|

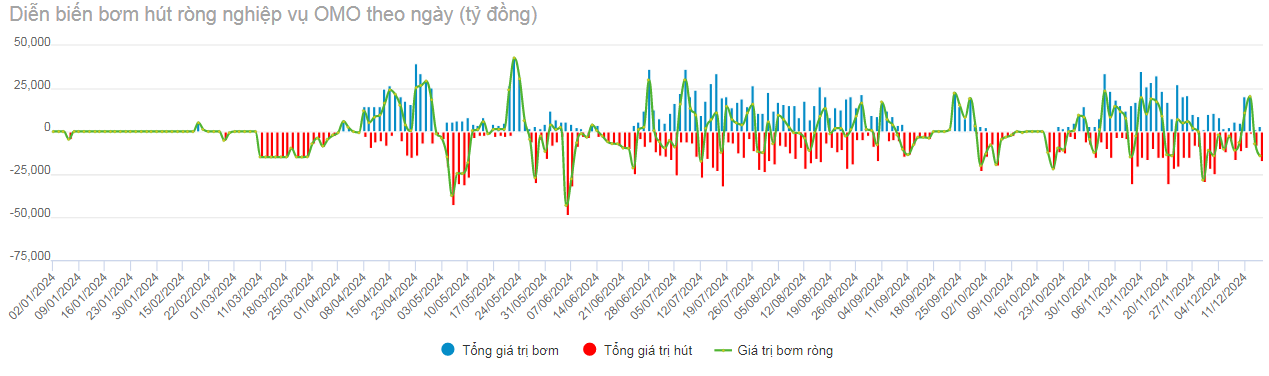

Net OMO pumping and withdrawal dynamics on a daily basis since the beginning of 2024 up to December. Unit: VND billion

Source: VietstockFinance

|

Accordingly, the SBV has been withdrawing funds on a net basis for the third consecutive week, mainly due to the maturity of 7-day term repo contracts in the first week of December, combined with an increase in the volume of issued bills.

Specifically, the SBV ramped up the issuance of 7-day term repo contracts with an interest rate of 4%/year, resulting in a volume of VND52 trillion against VND35 trillion in maturities.

Subsequently, on the last day of the week (December 13) and the first day of the following week (December 16), the SBV intensified the issuance of bills with values of VND7,100 billion and VND12,180 billion, respectively. During the period from December 9 to 16, the total value of issued bills reached VND29,130 billion against VND4,450 billion in maturities.

By the end of December 16, the SBV slightly withdrew funds from the system, resulting in a net withdrawal of VND7.68 trillion. The outstanding volume in the 7-day term repo channel stood at VND47 trillion, while that in the bill channel was VND61.28 trillion.

|

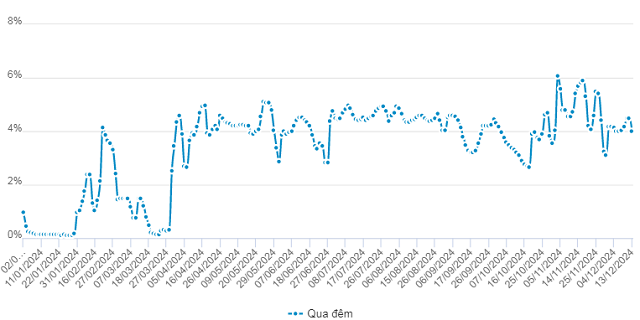

Interbank interest rates for overnight term since the beginning of 2024 up to December. Unit: %

Source: VietstockFinance

|

The SBV’s trend of slightly withdrawing funds from the system helped maintain stability in the interbank interest rates for the overnight term, with the highest rate reaching only 4.5%/year on December 12 before quickly dropping to 4.01% by the week’s end (December 13)

|

DXY dynamics over the past year

Source: marketwatch

|

Last week (December 9-13), the USD price continued its upward trajectory in the international market following the release of US inflation data. The DXY index rose by 0.98 points to 106.95 points. This marked the second consecutive week of increases for the index after a sharp drop in late November.

Domestically, the USD/VND exchange rate listed at Vietcombank also witnessed a slight increase, remaining within the permitted trading band limit (VND 25,477/USD), representing a 4.3% rise compared to the end of 2023.

The Central Bank’s Net Withdrawal Exceeds VND 27 Trillion

The State Bank of Vietnam (SBV) has resumed net withdrawal on the open market operation (OMO) channel, marking a shift from the previous month’s net injection to support systemic liquidity due to seasonal factors.