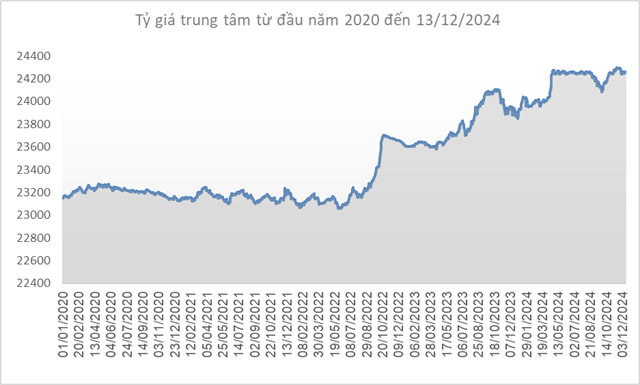

In the international market, the DXY index rose 0.98 points from the previous week to 106.95. This is the second week of gains for the index after a sharp fall in late November.

The USD continued its recovery after the release of US inflation data, which showed a further acceleration to 2.7% in November.

In this context, analysts on Wall Street believe that the US Federal Reserve (Fed) will likely pause in January to thoroughly assess the impact of the previous rate cut chain on the economy.

In a separate development, the European Central Bank (ECB) has cut interest rates for the third consecutive time, lowering them by 0.25 percentage points to 3% and widening the gap with the Fed (the US target rate range is currently 4.5-4.75%).

The Fed’s gradual rate cut has kept US interest rates higher than those in other countries, increasing demand for USD-denominated assets and bolstering the strength of the US dollar.

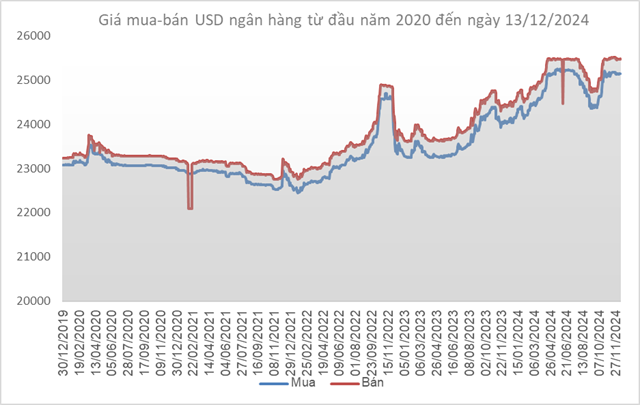

Source: SBV

|

Domestically, the Vietnamese dong to USD exchange rate increased by 9 VND/USD from the previous week (as of December 6) to 24,264 VND/USD on December 13, 2024.

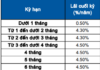

With a 5% margin, the allowed exchange rate range for commercial banks is between 23,051 and 25,477 VND/USD.

At the State Bank of Vietnam (SBV), the immediate buying price remains unchanged at 23,400 VND/USD. The selling price is also fixed at 25,450 VND/USD from October 25, which is the intervention price set by the SBV to “rein in” the exchange rate (equivalent to the intervention rate in Q2/2024). Commercial banks can purchase USD from SBV provided they have a negative foreign currency status.

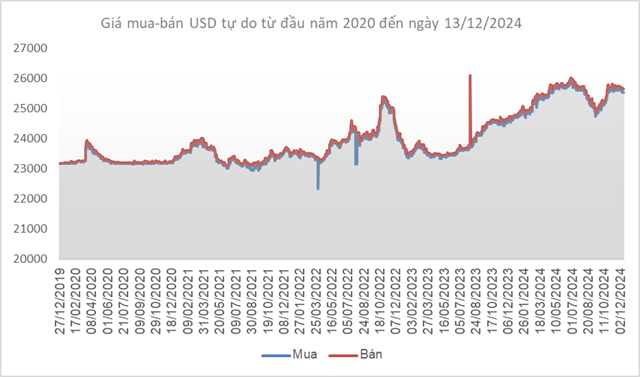

Source: VCB

|

Following a similar trend, Vietcombank increased the buying rate by 13 VND/USD and the selling rate by 10 VND/USD, resulting in an exchange rate of 25,147-25,477 VND/USD (buy-sell) on December 13.

Source: VietstockFinance

|

In contrast, the USD/VND exchange rate in the free market decreased by 50 VND/USD on the buying side and 40 VND/USD on the selling side, reaching 25,550-25,660 VND/USD (buy-sell).

Securities KIS: Forex Pressure to Ease in Coming Months

According to KIS Securities, in December and the first quarter of 2025, the exchange rate will cool down and no longer put too much pressure on the economy and the stock market. This is due to the loose monetary policies of major central banks around the world, such as the FED and ECB, low foreign exchange demand, and trade surplus.