|

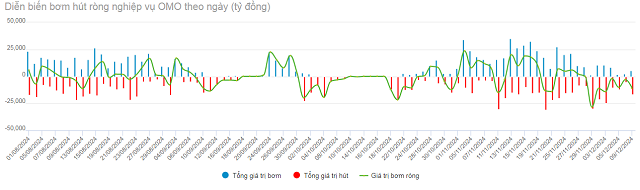

Net OMO pumping and draining developments on a daily basis from August to December 2024. Unit: VND billion

Source: VietstockFinance

|

From December 2 to 9, the SBV continued net draining for the second consecutive week, with a total value of VND 51,525 billion.

Specifically, the trend of draining liquidity persisted as the SBV regularly issued bills and term-buying contracts matured. Among these, a VND 35,000 billion 7-day term-buying contract with an interest rate of 4%/year was utilized out of a total of VND 64,000 billion in maturities. Simultaneously, a total of VND 26,975 billion in 14-day and 28-day bills were auctioned (with interest rates of 3.9-4%/year) out of a total of VND 4,450 billion in maturities.

As of December 9, the outstanding balance in the term-buying channel stood at 25 trillion VND, while the bill channel reached 42.61 trillion VND.

|

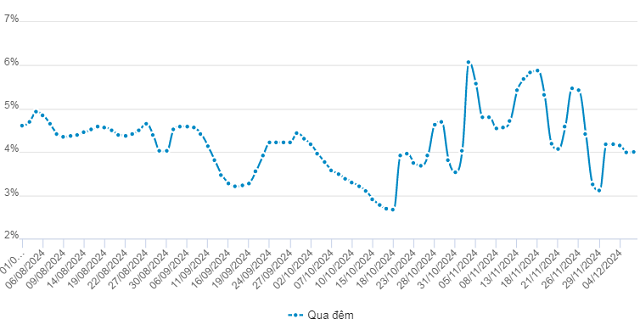

Interbank interest rates for overnight term from August to December 2024. Unit: %

Source: VietstockFinance

|

The overnight interbank interest rate traded within a narrow range of 3.99-4.18% throughout the week after plummeting to 3.11% at the end of November (November 29).

At the regular Government press conference for November 2024, held on December 7, SBV Deputy Governor Dao Minh Tu stated that as of December 7, credit had grown by 12.5% compared to the end of 2023, reaching an estimated VND 15.3 quadrillion.

According to the SBV representative, given the current credit growth rate and the typically active disbursement period towards the year-end, achieving the 15% credit growth target is feasible.

Consequently, to attain the 15% credit growth target, the banking system needs to disburse more than VND 300 trillion in credit into the economy during the final three weeks of 2024.

|

DXY movement in the last 3 years

Source: markewatch

|

Last week, the pressure on the USD/VND exchange rate was not concerning as the DXY index only slightly increased by 0.19 points in the international market, reaching 105.97 points.

Vietcombank’s posted exchange rates edged up by just 4 VND/USD in both buying and selling compared to the previous week, closing at 25,134-25,464 VND/USD (buying-selling) on December 9, remaining within the permitted trading band (23,042-25,468 VND/USD). Meanwhile, the free-market rates dropped by 50 VND/USD in both buying and selling compared to the previous week and traded within a narrow range of 25,600-25,700 VND/USD.

The Art of Money: A Gentle Guide to Navigating the Monetary System

The State Bank of Vietnam (SBV) continued its net withdrawal stance in the open market operations (OMO) channel despite ramping up its 7-day term deposit issuance last week (December 9-16, 2024).

The Power of Idle Money: Unlocking the Potential of Dormant Funds

Data from the State Bank of Vietnam (SBV) revealed that, as of the end of September 2024, the total means of payment in the economy reached over VND 16,900 trillion, a significant 5.91% increase compared to the end of 2023.