Four new price records set since the beginning of December 2024

As of the trading session on December 12, 2024, the Vietnamese stock market had undergone 237 trading sessions for the year. In the final stretch of the year, investor sentiment has been rather subdued, with many sessions hovering around the 1,270-point mark.

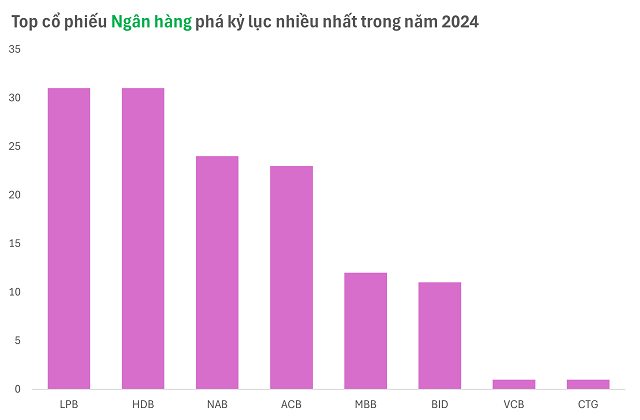

However, bank stocks have not entirely reflected this gloom. After November 2024, which saw no new price records, the sector has witnessed four new peaks since the start of December 2024, evenly distributed between two tickers: HDB (twice) and LPB (twice). Notably, HDB was the most recent stock to achieve a closing price record during the trading sessions of December 11 and 12.

It is worth noting that HDB concluded a 20% stock dividend payout, with the ex-dividend date also falling on December 11. Furthermore, HDB has demonstrated a remarkable price increase of 47% year-to-date, ranking third in the industry, following TCB (+57%) and LPB.

On the other hand, LPB has witnessed a staggering 110% surge since the beginning of 2024 and continues to be the top-performing stock among all banking stocks.

Collectively, HDB and LPB have achieved an equal number of peak-breaking instances (31 times) throughout 2024, outpacing their industry peers such as NAB (24 times), ACB (23 times), MBB (12 times), BID (11 times), VCB (once), and CTG (once).

In total, the entire banking sector has witnessed 134 peak-breaking instances in 2024, marking the third-highest record in its operational history. Specifically, the first quarter of 2024 recorded the highest number of peak-breaking instances, with 53 occurrences, followed by the third quarter (42 times), the second quarter (30 times), and the fourth quarter, which is currently at nine instances.

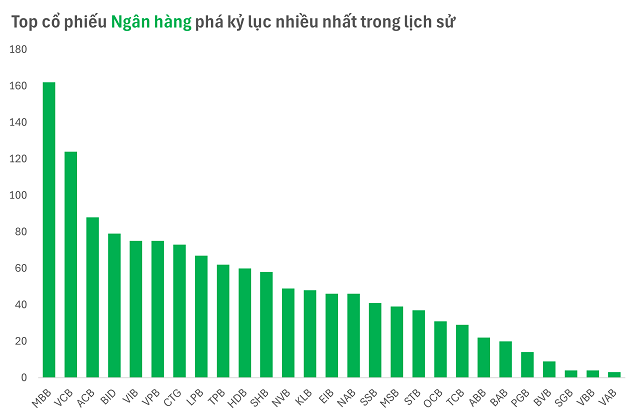

Historically, MBB (162 times) and VCB (124 times) remain the dominant players in the list of banks with the highest number of peak-breaking instances.

|

Most bank stocks remain undervalued

In the final stretch of the year, the banking sector has witnessed a mix of contrasting news, including announcements regarding capital increases, the State Bank of Vietnam (SBV) granting additional credit limits, and the impact of Circular 02 on debt restructuring, which is set to expire.

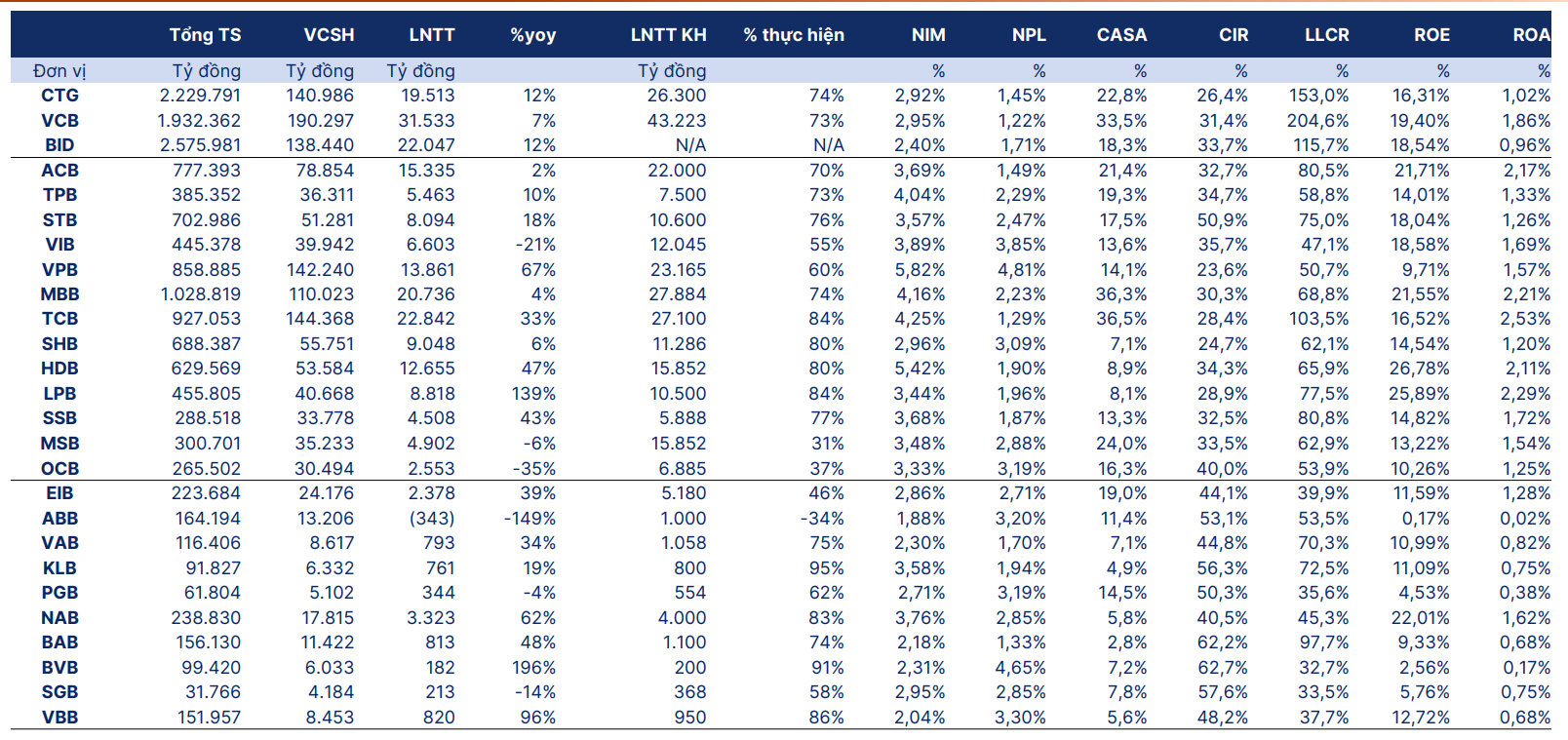

According to the latest report by SHS Securities on the banking industry, credit growth for the entire sector is estimated to have reached 11.5% as of November 27, 2024. Total credit outstanding as of the third quarter of 2024 stood at over 14.8 million billion VND, with 27 listed banks accounting for 11.4 million billion VND (77% of the total).

The group of private banks, particularly those specializing in corporate lending, exhibited a higher credit growth rate compared to state-owned banks. Institutions like TCB, HDB, and LPB have surpassed their annual limits and received additional credit room in the fourth quarter of 2024.

In contrast, VPB experienced a 9% credit growth (55% of the limit), which is relatively low compared to other commercial banks in the group. This is attributed to VPB‘s proactive reduction in corporate bond investments. During the nine-month period, the bank reported a 47% decrease to 18,442 billion VND after a 20% reduction in 2023. Meanwhile, consolidated customer lending increased by 12.2% (compared to a 19% increase in the same period last year).

SHS also estimates that five banks are eligible for additional credit limits at the end of November, having utilized 80% or more of their allocated limits. These banks include CTG, ACB, VIB, TCB, and MSB.

This marks the second time that additional credit limits have been granted in 2024 (the first being in August 2024), reflecting the determination to achieve the 15% credit growth target. The allocation of additional credit room enables these banks to expand their business operations, especially during the year-end peak season for credit demand.

Regarding Circular 02, which is set to expire on December 31, 2024, there has been no official communication from the SBV regarding its extension or discontinuation as per the planned timeline.

As of the end of the second quarter of 2024, restructured debt under Circular 02 amounted to 230 trillion VND, reflecting a 25.6% increase compared to the same period last year. As per the regulations, banks are required to make provisions for restructured debt according to the appropriate debt group, with the difference from the current debt group being provisioned at a rate of 50% per year, reaching 100% by the end of 2024.

Table: Consolidated data of listed banks for the first nine months of 2024.

|

Failing to extend Circular 02 could lead to an increase in non-performing loans and a decrease in the non-performing loan coverage ratio, without impacting the banks’ loan loss provisions.

SHS believes that the expiration of Circular 02 will have varying impacts on different banks. The group of banks that includes BIDV, Vietcombank, VietinBank, Techcombank, and ACB, among others, is expected to be less affected due to their robust loan loss reserves and strong financial health. In contrast, banks with a high proportion of Stage 2 loans and a low non-performing loan coverage ratio are anticipated to be more significantly impacted.

|

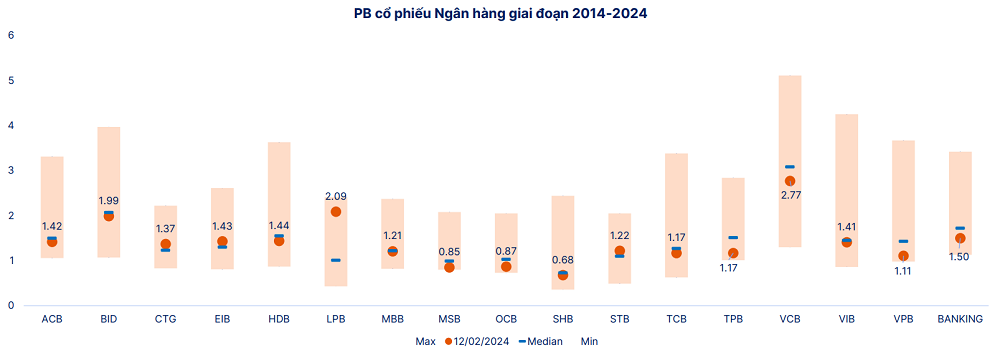

In terms of valuation, SHS Securities indicates that most banks are currently trading at or below their median historical price-to-book (PB) ratios, with the exception of LPB. TPB stands out as the bank with the cheapest PB ratio relative to its median (a deviation of 22.5%), followed by VPB (22.4%).

The Central Bank’s Net Withdrawal Exceeds VND 27 Trillion

The State Bank of Vietnam (SBV) has resumed net withdrawal on the open market operation (OMO) channel, marking a shift from the previous month’s net injection to support systemic liquidity due to seasonal factors.

The Market Beat: Afternoon Dip Turns All Three Boards Red

The unexpected afternoon slump saw all three market indices close in the red on December 12th. The VN-Index led the decline, falling 1.51 points to 1,267.35, followed by the HNX-Index, which dropped 0.19 points to 227.99. The UPCoM index also slipped, shedding 0.06 points to close at 92.68. Foreign investors offloaded Vietnamese shares for the fourth consecutive session.

The Secret to Joining the Elite 5% of Winning Investors in the Stock Market

The vast majority of active traders on the stock market, a staggering 95%, lose money. So, what’s the secret to success for the remaining 5%? How do they consistently beat the market and turn a profit?