The total trading value of the two exchanges today fell below 10 trillion VND, the lowest in 13 sessions. Low liquidity continues to indicate weak selling pressure, and both buyers and sellers are temporarily reducing trading intensity to observe. Price volatility in this situation can change rapidly.

Most of today’s trading session was an intraday decline, but the small liquidity showed that the dominant effect continued to be buyers pushing down prices. When demand became more aggressive, the thin sell-side resistance was not strong enough to hold, and prices recovered easily.

Overall, while the VNI has shown a string of consecutive declines recently, the range has only been typical fluctuations. Many stocks have even traded sideways in a narrow range, indicating an accumulation state rather than a correction. This afternoon, there was a broader decline than usual, and bottom-fishing demand appeared again.

This week, the market had many influential events, so maintaining a balanced state could be considered a positive signal. The general psychology in the market is not strongly tilted towards either side, as sellers are not eager to push prices lower, and buyers are not yet ready to push strongly upwards. When supply and demand do not meet, low liquidity is normal. In this context, the VNI does not clearly reflect the movement of stocks. As seen today, many strong stocks with good money flow showed resilience despite the majority still being in the red.

Currently, there is no unfavorable information in the market to cause fear. In fact, the end of the year usually sees an increase due to the NAV finalization effect. Stepping into 2025, the nearest time that could make the market hesitant is the end of January when Donald Trump officially takes office as President of the United States, and the first policies issued may cause a reaction. However, the time until then is still quite long.

The market will enter the last two weeks of 2024 after this restructuring week. Typically, money flow will not strengthen at this point as foreign investors are on holiday, and domestic capital will have to be withdrawn. However, balance and thin selling can be good conditions. In fact, stimulating psychology is not difficult because only a few strong stocks need to rise for the index to turn green strongly.

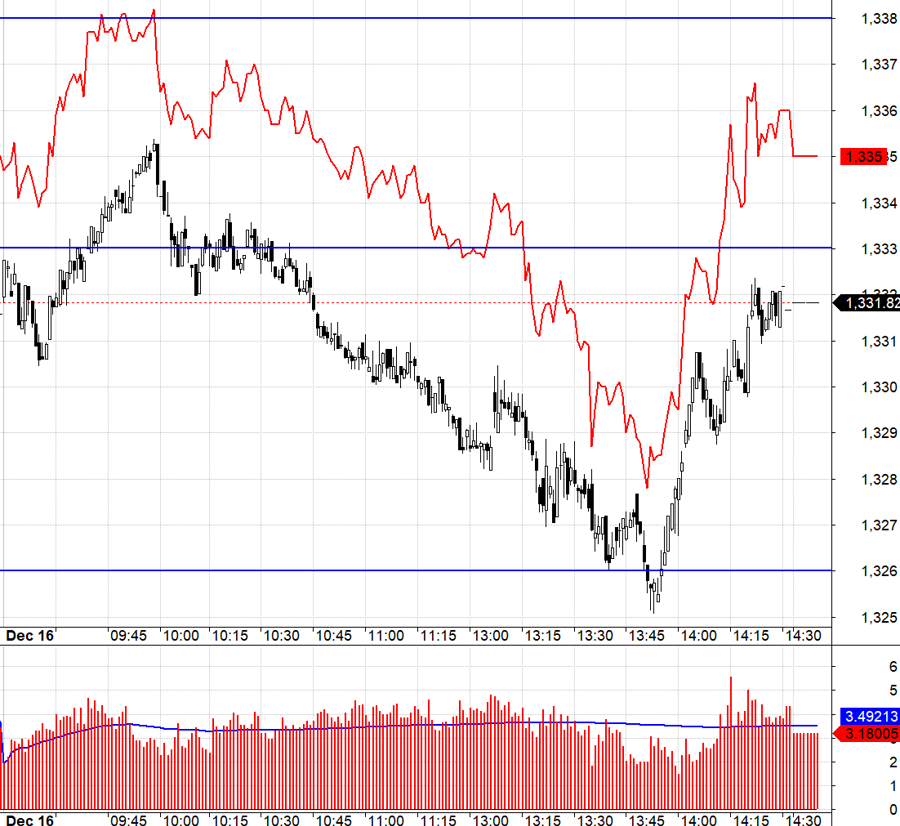

The futures market finally had to narrow the basis as the expiration date approached. The range opened today also completed from 1333.xx to 1326.xx. Short had a slight advantage in basis at the entry point when VN30 fell below 1333.xx, with a difference of more than 3 points. However, the basis maintained this difference when VN30 touched 1326.xx. Generally, today’s trading was easy, and the intraday volatility had good inertia.

Currently, the underlying market is in a state of balance, mainly due to low selling and lukewarm buying interest. Inertia can only be boosted if there is a strong stock influence. For example, today, HPG, TCB, CTG, and MBB pushed the first rhythm. The lower the liquidity, the easier it is to push volatility up. The strategy remains to hold stocks and be Long/Short flexible with futures.

VN30 closed today at 1331.82. The nearest resistance for tomorrow is 1333; 1338; 1346; 1350; 1356; 1362. Support is at 1326; 1317; 1310; 1303.

“Stock Market Blog” is a personal blog and does not represent the opinions of VnEconomy. The views and evaluations are those of the individual investor, and VnEconomy respects the author’s point of view and writing style. VnEconomy and the author are not responsible for any issues related to the investment evaluations and opinions presented.

The Little Engine That Could: Small-Cap Stocks Attracting Big Money, Liquidity Dries Up After 30 Sessions

The small-cap stock group was the only gainer in terms of liquidity on the HoSE today, while the overall market traded at a 30-session low. Even the blue-chip VN30 group witnessed record-low liquidity since the beginning of the year.

The Market Beat: Afternoon Dip Turns All Three Boards Red

The unexpected afternoon slump saw all three market indices close in the red on December 12th. The VN-Index led the decline, falling 1.51 points to 1,267.35, followed by the HNX-Index, which dropped 0.19 points to 227.99. The UPCoM index also slipped, shedding 0.06 points to close at 92.68. Foreign investors offloaded Vietnamese shares for the fourth consecutive session.

The Construction Industry: Poised for a New Cycle of Growth?

The business results and stock prices in the construction industry are presenting some surprising trends. A divergence is emerging, with opportunities unevenly distributed across segments.