting Vietnam’s stock market. However, several positive developments countered these challenges, including soft landings in some economies that averted a global recession, a shift towards renewable energy, and the momentum of technological innovations (AI, blockchain, big data, cloud computing) offering expanded opportunities for countries like Vietnam.

Domestically, Vietnam maintained its reputation for macroeconomic stability, high growth rates, and attractive FDI inflows, all while keeping interest rates low. The economy is undergoing a digital transformation, evident from the visits and collaboration proposals of global tech giants like Nvidia, Amazon, Google, Intel, Microsoft, Tesla, and Apple. Additionally, leading companies from Singapore, India, Japan, and South Korea have been actively investing in Vietnam, reinforcing its appeal.

However, challenges remain. Vietnam faces rising inflationary pressures, a reliance on exports and FDI, escalating exchange rates, and a banking system burdened by bad debts, partly due to the precarious real estate market. The stock market also contends with unknowns, such as Trump’s unexpected victory in the US presidential election and the potential return of carry trade strategies, making it challenging for analysts to predict the investment outlook for 2025.

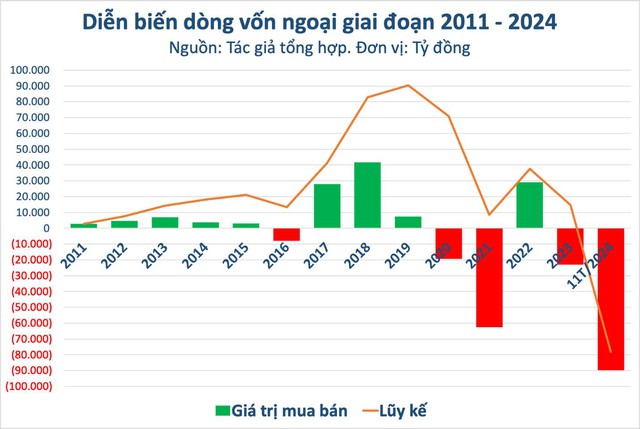

Diving into the investment flows, the dominant narrative of 2024 was the record foreign net selling, despite Vietnam’s progress toward meeting the FTSE Russell’s criteria for market status upgrade after removing the prefunding requirement. In the first eleven months, foreign investors withdrew nearly VND 90,000 billion from the Vietnamese stock market, and this trend shows no signs of abating. Domestic individual investors have been the counterparty to this foreign selling pressure.

Given the stock market’s uncertainties, stemming from both macro factors and investment flows dynamics, VPBank Securities will host VPBankS Talk 04, themed “Staying Resilient through the Storm,” on December 16 in Hanoi. The event will feature two main discussion panels: one focusing on the macro landscape and market outlook and the other on the prospects of key sectors for 2025.

The conference aims to provide foundational insights for investors, offering a clearer vision of the stock market’s trajectory in the coming year and answering the pressing question of “what to invest in” for 2025. Renowned experts from VPBankS Research will be present, along with guest speakers who are seasoned professionals in macroeconomics, banking, and listed companies, ensuring a holistic perspective for attendees.

For more information and to register, please visit this link.

VPBankS Talk is a biannual event designed to support VPBankS clients and the broader investment community. In line with our mission of “For a Prosperous Future,” VPBankS continuously develops investment support tools, such as the NEO Invest app, and offers attractive transaction fee promotions and margin trading facilities. We recently co-hosted “The Investors,” an inspirational talk show featuring prominent figures in the securities and fund management industry, which reached millions of investors and garnered hundreds of millions of views across media and social media platforms.

The Good News: Foreigners Change Course, Pouring Nearly VND 700 Billion into Vietnam Stocks – What’s the Focus?

In the afternoon trading session, HPG stock witnessed the largest foreign buying on HOSE, with a value of VND 127 billion. Following closely, MSN, FPT, and SSI stocks each experienced net buying of over VND 70 billion.

The Vietnamese Stock Market Soars: A Surprising Rise to the Top in Asia

The Vietnamese stock market witnessed an unexpected surge in trading activity, with the VN-Index leading gains across Asia. This rally was characterized by a significant jump in trading volume and a return to net buying by foreign investors, setting the stage for a potential shift in market dynamics and investor sentiment.