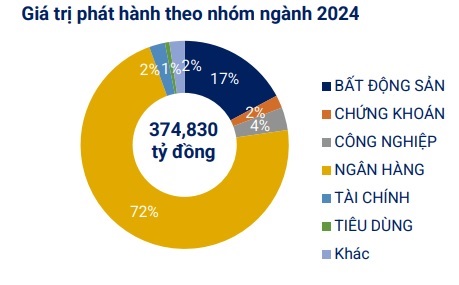

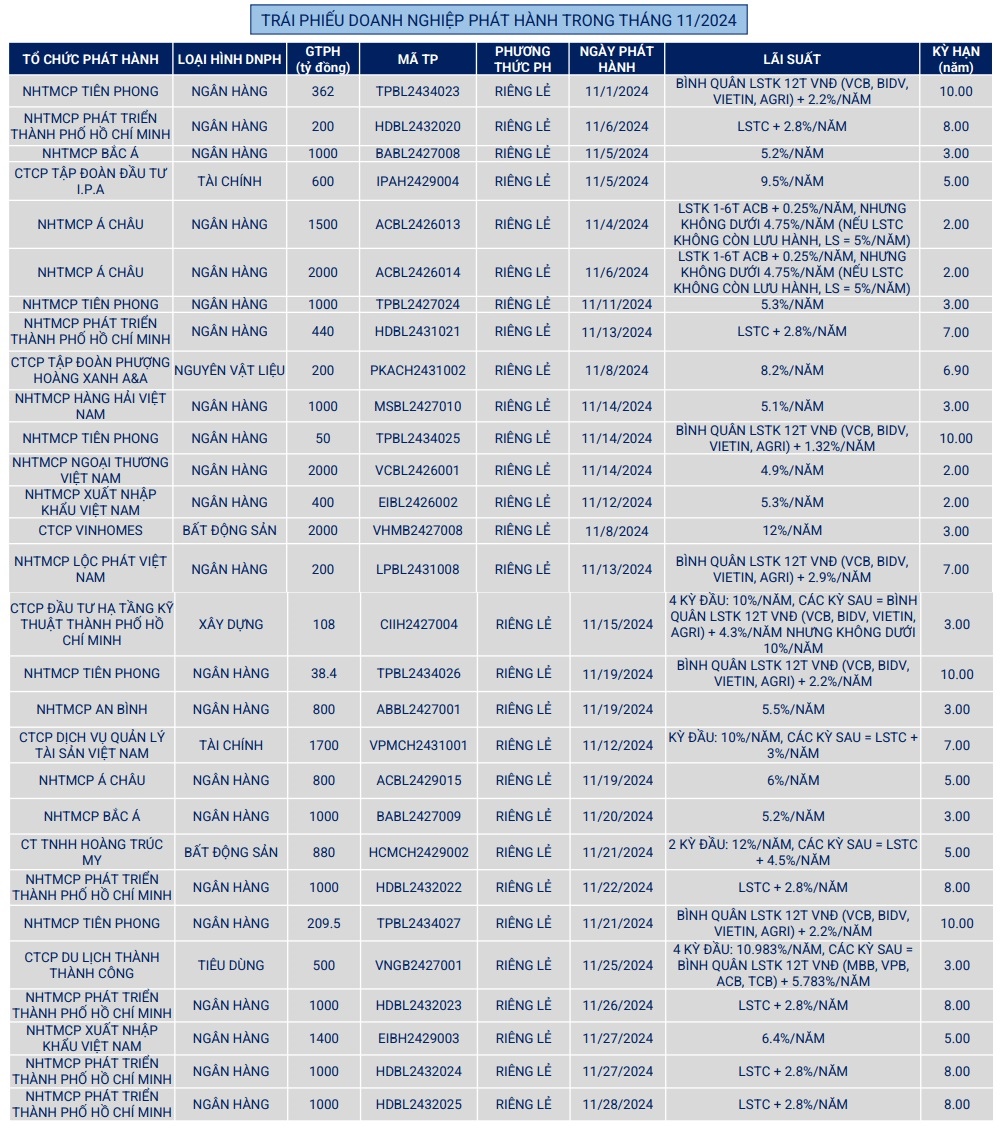

Since the beginning of the year, there have been 362 private placements valued at nearly VND 343 trillion, along with 21 public offerings worth more than VND 32 trillion. This brings the total value of bond issuances to nearly VND 375 trillion so far this year.

Source: VBMA

|

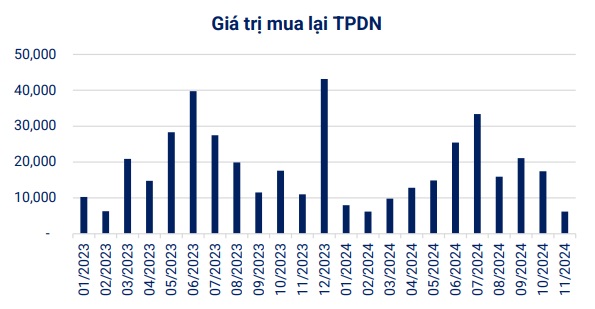

In November, early bond buybacks by enterprises amounted to approximately VND 6.2 trillion, a 44% decrease compared to the same period in 2023. For the last month of 2024, it is estimated that more than VND 42 trillion worth of bonds will mature. The majority of these are real estate bonds, with more than VND 14.5 trillion, accounting for about 34%. Additionally, there were 7 new codes of bonds that were delayed in paying interest, with a total value of more than VND 151 billion.

Source: VBMA

|

In the secondary market, the total trading value of private enterprise bonds in November exceeded VND 95 trillion, averaging more than VND 4.5 trillion per session, a 14% decrease compared to the October average.

According to VBMA, there will be 2 notable bond issuances in the near future. The first is from TTC Hospitality (HOSE: VNG), as their Board of Directors approved a plan to issue private placement bonds in Q4 2024 with a maximum value of VND 500 billion.

In fact, this bond lot seems to have been successfully issued by VNG on November 25, 2024 (the enterprise has not announced information about the approval of any other bond lot). These are non-convertible bonds, without warrants, that are asset-backed, with a par value of VND 100 million per bond, equivalent to issuing 5,000 bonds.

The bonds have a 3-year term and an interest rate of 11% per annum for the first 4 periods. The subsequent periods will have a floating rate plus a margin of 5.78%. This new lot is still arranged by KIS Vietnam Securities (TCBS) and will be unconditionally and irrevocably guaranteed by Investment Thanh Thanh Cong (TTCI) – a unit holding 30.36% of VNG’s capital. The proceeds will be used to repay the principal of the VNG bond lot offered to the public at the beginning of 2022, with a value of exactly VND 500 billion, expected to mature in early January next year of 2025.

In the latest loan, the hospitality enterprise put up two hotels as collateral; including land use rights, assets attached to the land, and all property rights related to TTC Hotel Premium – Can Tho and Michelia Hotel. In addition, the bonds are also guaranteed by the entire equity contribution in VNG.

The second unit that will issue bonds in the near future is Nam Long Investment Joint Stock Company (HOSE: NLG), which has approved a plan to issue private placement bonds in Q4 2024 with a maximum value of VND 1 trillion. These are non-convertible bonds, without warrants, that are asset-backed with a par value of VND 100 million per bond. The bonds have a 3-year term with an interest rate of 10.11% per annum for the first 4 periods.

Similar to VNG, Nam Long appears to have successfully issued this bond lot in late November, and there has been no announcement of any other bond lot in Q4. The company plans to use the VND 1,000 billion raised to repay the entire principal amount of the early buyback of two bond lots, NLGH2229001 and NLGH2229002 (VND 500 billion each). It is understood that these two lots will mature on March 28, 2029.

Source: VBMA

|

[Châu An]

The Big Bank Bond Bonanza: 7 Months of Issuance Dominance

In the first seven months of 2024, real estate businesses issued bonds worth 38.7 trillion VND, accounting for a significant 24% of the total bond issuances.