VIC: Vingroup Joint Stock Group (stock code: VIC) has just announced the Board’s resolution to transfer 99.93% of the shares in VYHT Joint Stock Company.

Accordingly, VYHT Joint Stock Company, which is in charge of a part of the Vinhomes Royal Island project, will transfer 80% to foreign partners, and 19.93% of the shares will be transferred to Vinhomes Joint Stock Company under Vingroup.

After the transaction is completed, VYHT will no longer be a subsidiary of Vingroup.

BVH: The Board of Directors of Bao Viet Holdings (stock code: BVH) has decided to appoint Ms. Tran Thi Dieu Hang – Member of the Board of Directors as Chairman of the Board of Directors from November 27 until the position of Chairman of Bao Viet Holdings is filled.

The position of Chairman of the Group has been vacant for more than 2 years since Mr. Dao Dinh Thi left the position in August 2022.

VTL: Phuc Tin Service Company has sold all 2.4 million VTL shares of Vang Thang Long Joint Stock Company and is no longer a major shareholder as of November 27.

DP1: Central Pharmaceutical Joint Stock Company CPC1 (stock code: DP1) has appointed Mr. Ta Van Dung as Acting General Director of the company from December 13.

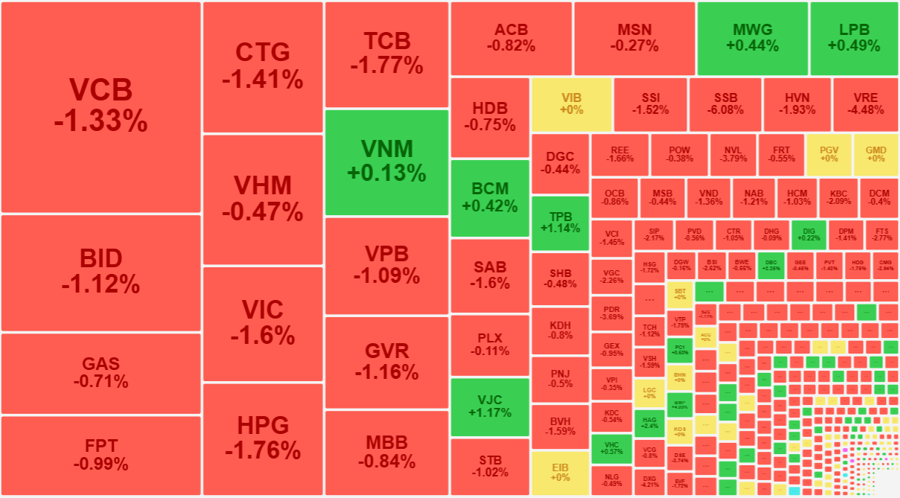

Market volatility in the past month Source: Fireant

TNB: Mr. Le Viet – Chairman of the Board of Directors of Thep Nha Be Joint Stock Company (stock code: TNB) has just submitted his resignation from this position to enjoy retirement benefits.

SBH: Song Ba Ha Hydropower Joint Stock Company (stock code: SBH) has appointed Mr. Nguyen Anh Vu as Acting Chairman of the Board of Directors of the company from December 1.

GIL: Binh Thanh Production, Business and Import-Export Joint Stock Company (stock code: GIL) announced that it has received a decision from Ho Chi Minh City Tax Department on administrative fines for tax violations with a total amount of tax arrears, late payment interest, and fines for the period 2019-2022 of VND 3.6 billion.

VDP: Central Pharmaceutical Joint Stock Company VIDIPHA (stock code: VDP) announced that it has received a document from the State Securities Commission on violations of securities and securities market laws. Accordingly, the enterprise was fined VND 65 million for late disclosure of information.

Dividend payment:

DNH: Da Nhim – Ham Thuan – Da Mi Hydropower Joint Stock Company (stock code: DNH) pays an interim dividend for 2024 in cash at a rate of 12%. The record date is December 16. The dividend payment amount is over VND 506 billion.

PCM: Postal Construction Materials Joint Stock Company (stock code: PCM) has appointed Mr. Ha Thanh Hai as Chairman of the Board of Directors of the company from November 28.

VNR: National Reinsurance Corporation (stock code: VNR) pays dividends in shares to existing shareholders at a ratio of 10:1 (shareholders owning 10 shares will receive 1 new share). The ex-dividend date is December 11.

TV2: Electric Power Construction Consulting Joint Stock Company 2 (stock code: TV2) pays dividends for 2023 in cash at a rate of 10%. The ex-dividend date is December 5.

-

Quoc Cuong Gia Lai’s shares hit the ceiling price after Nhu Loan was released

HTG: Hoa Tho General Corporation (stock code: HTG) pays an interim dividend for 2024 in cash at a rate of 30%. The ex-dividend date is December 24.

A32: Company 32 (stock code: A32) pays an interim cash dividend for 2024 at a rate of 10%. The record date is December 12.

MA1: Equipment Joint Stock Company (stock code: MA1) pays dividends in shares to existing shareholders at a ratio of 100:90 (shareholders owning 100 shares will receive 90 new shares). The ex-dividend date is December 11.

HD6: Hanoi Housing Development and Investment Company No. 6 (stock code: HD6) pays dividends in cash for 2023, at a rate of 10%. The ex-dividend date is December 9.

HC3: Hai Phong Construction No. 3 Joint Stock Company (stock code: HC3) pays an interim cash dividend for 2024, at a rate of 10%. The ex-dividend date is December 19.

The Insurance Tycoon’s Stock Surges Post-Dividend Payout: Is the State Divestment Story Heating Up Again?

In just 3 sessions, this insurance stock has surged over 17%, climbing to 52,100 VND per share – a level not seen in over 2 years.

The VCB Pushes VN-Index Below 1,250 Points, Insurance Stocks Surge: A Market Surprise

The recovery efforts this afternoon failed to bear fruit, as the dominant force of the ‘super-pillar’ VCB overwhelmed the lackluster performance of other blue-chips. The VN-Index closed with a loss of 1.38 points, with VCB’s 1.27% decline accounting for over 1.6 points. However, bottom-fishing funds were active, driving significant gains in numerous stocks, particularly in the insurance sector.

Market Beat: Dec 02 – Continuing Divergence, VN-Index Revisits 1,251 Point Milestone

The market closed with slight gains, as the VN-Index rose by 0.75 points (0.06%) to reach 1,251.21, while the HNX-Index climbed 0.68 points (0.3%) to 225.32. The market breadth tilted towards decliners, with 373 tickers falling against 319 advancers. The large-cap stocks in the VN30 basket painted a similar picture, as 17 tickers fell, 9 rose, and 4 remained unchanged.

Quarterly Review: Which Sector Will the 18,000 Billion NAV ETF Funds Buy Aggressively?

According to the latest report from BSC Research, the portfolios of two prominent ETFs are set to undergo notable changes during the upcoming Q4 2024 reconstitution. Viettel Post’s VTP is anticipated to feature in both ETF portfolios, while Nam A Bank’s NAB is likely to be added to the VNM ETF.

Market Beat: Telecoms Rebound, VN-Index Surges Over 8 Points

The market ended the session on a positive note, with the VN-Index climbing 8.35 points (0.67%) to reach 1,250.46, while the HNX-Index gained 1.07 points (0.48%), closing at 224.64. The market breadth tilted in favor of buyers, with 402 tickers advancing against 279 declining ticks. The VN30 basket painted a similar picture, as bulls dominated with 21 gainers, 6 losers, and 3 unchanged stocks, ending the day in the green.