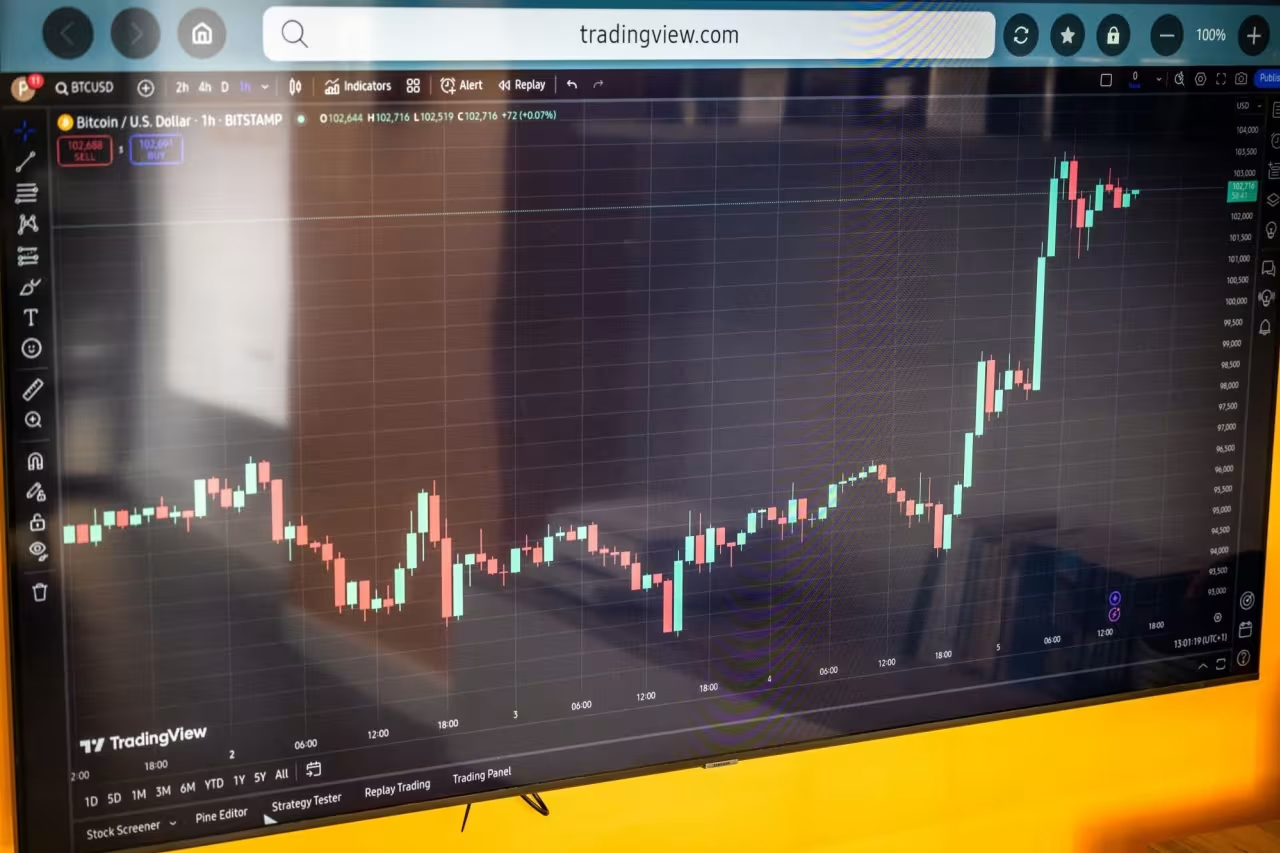

Bitcoin soared past the $100,000 mark this week, while the Dow Jones Index surpassed 45,000 for the first time. Investors are rejoicing as if the good times will never end, and it’s hard to blame them with the Fed promising more easing moves.

Financial media attributes Bitcoin’s rally to expectations of a more crypto-friendly Trump administration. Undeniably, the prospect of more open regulators has contributed to the digital currency’s 124% surge this year. However, prices of other assets are also at record highs — from gold, risky bonds to stocks — and are often fueled by speculative leverage.

One of the biggest stock gainers is MicroStrategy, surging 464% this year. Despite negligible revenues, the 35-year-old software company is valued at $91 billion. Why? They’ve accumulated a massive amount of Bitcoin, now worth about $41 billion. Investors are flocking to the stock as a bet on Bitcoin.

MicroStrategy announced plans to spend $40 billion more on Bitcoin in October, fueling a buying spree in both the company’s stock and Bitcoin. How did MicroStrategy raise capital to buy Bitcoin? Through convertible bonds that can be converted into stocks in the future. Investors buy these bonds, expecting MicroStrategy’s stock price to keep rising.

Similar to the meme stock frenzy of early 2021, everything is fine as long as the “happy music keeps playing.” Once Bitcoin prices decline and leveraged positions start to unwind, both MicroStrategy’s stock and Bitcoin could witness a steep fall, just as sharp as the rise.

However, beware as Bitcoin prices are notoriously volatile. They tend to rise and fall with the overall market, despite crypto enthusiasts touting it as a hedge. Prices plummeted about 75% when the Fed tightened in 2022. Bitcoin is now skyrocketing amid loose monetary conditions.

Looking at the broader market, signs of exuberance are mounting. The Russell 2000 Index of small-cap stocks has surged nearly 30% over the past year. These companies are typically more affected by macroeconomic policy changes, so investors may be betting on robust growth and Trump’s deregulation plans.

However, the index’s P/E ratio of 36 harkens back to the dot-com bubble. Expectations about AI-driven productivity may also be fueling the euphoria — Nvidia stock, an AI chipmaker, soared 211% in the past year — but it doesn’t explain the rise in high-risk debt.

The last time the yield spread between risky bonds and government bonds was this low was in 2007, and before that, 1997, when markets were also flush with cash. There are no signs of liquidity shortages. Booming asset prices and stubbornly slow inflation may even suggest overly easy financial conditions. The core Consumer Price Index (CPI) — excluding food and energy — has remained stagnant at 3.3% since June.

Even the Fed’s preferred inflation measure, the Personal Consumption Expenditures Price Index (PCE), has halted its downward trend. On December 4th, Fed Chair Jerome Powell remarked that “growth is surely stronger than we thought, and inflation is somewhat higher” compared to September when the Federal Open Market Committee (FOMC) cut rates by 50 basis points. The market interpreted this aggressive cut (and an additional 25-point cut in November) as a signal that the Fed considered the fight against inflation won. But that’s not the case.

While the Fed is signaling another 25-point cut this month, it’s unusual for a central bank to lower rates amid persistent inflation, robust growth, and soaring asset prices. This raises significant questions about the prudence of current monetary policies.

The Systemic Risks in the Bitcoin Frenzy

Bitcoin’s price surge of over 40% has captured the attention of the global market, with US President-elect Donald Trump’s endorsement of digital currency and his appointment of like-minded individuals to his cabinet taking center stage.

“Standard Chartered: Robust USD and Vietnam’s Economic Growth Trajectory Towards 6.7% in 2025”

In its latest economic update on Vietnam, released on December 12, 2024, Standard Chartered Bank forecasts a strong USD in 2025, with a weakening bias in the early part of the year. The bank predicts a 6.7% GDP growth for Vietnam in 2025, with a 7.5% year-on-year expansion in the first half and a 6.1% growth in the latter half.

The Greenback Recovers Gracefully

After a sharp decline, the US dollar rebounded slightly in the international market last week (December 2-6, 2024), as robust US jobs data indicated a strong recovery in the labor market.