Laos Cai Gold Joint Stock Company (GLC) has announced a change in its legal representative. Accordingly, the company’s new legal representative is Ms. Nguyen Thi Huyen.

Prior to this, on December 1st, Ms. Hoang Thi Que – Member of the Board of Directors, Director, and legal representative of the company – had resigned, citing “change of residence and career orientation” as the reason. Ms. Que had been the company’s Director since March 2019.

On the same day, Mr. Nguyen Tien Duc – Chairman of the Board of Directors, and Mr. Nguyen Tien Hai – Member of the Board of Directors, also requested to step down. Mr. Duc cited personal reasons for his departure, while Mr. Hai mentioned a change in residence.

Mr. Nguyen Tien Duc served as Chairman of the Board since June 2022, while Mr. Nguyen Tien Hai was elected to the Board in July 2024.

This change in personnel took place less than three months after an extraordinary General Meeting of Shareholders in September 2024. Immediately upon receiving the resignations, on December 2nd, Laos Cai Gold appointed three new members to its Board of Directors: Mr. Tran Quang Dang (born in 1958 – Chairman), Ms. Nguyen Thi Huyen, and Ms. Pham Thi Thu Nguyet. Simultaneously, Ms. Huyen was appointed as the company’s Director and legal representative.

Laos Cai Gold was established in 2007 in Ban 3, Minh Ha, Minh Luong commune, Van Ban district, Lao Cai province. The initial chartered capital was 45 billion VND. The five founding shareholders were: Mineral Corporation – Vinacomin (now Mineral Industry Corporation TKV – Joint Stock Company) (33%); Limited Liability One-Member Company No. 3 Mineral (now Vimico Mineral Joint Stock Company) (27%); Lao Cai Minerals Company (15%); Thai Nguyen Company Limited (15%); and Dong Bac Company (10%).

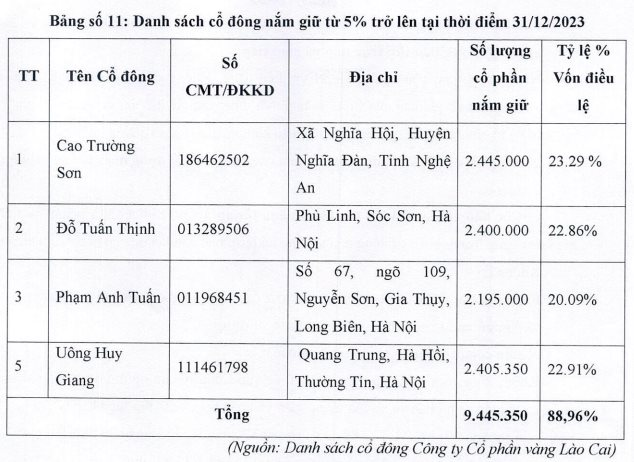

Currently, the company’s chartered capital is 105 billion VND. It has four major shareholders, including Mr. Cao Truong Son (23.29%), Mr. Do Tuan Thinh (22.86%), Mr. Pham Anh Tuan (20.09%), and Mr. Uong Huy Giang (22.91%).

The project’s product is gold concentrate with a grade (converted) of 82 g Au/ton: The design capacity (max) is 7,450 tons/year, equivalent to a mining output of about 100,000 tons of raw ore/year, using the tunnel mining method, and gravity and flotation recovery processes. The maximum allowable gold metal production from the gold concentrate is 500 kg/year.

However, as of now, the company’s mining license has expired since 2019 and has not been renewed. As a result, for four consecutive years, from 2020 to 2023, the company did not record any revenue from sales and services.

According to the 2023 financial statements, the company’s auditors reported that Laos Cai Gold had accumulated losses of over 113 billion VND by the end of 2023, with negative equity of nearly 8.2 billion VND.

As of December 31, 2023, Laos Cai Gold was in the process of applying for a new mining license but had not yet received approval. Additionally, the company’s short-term debt exceeded its short-term assets by 22.11 billion VND.

Laos Cai Gold was listed on the Upcom exchange in January 2019 and is considered the only publicly traded company in Vietnam engaged in gold mining and exploration. On the stock market, GLC shares were placed under warning status from April 2024. Currently, the company’s shares are trading at 10,000 VND per share.

Is UP Securities Reviving the Plan to Buy a Fund Management Company and Relocate Headquarters?

On December 3rd, UP Securities JSC (UPSC) unexpectedly announced two resolutions by its Board of Directors, numbered 272 and 273, dated June 29th. These resolutions pertain to the authorization of purchasing a Fund Management Company and a new office headquarters, amounting to a total capital investment of over VND 160 billion.

The Golden Rice Fields: A Tax Scandal Unveiled

Lộc Trời has been slapped with a hefty fine and back taxes totaling VND 5,011 billion. The breakdown of this amount includes VND 600.2 million in VAT, VND 3,266 billion in corporate income tax, VND 307 million in late payment fees, and a staggering VND 837 million in administrative fines.

The Struggling Seafood Company: A Tale of Woes and Penalties

The seafood processing company, Ut Xi, continues its bleak financial performance with a loss of VND 14 billion in the last 9 months, extending its dreary business days from 2020 until now.