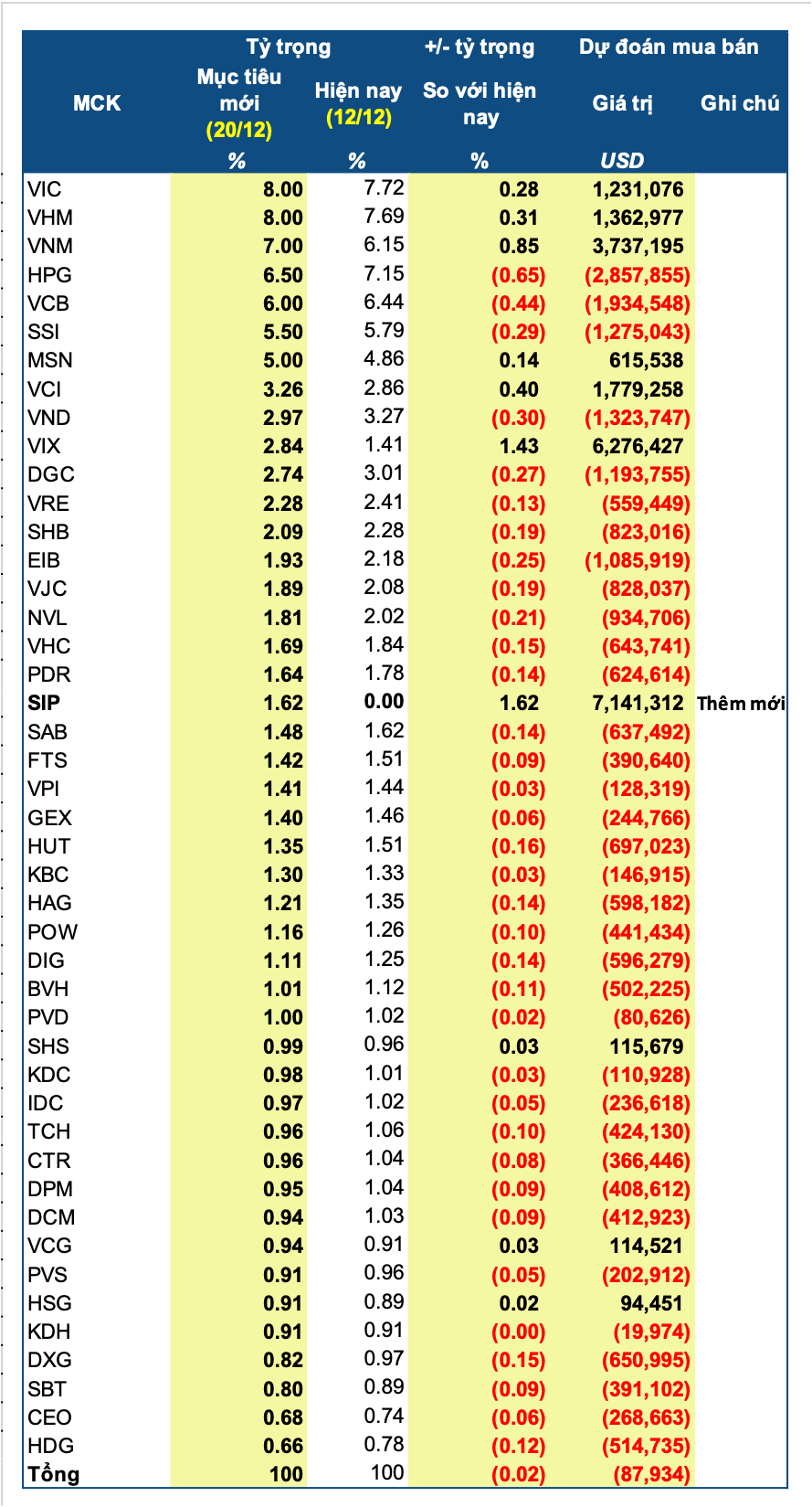

**Forecast of VNM ETF’s Stock Allocation Change After Q4 2024 Review**

In the latest review, *SIP* is the only new addition and is predicted to be the most heavily bought stock in terms of value, with over 7.14 million USD, equivalent to more than 2.2 million shares based on the closing price of 82,400 VND per share on December 13th. Following closely is *VIX*, with an expected purchase of nearly 6.3 million USD, or approximately 15.9 million shares at a price of 10,050 VND per share.

On the other hand, no stocks are expected to be removed from the index. The stock predicted to experience the largest sell-off in value is *HPG*, with nearly 2.86 million USD worth of shares (around 2.7 million shares at a price of 27,200 VND per share). This is followed by *VCB*, with a predicted sell-off of over 1.9 million USD.

Following the Q4 2024 review, the number of stocks in VNM ETF’s portfolio will increase to 45, along with one fund certificate, up by one stock from Q3. All are Vietnamese stocks. The largest weightings are predicted to be *VHM* and *VIC* (both at 8%). Following closely are *VNM* (7%), *HPG* (6.5%), and *VCB* (6%).

The changes in the constituent stocks of the MarketVector Vietnam Local Index will take effect after the market closes on Friday (December 20th) and will be officially traded from Monday (December 23rd).

*Chau An*

The Largest Industrial Park Owner in Tay Ninh Prepares to Dish Out Over VND 210 Billion in Advance Dividends for 2024

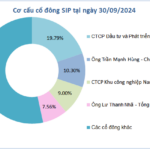

Saigon VRG Investment Corporation (HOSE: SIP) has announced December 12, 2024, as the record date for determining the shareholders’ eligibility for the first cash dividend of 2024.

The VCB Pushes VN-Index Below 1,250 Points, Insurance Stocks Surge: A Market Surprise

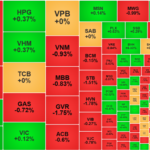

The recovery efforts this afternoon failed to bear fruit, as the dominant force of the ‘super-pillar’ VCB overwhelmed the lackluster performance of other blue-chips. The VN-Index closed with a loss of 1.38 points, with VCB’s 1.27% decline accounting for over 1.6 points. However, bottom-fishing funds were active, driving significant gains in numerous stocks, particularly in the insurance sector.

Market Beat: Dec 02 – Continuing Divergence, VN-Index Revisits 1,251 Point Milestone

The market closed with slight gains, as the VN-Index rose by 0.75 points (0.06%) to reach 1,251.21, while the HNX-Index climbed 0.68 points (0.3%) to 225.32. The market breadth tilted towards decliners, with 373 tickers falling against 319 advancers. The large-cap stocks in the VN30 basket painted a similar picture, as 17 tickers fell, 9 rose, and 4 remained unchanged.

Technical Analysis for the Session on Dec 3rd: A Tug-of-War Market

The VN-Index and HNX-Index moved in opposite directions, with a slight increase in trading volume in the morning session, indicating a cautious sentiment among investors.