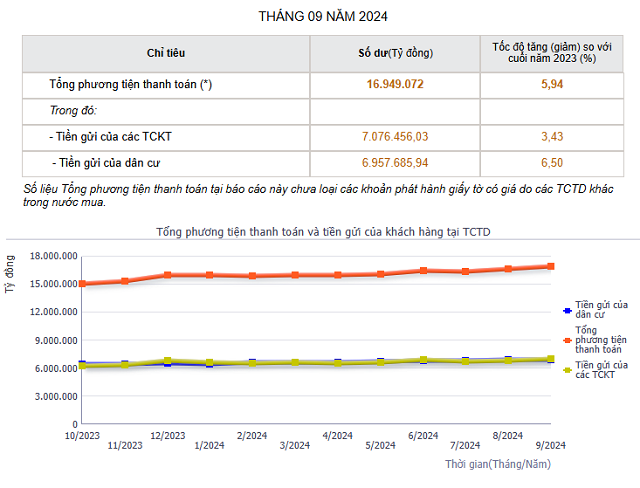

By the end of September, deposits from economic organizations reached over VND 7,000 trillion, an increase of 3.43%. Household deposits stood at nearly VND 6,960 trillion, up 6.5% from the end of 2023.

Compared to the previous month, deposits from economic organizations increased by more than VND 238,000 billion, while household deposits rose by over VND 32,700 billion.

Source: SBV

|

The influx of “idle” money into banks comes amid a gradual increase in deposit interest rates since April.

According to SBV data, the average interest rate for VND deposits in domestic commercial banks is 0.1-0.2%/year for non-term deposits and those with a term of less than 1 month; 2.9-3.8%/year for deposits with a term of 1 month to less than 6 months; 4.4-5.0%/year for deposits with a term of 6-12 months; 5.2-6.0%/year for deposits with a term of over 12 months to 24 months, and 6.9-7.2%/year for terms above 24 months.

Meanwhile, since the second quarter of 2024, the SBV has instructed credit institutions to reduce lending rates to facilitate businesses’ access to capital.

The average lending rate for new and existing loans in VND by domestic commercial banks is 6.8-9.2%/year. The short-term lending rate for priority areas is about 3.7%/year, lower than the maximum short-term lending rate stipulated by the SBV (4%/year).

On November 27, 2024, the SBV issued a document requesting credit institutions to stabilize deposit interest rates and strive to reduce lending rates.

The Road to Success: SGR Aims High with a Profitable Future in Mind, Targeting 365 Billion VND by 2025.

Joint Stock Commercial Company Saigon Real Estate (Saigonres, HOSE: SGR) has just approved the draft production and business plan for 2025 with a projected consolidated revenue of VND 1,078 billion and an after-tax profit of VND 365 billion.

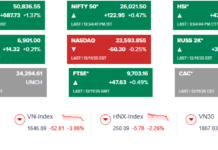

The Rising Dollar: A Story of Strength and Resilience

Last week (December 9-13, 2024), the US dollar continued its upward trajectory in the international market following the release of US inflation data.