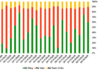

This week, 23 enterprises announced a dividend payout with 19 opting for cash dividends, 3 for stock dividends, and 1 opting for additional share issuance.

Racing to Buy

Mr. Nguyen Ba Sang, Chairman of the Board of Directors of An Gia Investment and Development Joint Stock Company (stock code: AGG), registered to purchase 30,832,630 AGG shares to restructure his investment portfolio.

Mr. Nguyen Ba Sang registered to buy 30,832,630 AGG shares.

If the transaction is successful, Mr. Sang’s ownership in An Gia will exceed 42.5 million shares, representing a 26.12% stake. The transaction will be executed by repurchasing shares from the seller, Truong Giang Management and Investment Joint Stock Company, with the expected transaction period being from December 5, 2024, to January 1, 2025.

Prior to this, Truong Giang Management and Investment Joint Stock Company registered to sell all of their 37,624,852 AGG shares to reduce their ownership to 0%. It is estimated that Mr. Sang will spend approximately VND 460 billion to buy the registered amount of AGG shares.

Ms. Nguyen Thi Thom, Chairwoman of the Board of Directors of 911 Group Joint Stock Company (stock code: NO1), registered to purchase 600,000 NO1 shares to increase her ownership to 2.5% of the charter capital. The transaction is expected to take place from December 6 to December 27, 2024. If the transaction is successful, Ms. Nguyen Thi Thom and related parties will own over 8.28 million NO1 shares, equivalent to 34.51% of the charter capital.

On November 23, 2024, the 911 Group appointed Ms. Thom as Chairwoman of the Board of Directors and legal representative for the term 2020-2025. Ms. Thom, 41 years old, holds a Bachelor’s degree in Accounting. She joined the 911 Group in March 2011 and has since held various positions.

During the same period, from December 6 to December 27, 2024, Mr. Nghiem Duc Thuan, Member of the Board of Directors and Vice President, will also register to buy 20,000 shares to increase his ownership to 0.17% of the charter capital.

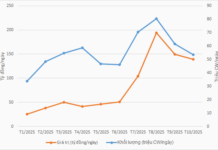

BAF shares have increased by 43.6%, prompting Mr. Luong Xuan Hai to sell.

Mr. Luong Xuan Hai, the brother-in-law of Ms. Bui Huong Giang, CEO of BaF Vietnam Agriculture Joint Stock Company (stock code: BAF), registered to sell 57,000 BAF shares to reduce his ownership to 767 shares. The transaction is expected to take place from December 4, 2024, to January 1, 2025. Recently, BAF shares have increased by 43.6%, from VND 17,300 to VND 24,850 per share.

Who Owns Sacombank?

Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank, stock code: STB) has just announced a list of shareholders owning a ratio of 1% or more, including 4 organizations and 1 individual, holding a total of over 267.5 million STB shares, equivalent to 14.2% of Sacombank’s capital.

Among them, the only individual on the list is Mr. Duong Cong Minh, Chairman of the Board of Directors of Sacombank, with more than 62.56 million STB shares, equivalent to 3.32% of the capital. A person related to Mr. Minh is Ms. Duong Thi Liem (his sister) who owns 11.86 million shares, equivalent to 0.63% of STB capital. Thus, the total ownership of Mr. Minh and his sister at Sacombank is 74.4 million shares, or 3.95% of the capital.

The organization with the largest holding of Sacombank shares is Pyn Elite Fund, with 125.9 million STB shares, equivalent to a 6.68% stake. This investment also accounts for the largest proportion in the portfolio of this foreign fund, at 20%.

Mr. Duong Cong Minh, Chairman of the Board of Directors of Sacombank, holds over 62.56 million STB shares.

The remaining three organizations with over 1% ownership include Tianhong Vietnam Thematic Fund (QDII) holding 30.25 million shares (1.71% of capital), SCB Vietnam Alpha Fund Not For Retail Investors owning 25.55 million shares (1.36% of capital), and Norges Bank holding 20.4 million shares (1.13% of capital).

On December 20, 2024, Nam Kim Steel Joint Stock Company (stock code: NKG) will finalize the list of shareholders for the public offering of shares and capital increase from owner equity.

Regarding the bonus share plan, NKG will issue shares at a ratio of 20%, meaning that for every 100 shares owned, shareholders will receive 20 new shares. Thus, the company will issue an additional 52.66 million shares.

For the share offering plan, NKG will offer shares to existing shareholders at a ratio of 2:1, meaning that for every 2 shares owned, shareholders will receive 1 new share at a price of VND 12,000 per share. The registration and purchase period will be from December 31, 2024, to January 24, 2025.

City Auto Joint Stock Company (stock code: CTF) has accepted the resignation of Mr. Nguyen Dang Hoang as CEO. Conversely, CTF has elected Mr. Tran Lam as the new CEO.

Mr. Tran Lam, 41 years old, is the son of Mr. Tran Ngoc Dan, Chairman of the Board of Directors of City Auto. Currently, Mr. Lam is a Member of the Board of Directors of City Auto and Saigon Passenger Car Company, as well as the CEO of Tan Thanh Do Group.

City Auto appoints a new CEO.

Mr. Lam currently owns more than 7.5 million CTF shares, representing 8.4% of the charter capital. Thus, he is the third-largest shareholder in City Auto, after his father, Mr. Dan (9.23% of capital), and a related organization, Tan Thanh Do Group (8.42% of capital).

December 13, 2024, will be the record date for Pharmedic Pharmaceutical and Medicinal Materials Joint Stock Company (stock code: PMC) to finalize the list of shareholders for the first cash dividend payment, with a ratio of 55%/share, meaning that for every 1 share owned, shareholders will receive VND 5,500. The payment will be made on December 25, 2024.

Subsequently, PMC will also finalize the record date for the second supplementary dividend payment on February 19, 2025, with a ratio of 54%. The payment date is set for February 28, 2025. Thus, the total dividend payout ratio is 109%.

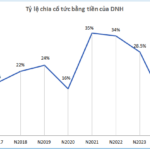

DNH Approves 12% Interim Dividend

This time, the dividend payout ratio matches the target dividend approved at the 2024 Annual General Meeting of Shareholders of Da Nhim – Ham Thuan – Da Mi Hydropower Joint Stock Company (UPCoM: DNH).

Handico6 Switches Dividend Payout from Stock to Cash

The Hanoi No. 6 Housing Investment and Development JSC (Handico6, UPCoM: HD6) has just announced a cash dividend for the year 2023. The record date for this dividend is set as December 9, 2024, meaning that shareholders who own the stock on this date will be eligible to receive the dividend payment.

“Funded by Bill Gates’ Foundation, Omachi and Chin-su Manufacturer Soars: Triples in Value This Year, Enters Top 10 Biggest Companies in the Stock Market”

With impressive business results and an exciting IPO and uplisting journey, MCH’s stock has soared over the past year.

PSP Pays Dividends After Two Years, Prepares for Extraordinary General Meeting

PetroVietnam Dinh Vu Port Joint Stock Company (UPCoM: PSP) is pleased to announce a cash dividend for the fiscal year 2023. Shareholders of record on November 27, 2024, will receive a dividend of 2% of the par value, equivalent to VND 200 per share. The payment date is scheduled for December 27, 2024.