This was a proposal by TV3 for shareholders to approve in writing, as per the list locked on December 9, 2024. The deadline for submitting the forms is 4:30 pm on December 24, 2024.

EVN staff maintain electrical equipment. Illustration

|

TV3’s management believes that given the results of the first nine months and the implementation of the production plan for the remaining months of the year, there are still many power grid projects awaiting approval for investment policies, especially those requiring the Prime Minister’s approval. Therefore, it is challenging to achieve the 2024 business plan as assigned by the General Meeting of Shareholders.

Consequently, TV3 proposes to the General Meeting of Shareholders to adjust the 2024 business plan, with a revenue target of VND 170 billion, a 15% decrease from the assigned plan of VND 200 billion. Net profit is expected to decrease by 21% to VND 11.4 billion.

The company explained that the 2024 business plan was initially based on the approved Power Development Plan VIII, and there were expectations for smoother procedures for approving investment policies compared to 2023. However, in reality, the approval process has encountered numerous obstacles, and the Land Law, which took effect on August 1, 2024, has significantly impacted the approval of investment policies. As a result, projects have been delayed in getting approved and entering the design phase, affecting the company’s revenue.

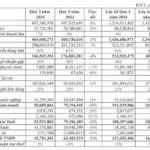

In the first nine months of 2024, TV3’s revenue reached nearly VND 89 billion, fulfilling over 44% of the yearly plan. Consulting revenue accounted for approximately VND 78 billion, achieving 40% of the plan. Profit reached only 8% of the plan, with a net profit of VND 808 million, mainly due to low revenue while still having to pay for operating expenses and project implementation costs, as well as a reduced profit margin on projects.

| TV3’s Business Results in Previous Years |

Additionally, the management of receivables from customers (mainly from units within EVN) has been a long-standing issue, causing challenges with cash flow. The company has had to borrow from banks to implement projects, pay taxes, and cover employee salaries. As of September 30, 2024, TV3’s total receivables stood at nearly VND 123.5 billion.

Electricity Construction Consulting Joint Stock Company No. 3 (TV3) is one of the four electricity construction consulting companies under the Vietnam Electricity Group (EVN). In addition to TV3, Electricity Construction Consulting Joint Stock Company No. 4 (HNX: TV4) also plans to seek shareholder approval to adjust its 2024 business plan.

Specifically, TV4 proposes to reduce total revenue to VND 200 billion, an 11.5% decrease from the assigned plan of VND 226 billion. Net profit is expected to decrease by almost 11% to VND 29.4 billion. The time frame for seeking shareholder approval is from December 18, 2024.

TV4 Proposes to Adjust Down 2024 Business Plan and Leadership Income

“Natural Disasters Take a Toll: Company Selling Coconut and Bitter Gourd Juice Reports a Sharp Decline in Q3 Profits”

With impressive results, the company achieved 72% of its annual revenue target and surpassed its profit goals, reaching 77%.