The Conference on Deployment of Banking Tasks for 2025 was held on December 14, 2024.

|

In 2024, the global economy grew slowly and unevenly, and inflation in countries cooled down more clearly after the monetary tightening and oil price drop. Central banks lowered interest rates, and the commodity and currency markets experienced strong fluctuations due to the uncertainty of the global economy. The domestic economy, however, grew positively, and inflation was controlled according to the set target. Compared to other countries, Vietnam was a bright spot in controlling inflation and maintaining macroeconomic stability, attracting FDI.

However, due to its high level of openness, Vietnam faced many difficulties and challenges as the global economic recovery remained fragile. Inflation risks persisted, and the country’s resilience was still limited. It had to adapt to the external situation while addressing internal issues and the aftermath of previous years, including the COVID-19 pandemic and the economic difficulties of 2023, natural disasters, and especially the recent Storm No. 3. These challenges greatly impacted macroeconomic management.

Amid these challenges and opportunities, the SBV proactively monitored the global and domestic economic developments to synchronously implement solutions that facilitate enterprises and people’s access to bank credit, recover production and business activities, promote growth, ensure macroeconomic stability, control inflation, and maintain the safe operation of the credit institution system.

Results in monetary policy management and banking activities

First, monetary policy management contributed to macroeconomic stability and inflation control. It supported liquidity for credit institutions, maintaining stability in the monetary and foreign exchange markets.

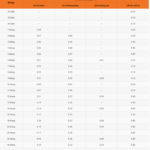

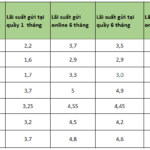

Second, regarding interest rate management, the SBV kept the operating interest rates unchanged in the context of still-high global interest rates. This allowed credit institutions to access capital from the SBV at low costs, thereby creating conditions to support the economy. The SBV also directed credit institutions to reduce operating costs to strive for lower lending rates and required them to report and publicly disclose average lending rates and the difference between deposit and lending rates on their electronic information pages. According to the commercial banks’ interest rate reports, the lending rate has decreased by about 0.96% per year compared to the end of 2023.

Third, the SBV flexibly and appropriately managed the exchange rate, helping absorb external shocks and coordinating monetary policy tools. As a result, the foreign exchange market remained stable, foreign currency liquidity was smooth, and the economy’s foreign currency needs were fully met. The exchange rate fluctuated flexibly in both increasing and decreasing directions, in line with market conditions.

Fourth, regarding credit management, to facilitate credit institutions’ provision of capital to the economy, on December 31, 2023, the SBV allocated the entire credit growth target for 2024 to credit institutions and publicly announced the determination principle for their proactive implementation. In 2024, following the Government and Prime Minister’s directions, the SBV proactively adjusted the credit growth target for credit institutions twice, on August 28, 2024, and November 28, 2024, based on specific principles, ensuring publicity and transparency. This was done under well-controlled inflation below the target and to promptly meet the economy’s capital needs, supporting production and business development.

Moreover, the SBV required credit institutions to strictly follow the directions on monetary and credit activities and the regulations on credit granting to improve business efficiency, ensure system safety, and stabilize the monetary market. It also instructed them to focus credit on production, business, and priority fields that drive economic growth according to the Government and Prime Minister’s orientations. Credit institutions were also asked to tightly control credit in potential risk areas, further stabilize deposit interest rates, and make more efforts to reduce lending rates by reducing costs, simplifying administrative procedures, promoting information technology application, and accelerating digital transformation. With the SBV’s synchronous solutions, as of December 13, credit growth for the entire economy increased by about 12.5% compared to the end of 2023. Credit was concentrated in production, business, and priority areas.

In addition, the SBV continued to direct credit institutions to promote the deployment of credit programs, such as the VND 120,000 billion program for social housing, worker housing, and renovation and reconstruction of apartment buildings; and the credit program for the forestry and aquatic sectors. Notably, the banking industry promptly implemented solutions to support customers affected by Storm No. 3.

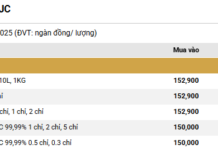

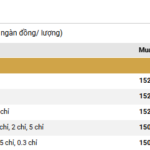

Fifth, in managing gold trading activities, with the Government’s attention and direction, the SBV’s synchronous solutions, and the coordination of related ministries and branches, the initial basic goal of handling and controlling the difference between SJC gold bar prices and world gold prices within an appropriate range has been achieved.

Sixth, the stability and safety of the credit institution system were maintained, ensuring the legitimate rights and interests of depositors. Bad debt was focused on handling and controlling, given the difficulties faced by the economy and production and business activities, which affected enterprises’ debt repayment ability.

Seventh, the legal framework, mechanisms, and policies for cashless payment activities and digital banking continued to be supplemented and improved, creating synchronization and favorable conditions for the development of cashless payments, promoting digital banking, applying new technologies, and ensuring security and safety in payment activities. Additionally, the banking industry intensified communication and financial education to enhance the public’s knowledge and skills in accessing and using banking services in the online environment. Thanks to these efforts, cashless payments and digital transformation in banking continued to yield positive results.

Eighth, the legal system for currency and banking activities was further improved to ensure the safe operation of the banking system and keep up with practical requirements, meeting international trends, standards, and practices. The SBV is constructing and submitting to competent authorities for amendment and supplementation of documents detailing and guiding the implementation of the Law on Credit Institutions 2024 to ensure consistency with the Law’s provisions.

Some tasks and orientations for the coming time

In the future, the SBV will continue to closely monitor market developments and domestic and foreign economic situations to proactively, flexibly, timely, and effectively manage monetary policy, coordinating harmoniously and closely with fiscal policy to support priority economic growth and promote production and business activities. It will also contribute to macroeconomic stability and inflation control as follows:

(i) Manage interest rates in line with market developments, macroeconomic conditions, inflation, and monetary policy goals.

(ii) Closely monitor the market situation to flexibly and appropriately manage the exchange rate, coordinating with monetary policy tools to contribute to inflation control and macroeconomic stability.

(iii) Continue to monitor and direct credit institutions: ensure safe and efficient credit growth, direct credit to production, business, and priority fields, and the economy’s growth drivers according to the Government and Prime Minister’s orientations. Tightly control credit in potential risk areas, review and simplify loan procedures and collateral requirements, create favorable conditions for enterprises and people to access bank credit, and expand credit to serve production, business, and consumption, helping curb “black credit.” Continue to monitor and urge credit institutions to strongly implement programs and credit policies as directed by the Government and Prime Minister.

(iv) Strongly and effectively implement the Project “Restructuring the system of credit institutions associated with handling bad debts in the 2021-2025 period” to develop a healthy, qualitative, efficient, public, and transparent credit institution system in accordance with the law and approaching and meeting international standards and practices. Promote bad debt handling, improve credit quality, and prevent and minimize new bad debts.

(v) Focus on implementing Decree No. 52/2024/ND-CP on cashless payment activities (Decree 52) and the Circulars guiding the Law on Credit Institutions, Decree 52/2024/ND-CP. Continue to effectively implement the contents of the Plan on deploying the Project for developing cashless payments in the 2021-2025 period and the Plan on digital transformation in the banking industry. Enhance security, safety, and confidentiality in payment and banking activities, and direct service-providing units to actively deploy online payment and bank card payment security and confidentiality solutions to protect the legitimate rights and interests of customers. At the same time, strengthen communication and financial education to improve the public’s knowledge and skills in using financial and banking products and services.

Unlocking Economic Growth: Unleashing Production and Business Through Policy Reform

Prime Minister Pham Minh Chinh concluded the regular Government meeting on the morning of December 7, emphasizing that policy formulation must be forward-thinking, ambitious, and bold. He stressed that policies should “unshackle” production and business activities to unleash their full potential, with the primary focus on boosting economic growth. This, in turn, will increase per capita income, raise labor productivity, improve the material and spiritual lives of the people, and enhance the country’s stature.

Securities KIS: Forex Pressure to Ease in Coming Months

According to KIS Securities, in December and the first quarter of 2025, the exchange rate will cool down and no longer put too much pressure on the economy and the stock market. This is due to the loose monetary policies of major central banks around the world, such as the FED and ECB, low foreign exchange demand, and trade surplus.