TCO plans to sell 1,000 bonds to Lighthouse and 800 bonds to Vietinbank Capital, respectively, with a face value of VND 100 million/bond, to borrow VND 180 billion at a fixed interest rate of 9% per annum for a term of 1 year.

The bonds are unsecured, but will be mandatorily converted into shares in one lot at maturity at a price of VND 10,000/share, therefore, TCO will not have to pay back the principal to investors unless the bonds are repurchased prior to maturity, subject to certain conditions.

The value of VND 180 billion is almost equal to the current charter capital of TCO, VND 187 billion. In case the investor converts the shares and owns from 25% of the circulating shares (including related parties), it will not have to carry out the procedures for a public offering.

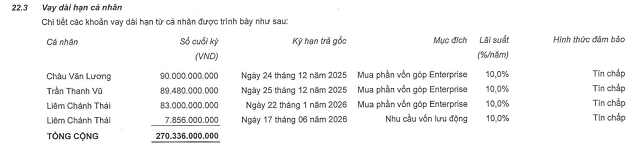

The proceeds will be used to repay debts to 3 other individuals, each owing VND 60 billion. The enterprise previously borrowed VND 262 billion from these individuals at an interest rate of 10% per annum, plus VND 299 billion borrowed from a bank to buy 100% of the capital of Enterprise Investment Joint Stock Company, thereby owning the Enterprise Tower office building located at 290 Ben Van Don, District 4, Ho Chi Minh City.

Source: TCO

|

Enterprise Tower, recently acquired by TCO. Source: TCO

|

TCO was previously known as Duyen Hai Multi-Modal Transport Joint Stock Company, but the name was changed last year, along with the relocation of its head office from Hai Phong city to Vietcombank Tower in District 1, Ho Chi Minh City, to “facilitate the process of seeking investment opportunities and expanding the market.”

The company currently operates in multiple sectors, besides the traditional logistics segment, TCO has gradually expanded into real estate and decided to focus on agriculture by acquiring almost the entire stake of Nam An Group Joint Stock Company – a company headquartered in An Giang province that owns a rice milling and polishing factory serving both export and domestic markets.

After consolidating this subsidiary in 2024, rice and by-products contributed over VND 2,600 billion in revenue to TCO in the last 9 months, while the other segments accounted for only about VND 100 billion. However, the profit margin of this new segment is not high, with a gross profit margin of only about 2.1%.

The Rising Dollar: A Story of Strength and Resilience

Last week (December 9-13, 2024), the US dollar continued its upward trajectory in the international market following the release of US inflation data.

The Revenue Slump: ThaiBev’s Vietnam Sales Retreat for the Second Year Running

According to Thai Beverage Public Company Limited’s (ThaiBev) 2024 financial statements (covering the period from September 2023 to September 2024), the parent company of Sabeco (HOSE: SAB) experienced growth in both revenue and profit. However, the Vietnamese market saw a second consecutive year of declining revenue.

The Hydration Industry’s Hottest New Bond Offering: A Dehydrated Perspective.

The company, which is over 94% owned by Biwase, JSC – Binh Duong Water – Environment Corporation (Biwase, HOSE: BWE), has successfully raised a significant amount of bonds with an impressively low-interest rate of just 5.5% per annum, undercutting the bond interest rates offered by many other enterprises.