Dr. Vu Dinh Anh, Macroeconomic Expert, Former Deputy Director of the Institute for Market and Price Research (Ministry of Finance)

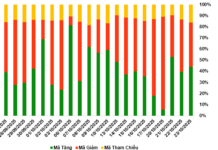

According to data released by the State Bank of Vietnam, in the first nine months of this year, credit outstanding for real estate consumption increased by only 4.6%, while credit for real estate business surged by 16% compared to the beginning of the year.

Commenting on this discrepancy, Dr. Vu Dinh Anh asserted that credit for the real estate sector is currently very large. Out of the nearly 15 quadrillion VND in total credit in the economy, real estate accounts for more than 3 quadrillion VND, or 21% of the total outstanding credit in the economy.

In addition, among the 30 joint-stock commercial banks providing real estate loans, there are those that have a very high concentration of real estate lending.

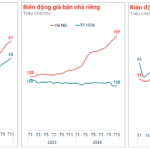

Although the growth rate of real estate consumer credit is lower than that of business credit, the total credit for real estate is currently very high. This is also a consequence of the fact that the real estate price increase rate is much higher than that of non-real estate sectors, according to the economic expert.

Also, according to Dr. Vu Dinh Anh, real estate credit consists of two components: the first is for real estate developers and businesses, and the second is for individual and small investors – these are the subjects grouped into consumer credit such as home improvement and new home purchases.

In the opinion of Mr. Phan Le Thanh Long, a finance expert and founder of the Finance & Business channel, looking at the overall picture, real estate credit in the past has been mainly focused on real estate developers and businesses.

“We can see that in 2024, a series of new projects were launched, more than in 2023. After the loans were concentrated on the investors for project development, the loans for individual real estate purchases gradually returned, mainly for deposits, and some for land purchases…

In addition, Mr. Long shared that currently, homebuyers with real needs are waiting. These factors reflect the decrease in consumption credit growth over the past time.

Is Investing in Gold, Real Estate or Stocks the Most Profitable?

The year 2025 is set to be a period of significant change, but also a time of opportunity for investors to reap success. While real estate, stocks, bonds, and savings accounts remain the dominant investment avenues, a strategic capital allocation is key. Notably, gold is expected to be the least attractive investment option among these traditional avenues.

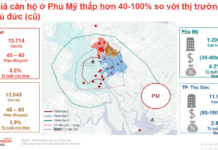

Why Aren’t Buyers Willing to Invest in Real Estate?

“Housing prices are a significant barrier for prospective homeowners, despite the increasing demand for housing and favorable loan interest rates.” said Dr. Can Van Luc, Member of the Monetary and Financial Policy Advisory Council.

The Regal Legend: Vietnam’s Premier Residential Destination

In just under 3 years, the super urban area, Regal Legend, has transformed the coastal city of Dong Hoi. With its exceptional architectural masterpieces and vibrant resident community, this development has fostered a bustling business environment and a host of unique, frequent events that have elevated the city’s appeal.