I. MARKET ANALYSIS OF STOCKS ON 12/12/2024

– The main indices witnessed a slight decline during the trading session on December 12th. The VN-Index closed 0.12% lower at 1,267.35 points, while the HNX-Index decreased by 0.08% compared to the previous session, settling at 227.99 points.

– The matching volume on the HOSE reached nearly 488 million units, a 2.8% decrease from the previous session. Conversely, the matching volume on the HNX increased by 3.9%, surpassing 46 million units.

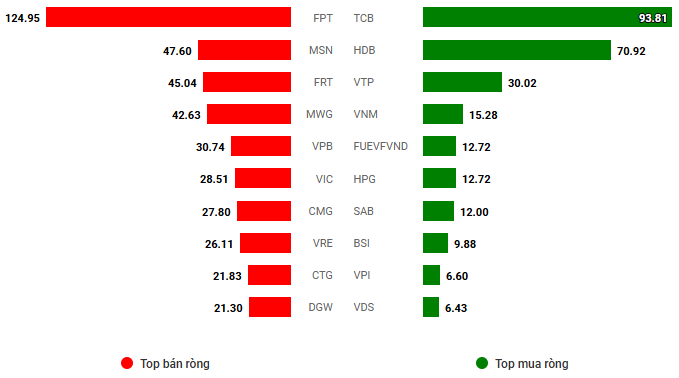

– Foreign investors net sold on the HOSE with a value of nearly VND 338 billion and net sold over VND 15 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

– The market commenced the trading day on December 12th on a positive note, particularly with vigorous transactions in the group of “king stocks,” leading the VN-Index to gain nearly 5 points by the end of the morning session, accompanied by improved liquidity. However, a cautious sentiment gradually took over in the afternoon session as buying forces weakened, allowing sellers to regain the upper hand. The strong selling pressure towards the end of the session not only erased the gains but also pushed the VN-Index into the red, resulting in a 0.12% decline to 1,267.35 points.

– In terms of impact, three bank stocks, including VCB, EIB, and HDB, led the positive side, although their upward momentum was significantly narrowed in the afternoon session, contributing to an increase of just over 0.7 points in the VN-Index. Conversely, HPG, VIC, and LPB had the most negative influence, deducting more than 1 point from the overall index.

– The VN30-Index closed slightly lower at 1,335.55 points, a 0.07% decrease. The market breadth was relatively balanced, with 15 declining stocks, 11 advancing stocks, and 4 stocks remaining unchanged. BVH and HDB topped the gainers with a 1.3% increase each. Meanwhile, PLX and VIC were the worst performers, falling by 1.3% and 1%, respectively. The remaining stocks witnessed only minor fluctuations around the reference level.

Sectors continued to diverge. The energy sector shone the brightest, thanks to the stellar performances of BSR (+1.9%), PVD (+0.84%), TMB (+2.94%), and HLC (+9.92%), resulting in a sectoral gain of 1.25%. On the other hand, the telecommunications sector recorded the steepest decline of 2.67%, dragged down by adjustments in VGI (-3.13%), FOX (-1.72%), CTR (-0.81%), SGT (-1.35%), and YEG (-2.36%).

Other sectors experienced fluctuations of less than 0.5%. The financial sector attracted positive buying forces in the morning session but reversed course in the afternoon, resulting in a modest gain of 0.07%. Several stocks managed to maintain significant increases by the session’s end, including HDB (+1.27%), EIB (+2.6%), SGB (+6.61%), PGB (+1.27%), and BVH (+1.34%). Conversely, selling pressure weighed on LPB (-1.49%), SHB (-0.94%), KLB (-2.54%), MIG (-2.82%), BMI (-1.18%), ORS (-1%), and a few others.

The VN-Index continued its downward trajectory, marked by a tug-of-war between buyers and sellers, with trading volume remaining below the 20-day average. This indicates that investor caution persists following the recent strong gains. At present, the Stochastic Oscillator indicator is venturing deeper into overbought territory. Investors are advised to exercise caution in the coming sessions if the indicator flashes a sell signal.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator May Signal a Sell

The VN-Index posted its third consecutive daily loss, forming an Inverted Hammer candlestick pattern, while trading volume remained below the 20-day average. This suggests that investor caution is still prevalent.

Currently, the Stochastic Oscillator indicator is poised to generate a sell signal within the overbought region. Should this occur, the index’s outlook for the upcoming sessions will turn increasingly bearish.

HNX-Index – Doji Candlestick Emerges

The HNX-Index witnessed a slight decline and formed a Doji candlestick pattern, reflecting investors’ indecision.

Additionally, the Stochastic Oscillator indicator has already signaled a sell within the overbought territory. This suggests that the risk of further corrections will escalate if the indicator falls below this region.

Money Flow Analysis

Movement of Smart Money: The Negative Volume Index indicator of the VN-Index has risen above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Flow: Foreign investors continued to net sell during the trading session on December 12, 2024. If this trend persists in the upcoming sessions, the market sentiment will become increasingly pessimistic.

III. MARKET STATISTICS ON 12/12/2024

Economic and Market Strategy Division, Vietstock Consulting

The Ultimate Headline: “The Looming Threat of Market Correction: Navigating the Storm”

The VN-Index witnessed another day of decline, with a tug-of-war session accompanied by below-average trading volume. This cautious investor sentiment persists following the recent strong rally. Notably, the Stochastic Oscillator is now venturing deeper into overbought territory. Investors are advised to exercise caution in the coming days if the indicator flashes a sell signal once again.

“Unleashing the Power of Words: Vietstock Weekly 16-20/12/2024: Navigating Through Hidden Risks”

The VN-Index stalled after three consecutive weeks of gains, with trading volumes remaining below the 20-week average. This reflects a cautious sentiment among investors. Currently, the index sits above the Middle Bollinger Band. If it can sustain this level in the upcoming sessions, the outlook may not be as pessimistic.

Is Investing in Gold, Real Estate or Stocks the Most Profitable?

The year 2025 is set to be a period of significant change, but also a time of opportunity for investors to reap success. While real estate, stocks, bonds, and savings accounts remain the dominant investment avenues, a strategic capital allocation is key. Notably, gold is expected to be the least attractive investment option among these traditional avenues.