The story of DRH’s restructuring began eight years ago, in 2016, not long after the current Chairman, Phan Tan Dat, joined the company’s Board of Directors.

Specifically, Mr. Dat joined the DRH Board in June 2015 and took on the role of General Director in November of that year. Under his leadership, DRH underwent significant changes in terms of its subsidiary structure and revenue sources.

In terms of subsidiaries, DRH reduced its number of associated companies from five in 2015 (including four real estate companies and one vocational training/event organization company) to just two in 2016. They retained a 23.37% stake in one of the original associates, CTCP Can Nha Mo Uoc Cuu Long, and established a new association with CTCP Khoang San va Xay Dung Binh Duong (HOSE: KSB) with a 22.34% stake, which later increased to 28.1% in 2017 and has been maintained since.

DRH also added CTCP Dia Oc An Phu Long to its list of subsidiaries, owning 99.95% with a chartered capital of 80 billion VND. An Phu Long is the investor in the D-Vela project (a complex apartment building at 1177 Huynh Tan Phat), which DRH had mentioned in previous years.

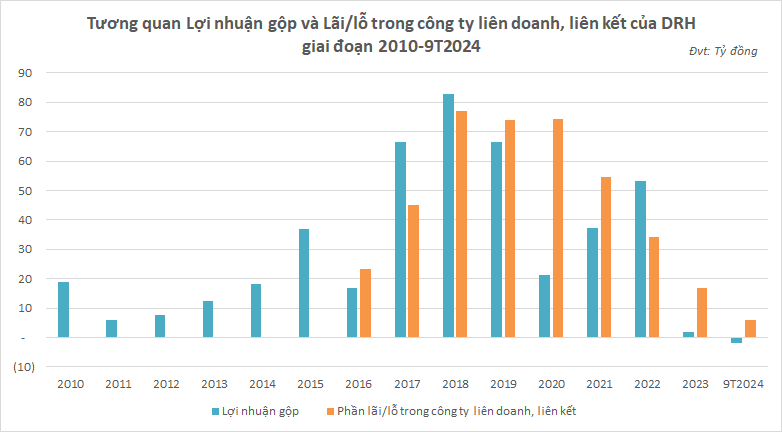

The highlight of the restructuring was the significant increase in profits from joint ventures and associates starting in 2016. Despite having multiple associated companies before (5-6), DRH did not mention their profits or losses in the financial statements during that period.

From 2016 onwards, profits from joint ventures and associates have had a considerable impact on DRH’s business results, with profits from these ventures often exceeding gross profits—an indicator of the company’s effectiveness in the real estate sector. By reducing their stake in Cuu Long to below 20% in mid-2017, DRH’s profits from joint ventures and associates since then have solely come from KSB.

Source: VietstockFinance

|

Despite being only an associated company, DRH has remained the largest shareholder of KSB since 2016. Mr. Dat also began serving as Chairman of the KSB Board of Directors during this time. Tran Ngoc Dinh, who joined the DRH Board simultaneously with Mr. Dat, also joined the KSB Board as a member.

As KSB’s role in DRH became increasingly important, in 2018, Mr. Dat replaced founding shareholder Dang Duc Thanh as Chairman of the DRH Board of Directors. That same year, the DRH Board elected four new members: Vo Cong Hoang, Duong Ngoc Hai, Nguyen Lam Tung, and Ho Ngoc Bach. Mr. Tung and Mr. Bach currently serve as independent members of the DRH Board.

In terms of projects, 2016 was also the year DRH announced its collaboration with CTCP and Phat Trien Bat Dong San Dong Sai Gon to develop the Metro Valley project (in Thu Duc City), bringing the total number of projects in which DRH participated as an investor or joint investor to seven.

However, during the period from 2016 to the present, only one of these seven projects has been successfully completed: the complex apartment building at 1177 Huynh Tan Phat, Phu Thuan Ward, District 7, Ho Chi Minh City (commercially known as D-Vela), with handovers beginning in 2019.

According to DRH’s 2023 Annual Report, the company is currently developing three other projects: the Aurora Riverside high-rise apartment building, Metro Valley (commercially known as Symbio Garden), and the Hoa Binh residential area. Aurora Riverside and Metro Valley are two of the seven projects mentioned since 2016, while the Hoa Binh residential area is a new addition to the 2023 Annual Report.

Bond debt prolonged due to unfinished projects

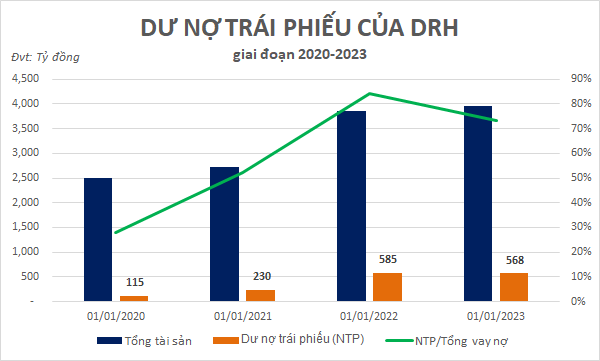

It is noteworthy that the Aurora Riverside and Metro Valley projects are both linked to two lots of DRH’s bonds that have matured. According to HNX, DRH issued two lots of bonds, DRHH2022001 and DRHH2224001, with a total value of 660 billion VND.

The DRHH2022001 lot (250 billion VND) was issued on November 16, 2020, with a maturity date of November 16, 2022, and an interest rate of 11% per annum. The proceeds were intended for investing in the Metro Valley and Aurora residential area projects in Ho Chi Minh City, with two subsidiaries, CTCP Bat Dong San Dong Sai Gon (Dong Sai Gon Company) and CTCP Dau Tu Bat Dong San Binh Dong (Binh Dong Company), as the investors. The collateral included the land use rights and assets attached to the land of the Metro Valley project, all shares of the Dong Sai Gon Company, and approximately 2.3 million shares of CTCP Khoang San va Xay Dung Binh Duong (HOSE: KSB) owned by DRH, as well as the right to collect on several apartment contracts belonging to the Binh Dong Company.

The DRHH2224001 lot (410 billion VND) was issued on February 23, 2022, with a maturity date of February 23, 2024, and an interest rate of 12% per annum. DRH planned to use the proceeds to collaborate with CTCP Phat Trien Cong Nghiep KSB and a third party to implement Phase 2 of the Dat Cuoc Industrial Park project (in Binh Duong) and to finance the Binh Dong Company to complete the Aurora project. The collateral included land use rights in Tan Phu Ward, Thu Duc City, owned by Mr. To Duy Thai, and more than 5 million shares of KSB owned by DRH.

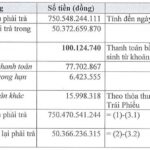

With the challenges faced by the real estate and corporate bond markets in 2022, DRH encountered difficulties in repaying its bond debt. Initially, they were only able to repay 54.8 billion VND of the principal instead of the expected 230 billion VND when the DRHH2022001 lot matured. In the 2022 audited financial statements, EY also emphasized that DRH had overdue bond debt with principal and interest amounts of 175.2 billion VND and 3.7 billion VND, respectively.

In the 2022 Annual Report, DRH stated that as of March 10, 2023, they had fully repaid the interest, but the principal was still being sourced. As of December 31, 2023, DRH still owed nearly 158 billion VND in principal, along with over 10 billion VND in interest (not explicitly stated).

In another development, despite the expectation that the proceeds from the DRHH2224001 lot would help the company improve its financial situation, DRH has been unable to make any payments for three out of four interest installments on this bond, totaling 36.8 billion VND. It was not until March 22, 2024, that the company was able to pay 5/12 billion VND of the interest installment due on May 23, 2023. Unsurprisingly, DRH was unable to repay any principal amount when the 410 billion VND bond lot matured on February 23, 2024.

In the recently published 2023 Annual Report, DRH stated that they are still working with potential partners to liquidate some investments to repay the debt.

Source: VietstockFinance

|

Thus, after more than two years of restructuring (since the issuance of the 410 billion VND bond lot), DRH has yet to resolve its bond issues, while the completion of real estate projects such as Aurora Residences and Metro Valley remains in the realm of promises.

Aurora Residences (or the Aurora high-rise apartment building) is a luxury apartment project located on Ben Binh Dong Street, District 8, with two street fronts and two river fronts. It comprises 445 apartments, 32 officetel units, and 9 shophouses. The project is currently behind schedule, and DRH plans to accelerate construction to deliver it by August 2025.

The Metro Valley residential area (commercially known as Symbio Garden) covers an area of 34,737m2 in Tan Phu Ward, Thu Duc City. It is designed as a model of townhouses, commerce, and health facilities, with 137 detached townhouses. However, the project has only received approval for its 1/500 planning, and DRH is in the process of completing the legal procedures related to land and investment.

What are DRH’s leadership plans?

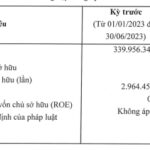

At the 2024 Annual General Meeting of Shareholders, the DRH leadership set a target of 60 billion VND in total revenue for the year, a 15% increase from the previous year, and a pre-tax profit of 5 billion VND (compared to a loss of over 99 billion VND the previous year).

To achieve these goals, the Chairman of DRH shared that the company will arrange for the divestment of an investment through a trust. Negotiations have reached the final stage, and if successful, the company expects a significant profit. Regarding project implementation, the management provided updates on several ventures.

The D-vela high-rise apartment project has completed the handover of homes to buyers, and the company is preparing for the project’s handover to the condominium management when their operating regulations are finalized. The Aurora high-rise apartment project is in the process of interior finishing, with an expected delivery in 2025. Metro Valley is still in the process of completing the legal procedures related to land and investment.

The most significant obstacle for Metro Valley is the calculation of land use fees. On September 20, the Ho Chi Minh City Department of Natural Resources and Environment sent a request to the City’s Land Price Appraisal Council to approve the land use fee calculation for 22 projects, including Metro Valley. Once approved, DRH will pay the land use fees. The company plans to recoup some investments to cover these fees.

After paying the land use fees, DRH will proceed with infrastructure construction and delivery to customers, with a deadline of Q3 2025. Regarding the Hoa Binh residential area in Quang Trung, Thong Nhat, Dong Nai, the project has received approval for its investment and detailed planning. DRH is in the process of completing the legal procedures and preparing for infrastructure construction. However, Mr. Dat noted that if there are prolonged legal complications, DRH will consider transferring the project to another partner.

Concerning the bond debt settlement, the company has sought bondholders’ approval to sell all collateral to repay the debt. If this is insufficient, the Board of Directors will consider transferring some assets and investments. DRH expects to settle all bond debt by 2025.

The Power of Persuasion: Crafting a Compelling Headline

“A Power Company’s Innovative Bond Offering: Overcoming Losses with a $36 Million Injection”

Despite recording a post-tax loss of over VND 500 billion in the first half of this year, a power company has surprisingly raised nearly VND 900 billion in “three-no” bonds with a three-year maturity.

Profits Plummet as Hoang Quan Mekong’s Debt Reaches 15 Times Equity

Hoang Quan Mekong reported a net profit of over 231 million VND in the first half of 2024, a staggering 92% decrease compared to the previous reporting period. The company’s total liabilities exceeded 5 trillion VND.