The Profitability Trajectory of Vietnam’s Construction Plastics Sector: Unraveling the Third-Quarter Performance of 2024

The construction plastics industry in Vietnam demonstrated resilient profitability in the third quarter of 2024, as evident from the financial reports of 26 listed companies on the stock exchange. According to data from VietstockFinance, their combined revenue and net profit for this period reached approximately 15 trillion VND, reflecting a modest increase of 4.7% and 2.4%, respectively, compared to the same quarter last year.

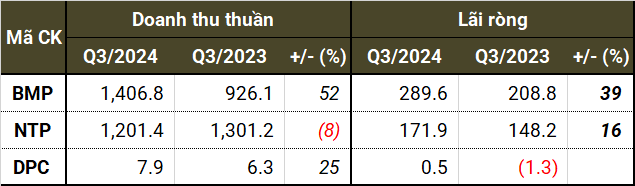

The continuous decline in PVC resin prices to multi-year lows benefited large manufacturers of plastic pipes, such as BMP and NTP, extending their growth trajectory. Despite a slight dip in revenue, NTP, the 64-year-old enterprise, maintained its impressive net profit at 172 billion VND in the third quarter, marking a 16% increase compared to the previous year.

Meanwhile, Nhựa Bình Minh (BMP) also exhibited positive growth, with a 52% surge in revenue and a 39% jump in net profit, amounting to over 1,400 billion VND and 290 billion VND, respectively. BMP’s revenue has been on an upward trajectory, benefiting from the decreasing PVC resin prices. The company achieved its highest-ever gross profit of 606 billion VND in the third quarter.

The intense rivalry between BMP and NTP, the dominant players in the Vietnamese construction plastic pipes market, persists, with the Thai-owned company often edging out its competitor in terms of revenue and profit. Their revenue targets for 2024 are comparable, at around 5,400–5,500 billion VND. However, while BMP anticipated a pre-tax profit of nearly 1,300 billion VND, achieving 74% of this goal in the first nine months, NTP surpassed its target of 555 billion VND by 12%.

|

The construction plastics sector maintained its positive trajectory in Q3 2024 (in trillion VND)

Source: VietstockFinance

|

Household Plastics Segment Shows Resilience

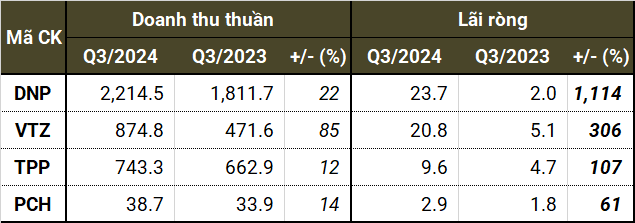

The third quarter proved lucrative for prominent companies in the household plastics segment, including Sản xuất và Thương mại Nhựa Việt Thành (VTZ) and Tân Phú Việt Nam (TPP). VTZ, focusing on diversifying and expanding its distribution channels, achieved its highest profit in years, with a net profit of nearly 21 billion VND—a fourfold increase compared to the previous year. TPP, emphasizing both packaging and household plastics, doubled its net profit to 9.6 billion VND.

DNP Holding, the owner of well-known brands such as Đồng Nai Plastics and Tân Phú Plastics, attributed its revenue growth to all three segments: clean water, plastics, and household goods. Consequently, their net profit soared tenfold to approximately 24 billion VND.

It is worth noting that DNP’s results were significantly influenced by the inclusion of profits from associated companies, which were not accounted for in the same period last year. Additionally, the consolidation of newly acquired subsidiaries, primarily in the water segment, had a considerable impact on the company’s final profit when compared to the third quarter of 2023.

|

A few household plastics businesses witnessed improved performance in Q3 2024 (in billion VND)

Source: VietstockFinance

|

Competitive Landscape Challenges the Packaging Segment

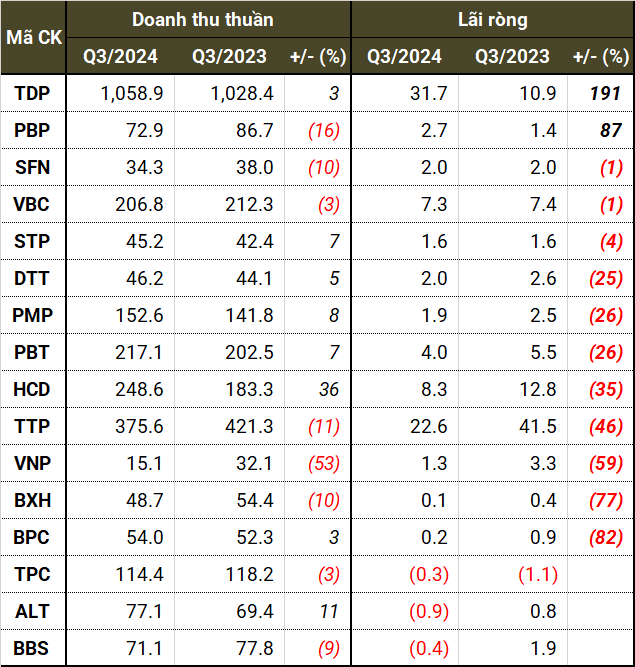

The packaging segment faced headwinds due to the overall increase in PE and PP resin prices—essential raw materials for most plastic packaging manufacturers. This dynamic resulted in underwhelming performance compared to the previous year. For instance, Bao bì Tân Tiến (TTP), specializing in flexible packaging for food and consumer goods, experienced a nearly 50% drop in profit due to heightened competition and subdued consumer demand. Their performance contrasts with the upward trend in PE resin prices.

Companies supplying cement and fertilizer packaging also faced challenges due to intense competition and a sluggish construction market. VICEM Bao bì Hải Phòng (BXH) witnessed a nearly 50% decline in sales volume, leading to a 77% drop in net profit to just over 100 million VND. Similar challenges were faced by VICEM Bao bì Bút Sơn (BBS), pushing them into the red. Meanwhile, VICEM Bao bì Bỉm Sơn (BPC) saw an 82% dip in profit due to escalating raw material prices.

TDP and PBP stood out as rare exceptions, achieving profit growth. TDP attributed its impressive 191% surge in net profit, reaching a record high of nearly 32 billion VND, to the robust recovery of their international market revenue. Their export revenue also doubled in the first nine months.

|

Most packaging businesses faced challenges in Q3 2024 (in billion VND)

Source: VietstockFinance

|

An Phát Holdings and Its Subsidiaries Witness Profit Decline

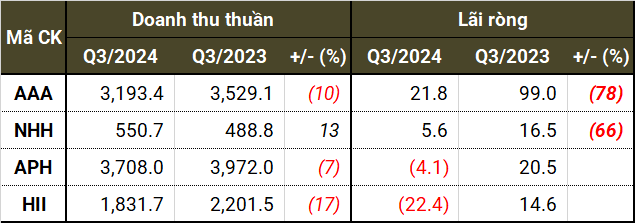

An Phát Holdings, along with its subsidiaries AAA, NHH, and HII, experienced a significant drop in profits, reaching their lowest point in two years. This downturn was primarily due to losses incurred by their associated company, CTCP Sản xuất PBAT An Phát, despite relatively stable core operations.

While Nhựa Hà Nội (NHH) maintained its output, as evidenced by growing revenue not only year-over-year but also in the last three quarters, it could only manage a net profit of 5.6 billion VND, a 66% decline, due to a 40 billion VND loss from Sản xuất PBAT An Phát. Similarly, An Tiến Industries (HII) suffered a net loss of over 22 billion VND, impacted by their 39% stake in the associated company.

|

An Phát Holdings and its members experienced profit declines in Q3 2024 (in billion VND)

Source: VietstockFinance

|

Tử Kính

The Power of Singular Focus: How a Niche Retailer Rakes in Billions with a Unique Business Model

This enterprise boasts an impressive 4 manufacturing plants with a combined capacity of 150,000 tons per annum. With this substantial output, it has claimed the leading market share in the domestic arena.