Services

The Vietnam Investment Summit 2024, held in Ho Chi Minh City on December 5th, in partnership with Techcombank, offered insightful perspectives and opportunities for a new era of investment in Vietnam.

The crucial role of Fintech

Commenting on investor behavior, Mr. Jens Lottner, CEO of Techcombank (HOSE: TCB), shared that during 2021-2021, investor confidence was positive, and they remained optimistic about the future, even during the Covid pandemic. However, in 2022-2023, Vietnam experienced some turbulent times. “Still, I believe investors will continue to be optimistic,” he added.

.JPG) |

“The number of middle-income earners will continue to grow, and there is still room for expansion. TCB’s services will further focus on providing what customers need most, addressing their financial and non-financial needs.

We can learn from neighboring markets, such as Thailand. Many services and products already seen in Thailand will soon be available in Vietnam. We agree that Vietnam’s development pace is rapid compared to other countries,” added CEO – Jens Lottner.

Mr. Lottner also emphasized the crucial role of Fintech, especially in prompting traditional banks to keep up with technological advancements. “I believe that in the future, there will be a harmonious collaboration between Fintech startups and traditional banks, leveraging each other’s strengths,” he stated.

Banks as the driving force for economic development

.JPG) |

Mr. Jens Lottner also shared that just 18 months ago, investors were concerned about political stability in Vietnam and China’s policies. However, they have since observed the Vietnamese government’s encouragement of the economy, including the private sector, and their support for investors.

In the current context, Vietnam needs to prepare for various economic development scenarios.

“I believe we are a production hub for products the world needs. We must associate our low-cost production with that. Vietnam is currently an attractive destination for these needs. As the economy grows, the financial and banking sector becomes the driving force for this development,” shared Mr. Lottner.

Of course, when investing, it is essential to consider a broader context, from corporate management to the country’s governance, to determine if investing here is efficient.

Techcombank’s role in Vietnam’s development

The CEO of Techcombank believes that to stand out and be competitive, one must identify their unique advantages.

|

While Techcombank possesses capabilities and technology, there are limitations regarding human resources. With the current team, the focus should be on training and upgrading consulting skills to better support customers.

It is also crucial to find ways to scale technology to reach every employee and, ultimately, each customer. Empowering employees, especially those directly advising customers, is an important aspect that banks should focus on.

Vietnamese people will become wealthier, and there will be more individuals with disposable income for investments. Techcombank must find ways to reach this group and build trust with them.

Regarding diversifying investment tools in Vietnam, Mr. Jens Lottner stated that when investment channels are limited, the asset market (lacking diversity) becomes unstable and prone to bubbles.

“However, I think that with the current legal framework, we have enough room to create and diversify products. Especially, securities companies need to develop more distinctive products to meet the needs and risk appetites of a wider range of investors.

When creating products, customer-centricity is key, and we must pay attention to reasonable risk management.

At this point, we should also focus on establishing investment funds to boost the domestic economy and connect these funds with international investors. This requires a combination of private and state efforts to develop legal frameworks.

We need to be creative in solving problems to offer more diverse investment products, including digital currencies, for instance,” concluded the CEO of TCB.

Banks connecting with supportive elements for the economy in 2025

At the event, Ms. Nguyen Hoai Thu, CEO of VinaCapital Fund Management Joint Stock Company, also shared her thoughts on the economic growth drivers for 2025, stating that they would differ from the previous two years. She predicted that production and exports would no longer be the main drivers, and growth would primarily come from public investment.

Additionally, the government will implement appropriate policies to stimulate the real estate market, helping it recover to its former glory. A revived real estate market will boost consumer confidence, indirectly contributing to the growth of domestic consumption.

.JPG) |

“Vietnam’s resilience is much stronger than that of other countries. Despite the two years of COVID, we still achieved positive growth and continued to attract FDI, while many other ASEAN countries experienced negative growth. I believe that a 6.5% GDP growth rate for 2025 is achievable, and an 8% target may be a bit ambitious. The government might introduce new policies in the coming months to reach this growth rate,” added Ms. Thu.

Mr. Nguyen Duc Hoan, CEO of ACB Securities (ACBS), shared a similar sentiment, acknowledging the government’s efforts to streamline its apparatus and improve administrative procedures to create a favorable environment for domestic businesses and attract FDI to Vietnam. He emphasized that to achieve a 7-8% GDP growth rate, improvements in infrastructure (public investment) are crucial, and the government is currently working diligently towards this goal.

“Techcombank’s Noble ESG Vision: Championing Sustainability and Community Engagement.”

Ms. Thai Minh Diem Tu, Chief Marketing Officer of Techcombank, offers a fascinating insight into the bank’s sustainability journey, its strategic vision for mass participation sports, and the integral role of ESG in Vietnam’s future growth and development. In this exclusive interview with VET, she highlights the bank’s commitment to long-term environmental and social responsibility, and how their involvement in sports is about more than just sponsorship, it’s about community engagement and a healthier, more prosperous Vietnam.

The Secret to Joining the Elite 5% of Winning Investors in the Stock Market

The vast majority of active traders on the stock market, a staggering 95%, lose money. So, what’s the secret to success for the remaining 5%? How do they consistently beat the market and turn a profit?

The Global Leap for Vietnamese Fintech: Opportunities Abound

Fintech is revolutionizing the global financial industry, leveraging cutting-edge technology and financial services to deliver convenient and efficient solutions to users. By harnessing the power of innovation, fintech is transforming the way people interact with their finances, making it more accessible, secure, and user-friendly than ever before. With a focus on convenience and efficiency, fintech is leading the charge in the financial world, offering a seamless experience that meets the evolving needs of customers worldwide.

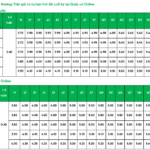

The Big Three Shake Up Savings: Techcombank, VPBank, and MSB Kick Off December With a Bang by Hiking Deposit Rates

In the first week of December, several banks adjusted their savings interest rates, with the highest increase reaching 0.7% per annum. This move underscores a shift in the financial landscape, as institutions recognize the importance of competitive rates to attract and retain customers.