In the international market, the DXY index rose slightly by 0.19 points compared to the previous week, reaching 105.97, a modest recovery from the previous week’s sharp drop.

The greenback’s rebound was driven by the jobs report, indicating a robust recovery in the US labor market in November after a subdued period due to large-scale strikes and natural disasters in the Southeast region.

According to the latest report from the Bureau of Labor Statistics released on December 6, the economy added 227,000 jobs in November. This figure not only surpassed the experts’ prediction of 214,000 but also showed a significant improvement from October’s 36,000.

Earlier, Fed Chairman Jerome Powell stated on December 4 that the economic outlook was generally positive and that the Fed was in no rush to cut rates. Other officials supported further rate cuts but said they would depend on changes in economic data.

While inflation has cooled significantly from its 40-year peak in mid-2022, recent months have seen a tendency for prices to creep up again. At the same time, the October jobs report and others have indicated that the labor market is still growing but at a slower pace.

The market still expects the Fed to cut rates by 0.25 percentage points in December, followed by a pause in January to monitor new economic information.

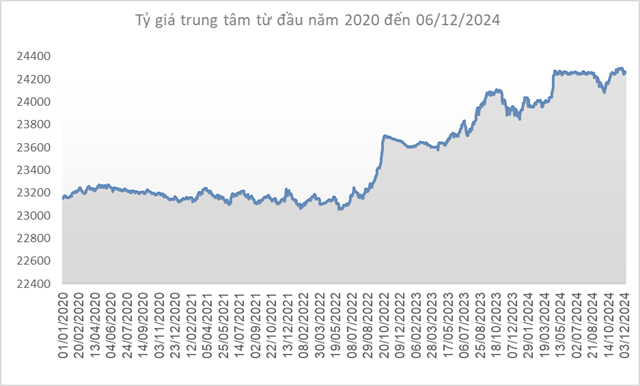

Source: SBV

|

Domestically, the central exchange rate of the Vietnamese Dong to USD rose slightly by 4 VND/USD compared to the previous week (November 29), reaching 24,255 VND/USD in the session on December 6, 2024.

With a 5% margin, the allowable trading range for USD at commercial banks is between 23,042 and 25,468 VND/USD.

At the State Bank of Vietnam (SBV)’s Trading Center, the buying price for immediate payment remained unchanged at 23,400 VND/USD.

The selling price for immediate payment was also kept fixed at 25,450 VND/USD from October 25 – this is the intervention selling price set by the SBV to “rein in” the exchange rate (equivalent to the intervention rate in the second quarter of 2024). Commercial banks can purchase USD from the SBV with the condition that their foreign currency status is negative.

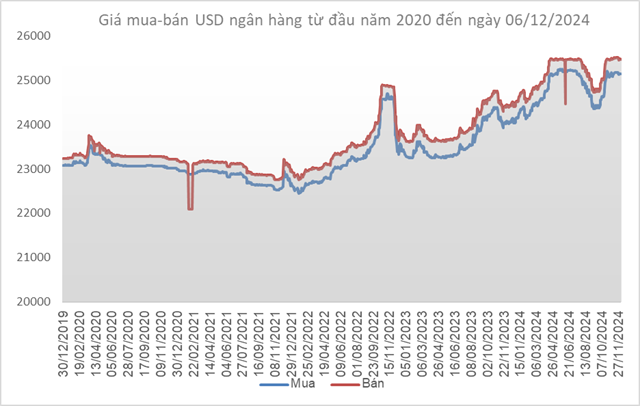

Source: VCB

|

Following a similar trend, Vietcombank also increased slightly by 4 VND/USD in both buying and selling rates, quoting a rate of 25,134-25,467 VND/USD.

Source: VietstockFinance

|

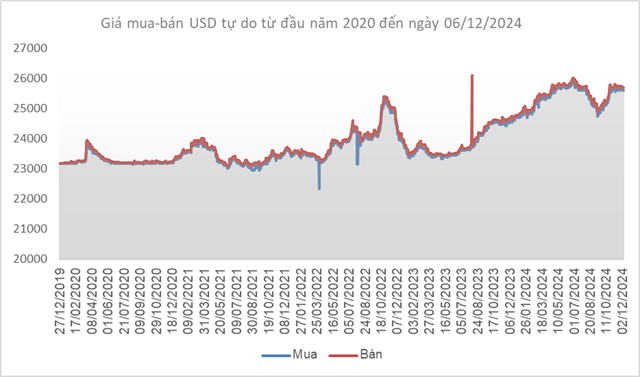

In contrast, the USD/VND exchange rate in the free market decreased by 50 VND/USD in both buying and selling rates, falling to 25,600-25,700 VND/USD.

The Central Bank’s Net Withdrawal Exceeds VND 27 Trillion

The State Bank of Vietnam (SBV) has resumed net withdrawal on the open market operation (OMO) channel, marking a shift from the previous month’s net injection to support systemic liquidity due to seasonal factors.

VNDirect: Undervalued Securities Present Attractive Discounts; A Good Time to Accumulate for the Long Term

In the base-case scenario, VNDirect believes the VN-Index will hover around the 1,250–1,270 point mark by the end of this year.