Saigon – Hanoi Commercial Joint Stock Bank (SHB) is set to issue bonds worth VND5,000 billion ($200 million) to bolster safe and lucrative investment avenues for its customers and augment its financial prowess. The first tranche will make available VND2,500 billion ($100 million) in bonds.

Bank Bonds: Dominating the Market

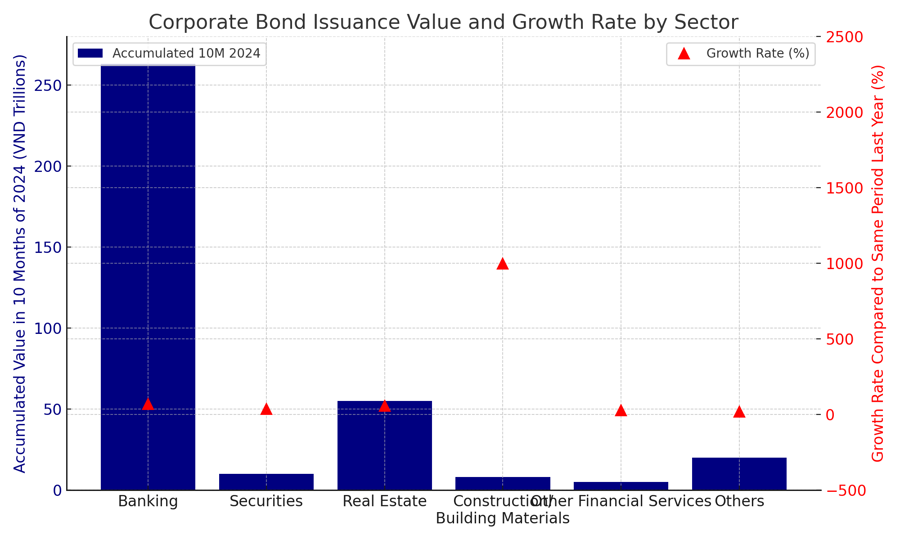

A recent bond market report by MBS Research analysts revealed a notable spike in corporate bond issuances during the fourth quarter of 2024. This surge is attributed to businesses’ rebounding capital demands and their proactive expansion initiatives in production and operations, bolstered by the broader economic upturn.

From January to October 2024, the banking sector led the way with the highest bond issuance value, totaling approximately VND263,000 billion ($10.52 billion). This accounted for a substantial 72 percent of the total market and marked a 154 percent increase compared to the same period in the previous year.

MBS experts predict that banks will continue to ramp up bond issuances to supplement their lending capital. Credit growth across the banking system has already shown promising progress, reaching 10.08 percent in the first ten months of 2024, outpacing last year’s rate of 7.4 percent. This growth is expected to further accelerate in the remaining two months of the year, propelled by the robust recovery in production, exports, and services.

Associate Professor Dr. Dinh Trong Thinh, a renowned banking and finance expert, shed light on the revival of the bond market, led primarily by issuances from commercial banks. He emphasized that “bonds issued by banks provide a safe and regulated investment channel, similar to savings accounts, with guaranteed principal and interest payments.”

SHB Broadens Investment Horizons for Customers

SHB’s impending bond issuance is strategically designed to present customers with secure and rewarding investment choices while bolstering its financial prowess. The first tranche, offered under Resolution 21/2024/NQ-HDQT, will make available VND2,500 billion ($100 million) in bonds for registration from December 26, 2024, to February 28, 2025.

As of November 30, 2024, SHB boasted total assets of VND708 trillion ($28.32 billion) and outstanding credit balances nearing VND522 trillion ($20.88 billion), reflecting an impressive 18 percent increase. The bank’s capital adequacy ratio (CAR) stands at 12 percent, in adherence to Basel III standards since 2023. With a substantial charter capital of VND36,629 billion ($1.46 billion), SHB firmly maintains its position among the top five largest private commercial banks in Vietnam.

Committed to sustainable and efficient development, SHB consistently raises the bar for management standards, aligning with international best practices while ensuring operational stability within Vietnam’s banking sector. The bank has tightened credit quality control, intensified debt recovery efforts, and provided unwavering support to customers navigating challenges during their recovery journeys.

Dr. Dinh Trong Thinh further emphasized SHB’s prominent position as one of Vietnam’s top five private banks, recognized by both domestic and international credit rating agencies for its robust risk management practices. The issuance of VND5,000 billion ($200 million) in bonds underscores SHB’s unwavering credibility and financial fortitude, presenting investors with a secure and profitable investment avenue.

As part of its transformative strategy for 2024-2028, SHB is harnessing innovation and technology to optimize internal operations and deliver cutting-edge, convenient solutions to its customers. This focus has resulted in an industry-leading low cost-to-income ratio (CIR) of 24.68 percent.

Nam A Bank – Leading the Pack: Ranked Among Vietnam’s Top 50 Most Efficient Businesses in 2024

Nam A Bank has been recognized as one of the Top 50 Most Effective Companies in Vietnam for 2024. The bank has excelled in meeting stringent criteria based on outstanding financial performance, efficient risk management practices, and consistent improvement in asset quality over the years.

Vice Governor of the State Bank of Vietnam Dao Minh Tu: 15% Credit Growth Target is Attainable

At the regular Government press conference for November 2024, held on the afternoon of December 7th, a representative from the State Bank of Vietnam (SBV) addressed queries regarding the feasibility of achieving a 15% credit growth target for the year 2024.