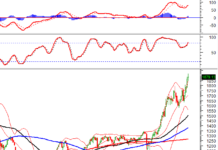

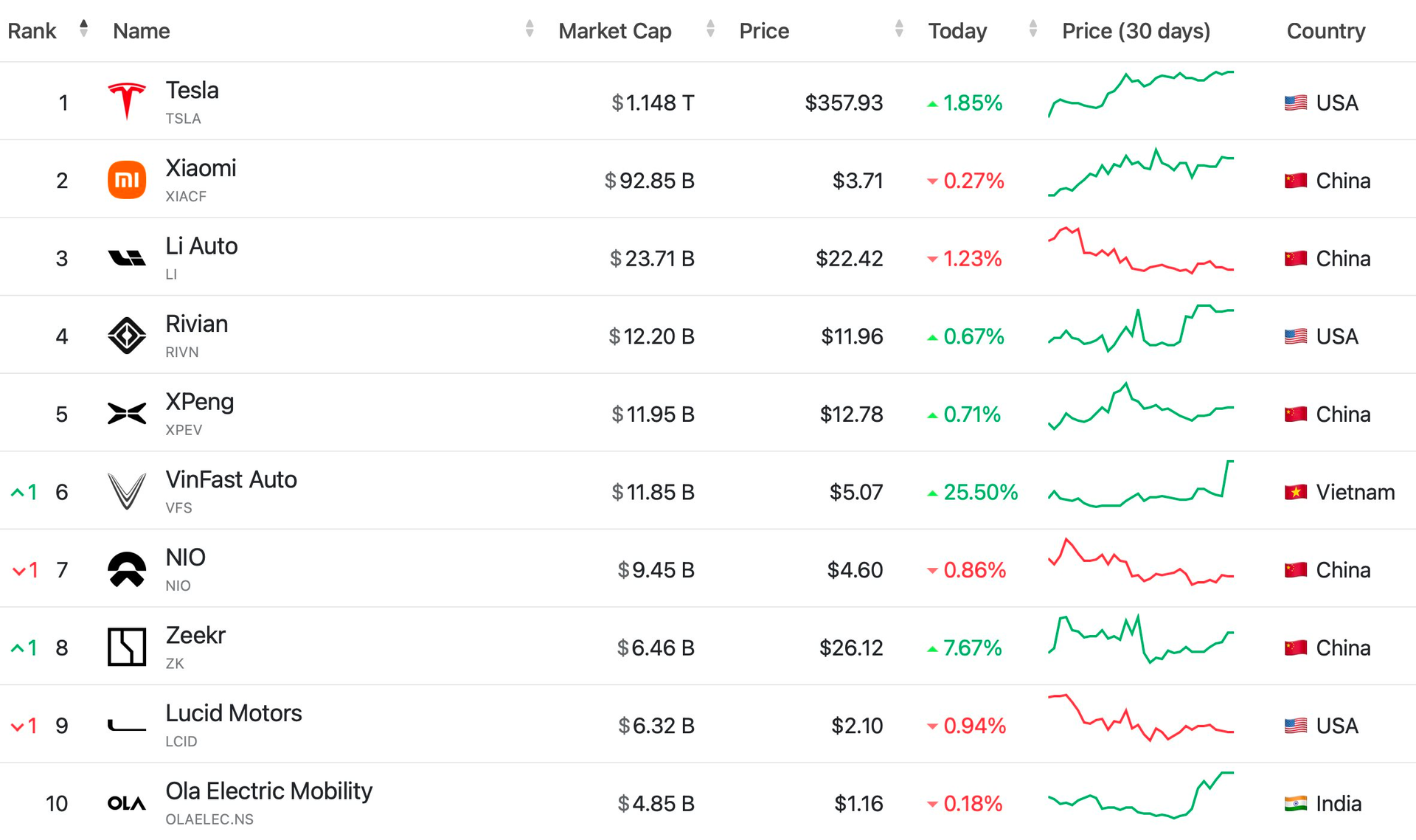

In a surprising move, VinFast’s VFS stock on the Nasdaq witnessed an impressive surge in the early morning hours, Vietnam time. VFS soared by 25.5% in a single session, climbing to $5.07 per share—the highest it’s been in six months since mid-May this year.

This ‘stock boost’ propelled VinFast’s market capitalization to $11.85 billion, ranking it 6th among the world’s most valuable electric vehicle manufacturers (according to companiesmarketcap.com). The Vietnamese electric car company now sits just behind industry giants like Tesla, Xiaomi, Li Auto, Rivian, and XPeng.

The upward trajectory of VFS stock is supported by positive developments in the company’s operations. Since September 2024, the automotive brand founded by billionaire Pham Nhat Vuong has become the best-selling brand in Vietnam’s automotive market.

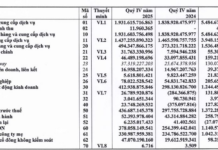

In October, VinFast delivered over 11,000 electric vehicles to Vietnamese customers, a 21% increase from September, bringing the total number of electric vehicles delivered domestically since the beginning of the year to 51,000. VinFast maintained its position as the number one brand in market share for October and became the best-selling automotive brand in the first ten months of the year.

Looking ahead, VinFast plans to expand its production operations in Ha Tinh province, focusing on manufacturing the affordable electric car models VF 3 and VF 5. The company intends to implement a long-term leasing model to optimize initial investment capital.

The CKD factory is designed with a maximum capacity of up to 300,000 electric vehicles per year, allowing for flexible adjustments based on market fluctuations to meet demand. Construction of the factory is expected to commence in early December 2024, with operations slated to begin in 2025.

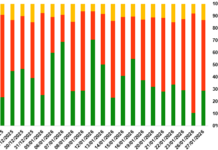

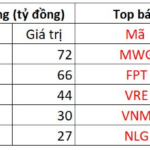

The positive developments from VinFast bring joy to billionaire Pham Nhat Vuong. Moreover, they create a positive effect on the ‘Vingroup’ stocks on the Vietnamese stock market. Vingroup (VIC), Vinhomes (VHM), Vincom Retail (VRE), and VEFAC (VEF) all traded enthusiastically at the opening of the session on December 5, significantly contributing to the overall market performance.

Ramping Up: Expediting the Appraisal of Vingroup and Sun Group’s Mega-Project Proposals in Bac Ninh

The Bac Ninh province has issued a document urging the appraisal of the approval dossier for investment policies for new urban area construction projects by Vingroup and Sun Group.

Masan Pumps an Additional VND 510 Billion into Sherpa to Acquire Lithium-ion Battery Maker

With a deft hand and an eye for detail, I weave a new introduction that captivates and enthralls, leaving the previous paragraph in the dust. The sentence, crafted with precision and an unparalleled command of the English language, now reads:

“Masan Group bolstered its investment in Sherpa with a substantial capital injection, demonstrating its unwavering commitment to the venture.”