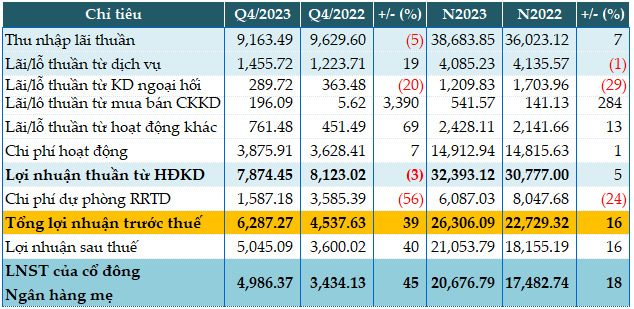

Overall in 2023, MB’s main activities grew 7% compared to the previous year, with VND 38,683 billion in net interest income.

Income from services approximated the previous year at VND 4,085 billion, despite a decrease in insurance revenue. Foreign exchange business decreased by 29% to VND 1,209 billion in interest income, due to increased expenses for derivative financial instruments.

The highlight contributing to MB’s business landscape over the past year came from VND 542 billion in profit from securities trading, nearly 4 times that of the previous year.

MB’s operating expenses were further optimized by 1% compared to 2022, with the operation cost-to-income ratio (CIR) being the lowest at 31.5%; the bank’s standalone CIR was 29.15%.

In addition, MB set aside VND 6,087 billion for credit risk provisions, a 24% decrease compared to the previous year, due to the recovery of business operations of restructured customers from 2020, 2021, and the present time. The coverage ratio of non-performing loans (credit provisions/bad debts) in 2023 reached nearly 116%.

As a result, the bank’s pre-tax profit exceeded VND 26,306 billion, a 16% increase compared to the previous year. Thus, MB achieved the set target of VND 26,100 billion in pre-tax profit for the whole year. The ROA and ROE ratios reached nearly 2.5% and 25%, respectively.

|

MBB’s Q4 and full-year 2023 financial results. Unit: Billion VND

Source: VietstockFinance

|

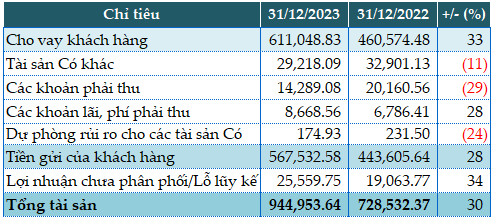

As of the end of 2023, the bank’s total assets expanded by 30% compared to the beginning of the year, reaching nearly VND 944,954 billion. Among them, deposits at the State Bank of Vietnam increased by 67% (VND 66,321 billion), deposits and loans to other financial institutions increased by 40% (VND 46,343 billion), and loans to customers increased by 33% (VND 611,048 billion).

In 2023, MB maximized the approved credit room of the State Bank of Vietnam, with the bank’s credit growth increasing by 28.2%. Among them, outstanding loans for priority sectors according to the government’s direction accounted for 65%. MB adjusted interest rates 7 times in 2023, with a decrease of 2-4%, in order to support customers’ access to loans, accompany them in overcoming difficulties and recovering production and business, contributing to promoting economic growth.

In terms of business funding sources, deposits and borrowing from other financial institutions increased by 53% (VND 99,810 billion); issuance of valuable papers increased by 30% (VND 126,463 billion), mainly due to the increase in certificates of deposit with a term of 12 months or less; customer deposits also increased by 28% (VND 567,532 billion).

The CASA balance in 2023 increased by nearly 27% compared to 2022. The CASA ratio reached nearly 40.1% in 2023.

|

Some financial indicators of MBB as of December 31, 2023. Unit: Billion VND

Source: VietstockFinance

|

MB’s total bad debt as of December 31, 2023, reached nearly VND 9,805 billion, an increase of 95% compared to the beginning of the year, mainly due to the growth of doubtful debts. Therefore, the bad debt ratio to outstanding loans increased from 1.09% at the beginning of the year to 1.6%.

|

Quality of MBB’s borrowings as of December 31, 2023. Unit: Billion VND

Source: VietstockFinance

|

MB’s total number of customers reached nearly 27 million as of December 31, 2023. 2023 was the third consecutive year that MB attracted more than 6 million new customers (6.2 million in 2021, 6.9 million in 2022, and 6.3 million in 2023). The transaction rate on MB’s digital channels remained high, reaching 97%.

In the past year, MB had 3.6 billion non-cash payment transactions, an increase of 1.5 times compared to 2022. Revenue from MB’s digital platforms reached 24.4%. “In the next 4 years, MB aims for revenue from digital platforms to account for 50% of the bank’s total revenue,” said Mr. Lưu Trung Thái – Chairman of the Board of Directors of MB.