I. MARKET ANALYSIS OF STOCKS ON 12/11/2024

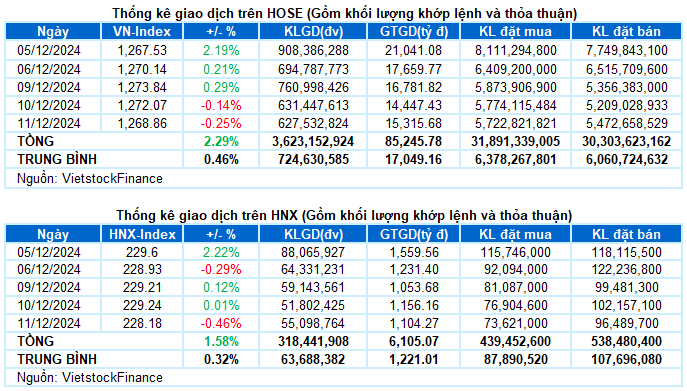

– The main indices dropped points during the 12/11 trading session. The VN-Index closed 0.25% lower at 1,268.86, while the HNX-Index fell 0.46% from the previous session to 228.18.

– Matching volume on the HOSE reached nearly 502 million units, up 0.4% from the previous session. Matching volume on the HNX decreased by 1.4%, reaching nearly 45 million units.

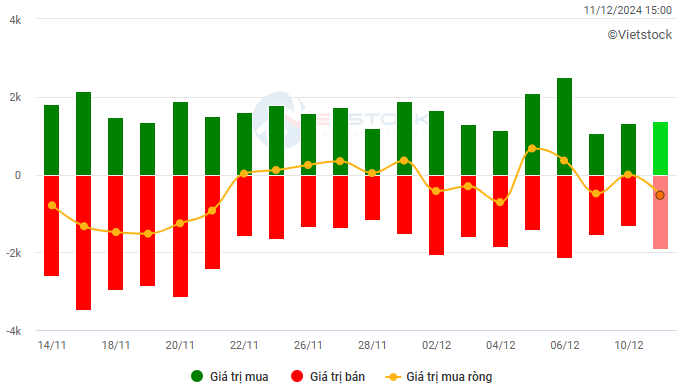

– Foreign investors net sold on the HOSE and HNX exchanges, with values of over VND 295 billion and nearly VND 59 billion, respectively.

Trading value of foreign investors on the HOSE, HNX, and UPCOM exchanges by day. Unit: VND billion

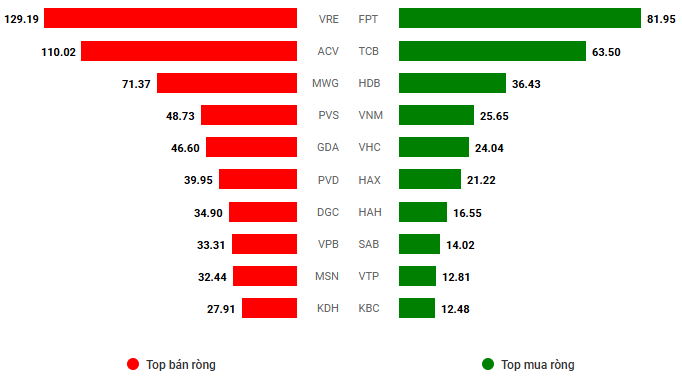

Net trading value by stock code. Unit: VND billion

– The market experienced another session of tug-of-war around the 1,270-point threshold. A familiar pattern emerged as buyers dominated the early session but couldn’t sustain their momentum, and selling pressure gradually pushed the index back to the starting point by the end of the morning session. The situation worsened in the afternoon session, with sellers widening the gap and causing the index to drop more than 7 points at one point. A late recovery helped the VN-Index narrow its loss but it still closed in the red, ending at 1,268.86, down 3.21 points from the previous session.

– In terms of impact, VCB remained the stock with the most negative influence on the overall index, with this stock alone taking 1.6 points off the VN-Index. The impact of the other stocks was not significant, with FPT leading on the positive side (0.36 points).

– The VN30-Index closed just above the reference level at 1,336.48. Sellers had a slight edge with 16 declining stocks, 10 advancing stocks, and 4 unchanged stocks. POW, BCM, VCB, MWG, and VRE were the bottom five stocks, each falling over 1%. On the upside, SHB and HDB traded positively, rising 2.42% and 1.07%, respectively.

The tug-of-war and divergent trends dominated, resulting in half of the industry groups fluctuating within a 1% range, with half of them gaining and the other half losing ground. The IT group led the market with a 0.67% gain, thanks to the positive performance of FPT (+0.67%) and CMG (+0.71%). Following suit were the telecommunications and essential consumer goods sectors, with YEG (+4.96%), FOX (+1.03%), and VGI (+0.55%) making notable contributions; MCH (+1.45%), KDC (+4.77%), VHC (+1.37%), and HNG (+1.85%) also stood out.

In contrast, the utilities group lagged the market as many large-cap stocks faced selling pressure, including POW (-1.98%), GAS (-0.43%), DNH (-9.77%), REE (-1.19%), QTP (-2.03%), HND (-1.49%), and TMP (-6.83%), among others. The non-essential consumer goods and industrial sectors also witnessed several stocks falling over 1%, such as MWG, GEX, VGT, and TCM; ACV, HVN, VEA, VEF, GMD, VTP, CTD, and SGP.

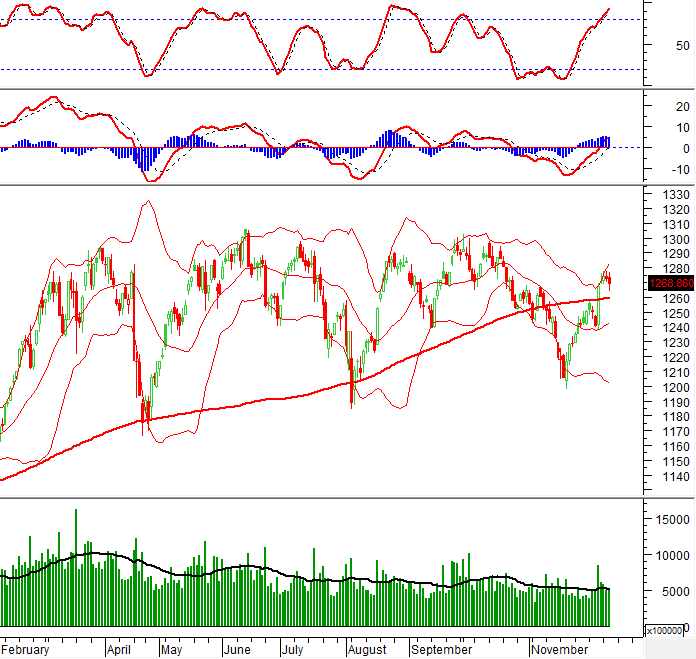

The VN-Index continued its decline amid a tug-of-war with trading volume below the 20-day average. This indicates that investor caution persists following the recent strong gains. Currently, the Stochastic Oscillator indicator is venturing deeper into overbought territory. Investors should remain vigilant in the coming period if the indicator triggers a sell signal.

II. TREND AND PRICE MOVEMENT ANALYSIS

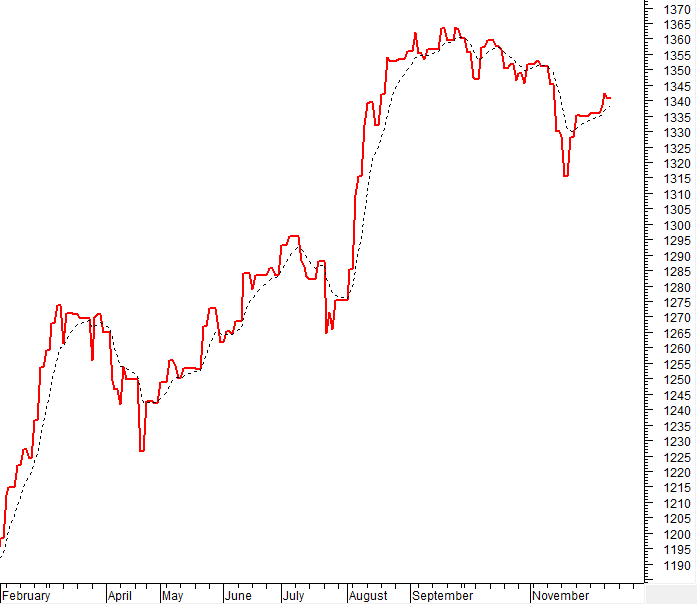

VN-Index – Stochastic Oscillator ventures deeper into overbought territory

The VN-Index continued its downward trajectory amid a tug-of-war, with trading volume remaining below the 20-day average. This suggests that investor caution is lingering after the recent sharp increases.

At present, the Stochastic Oscillator indicator is delving further into overbought conditions. Investors are advised to exercise caution in the upcoming period should the indicator generate a sell signal.

HNX-Index – Trading volume remains below the 20-day average

The HNX-Index declined amid trading volume that continued to stay below the 20-day average, indicating a rise in investor caution.

Additionally, the Stochastic Oscillator indicator is venturing deeper into overbought territory. Should the indicator trigger a sell signal in the near term, the index’s outlook will turn more pessimistic.

Analysis of Money Flow

Movement of Smart Money: The Negative Volume Index indicator for the VN-Index has risen above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Flow: Foreign investors continued to net sell during the trading session on 12/11/2024. If foreign investors maintain this stance in the upcoming sessions, the situation will become more pessimistic.

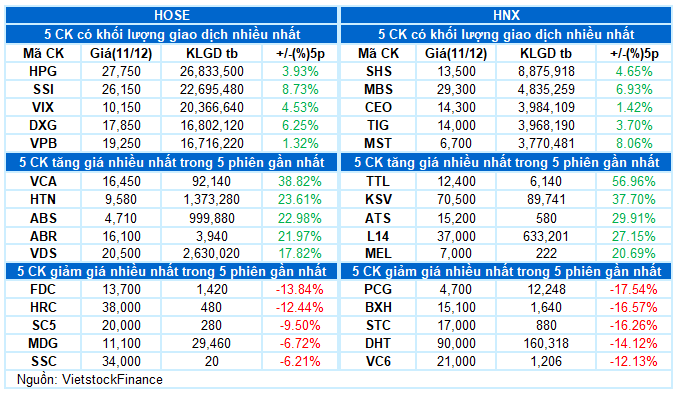

III. MARKET STATISTICS ON 12/11/2024

Economy and Market Strategy Analysis Department, Vietstock Consulting

“Unleashing the Power of Words: Vietstock Weekly 16-20/12/2024: Navigating Through Hidden Risks”

The VN-Index stalled after three consecutive weeks of gains, with trading volumes remaining below the 20-week average. This reflects a cautious sentiment among investors. Currently, the index sits above the Middle Bollinger Band. If it can sustain this level in the upcoming sessions, the outlook may not be as pessimistic.

Technical Analysis for the Session on December 12: Risk Signals Persist

The VN-Index and HNX-Index rose in tandem, with trading volume also showing significant improvement during the morning session, indicating a renewed sense of optimism among investors.

The Market Beat: Afternoon Dip Turns All Three Boards Red

The unexpected afternoon slump saw all three market indices close in the red on December 12th. The VN-Index led the decline, falling 1.51 points to 1,267.35, followed by the HNX-Index, which dropped 0.19 points to 227.99. The UPCoM index also slipped, shedding 0.06 points to close at 92.68. Foreign investors offloaded Vietnamese shares for the fourth consecutive session.

“Steering Through the Storm: Navigating Investment Strategies for 2025 and Beyond”

In less than a month, the stock market will close out an unpredictable 2024. As we transition into the new year, investors are seeking answers to the question: What’s in store for 2025? To provide insights and guidance, VPBankS Talk 04, themed “Navigating Through the Storm,” will be held on December 16.

The Stock Market Soars Unexpectedly by 27 Points: What’s Behind the Surge?

The standout feature of this report is the HOSE matching liquidity, which surged over 60% from the previous session to 19.2 trillion dong – the highest level in the past 2 months.