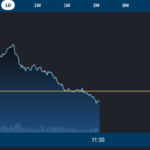

A rapid sell-off occurred at the start of this afternoon’s session, with the VN-Index bottoming out at 1258.65 points at 1:52 pm. Bottom-fishers emerged and bought enthusiastically, pushing stock prices and the index higher, with trading volume increasing by over 33% compared to the morning session.

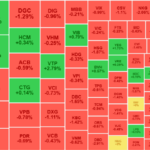

The VN-Index closed with a gain of 1.22 points (+0.1%) compared to the reference price, despite earlier losses of around 3.9 points (-0.31%). The breadth of the index showed 100 gainers and 273 losers at the bottom, but by the end, there were 158 gainers and 215 losers, indicating a strong recovery for stocks.

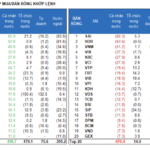

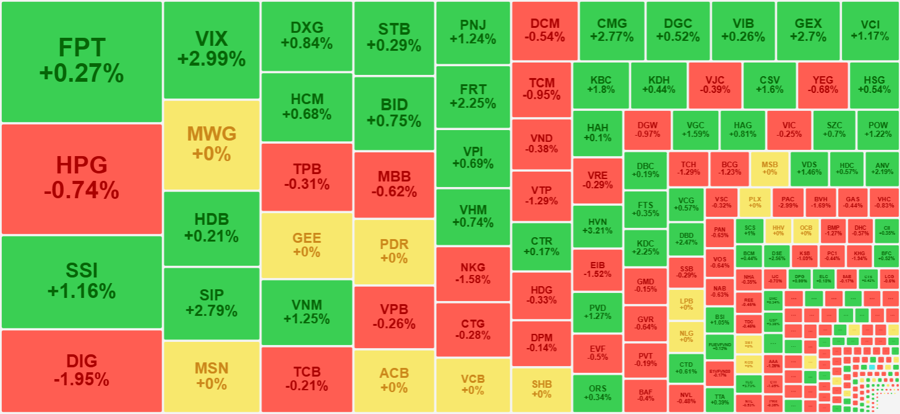

Some of the blue-chips showed strength this afternoon but couldn’t lead the market entirely. Of the 10 stocks that contributed the most to the VN-Index’s gain, only 5 were from the VN30 basket. The VN30-Index itself barely edged higher, ending the day up 0.02% with 10 gainers and 14 losers.

While the late rally wasn’t very evident, the afternoon session was significantly better than the morning. As a mild decline occurred in the first half of the afternoon, and the subsequent recovery wasn’t strong, the number of stocks that successfully reversed course wasn’t overwhelming. Moreover, the lack of explosive price action in the large caps slowed down the index’s ascent.

Among the 10 largest stocks by market capitalization, only three posted gains: BID rose 0.75%, FPT gained 0.27%, and VHM climbed 0.74%. BID was actually weaker this afternoon, falling 0.43% from its morning session closing price. FPT and VHM inched up marginally, adding 0.07% and 0.12%, respectively, to their morning gains. The only large-cap stock that showed notable strength was VNM, which, after a prolonged decline, fell out of the Top 10, ranking 11th. VNM rose 0.62% in the afternoon session and closed 1.25% above the reference price, making it the strongest stock in the VN30 basket.

Some other stocks in this blue-chip group also performed well but had limited influence due to their smaller market caps. POW, which was unchanged in the morning, rose 1.22% in the afternoon. SSI also climbed higher by 0.77%, ending the day up 1.16%. Several others also reacted positively, such as MWG, which recovered all of its morning losses of 1.31% to return to the reference price. According to statistics from the VN30 basket, the vast majority of stocks hit intraday lows during the afternoon session but recovered to varying degrees by the end of the day. GAS was the sole stock that closed at its intraday low.

Expanding to the full HoSE floor, the second-half recovery in the afternoon improved prices for numerous stocks. About 39.2% of the actively traded stocks today reversed course and gained more than 1% from their intraday lows. Only about 30 stocks closed at their intraday lows in negative territory. This recovery in stock prices coincided with a 34.5% increase in trading volume compared to the morning session, indicating a more active participation of bottom-fishers.

In reality, due to low trading activity among investors, liquidity was extremely low, and price movements were not very reliable. Some stocks even had empty buy orders, so even a minimal sell order could cause the price to shift by 2-3 ticks in one go. Such fluctuations do not reflect sustainable price movements, and when buy orders enter the market, prices quickly rebound.

Of the 214 stocks that closed in the red on the VN-Index today, 66 fell by more than 1%, but only 13 had a minimum liquidity of VND10 billion or more. In fact, less than half of this group had trading volumes of VND1 billion or higher. There is no guarantee that the closing prices of these low-volume stocks will hold overnight. The only stocks with decent liquidity were DIG, with VND337.5 billion in trading volume and a 1.95% drop; NKG, with VND105.4 billion and a 1.58% decline; VTP, with VND78.1 billion and a 1.29% fall; and EIB, with VND54.9 billion and a 1.52% loss. The total liquidity of these 66 deeply fallen stocks accounted for just 9.5% of the HoSE floor’s matched orders.

On the upside, 57 stocks rose by more than 1%, but their combined liquidity accounted for 22.5% of the floor, indicating a higher concentration. SSI, VIX, SIP, VNM, PNJ, FRT, and CMG were among the stocks with liquidity of VND100 billion or more, and their prices rose robustly. Mid-cap stocks such as GEX, VCI, KBC, CSV, HVN, PVD, VGC, and KDC also witnessed strong liquidity and gains of over 1%.

Foreign investors were notably more active in the afternoon session compared to the morning. Specifically, they increased their buying by 59% from the morning session, reaching VND769.7 billion, and their selling by 61%, totaling VND895.5 billion. The net balance was accordingly -VND125.8 billion, whereas, in the morning, they had only sold a net of VND72.1 billion. HPG faced the most significant selling pressure, with net outflows of -VND148.2 billion, followed by BID (-VND61.6 billion), PDR (-VND54.8 billion), DIG (-VND35.6 billion), and MSN (-VND34.8 billion). On the buying side, SSI (+VND79.9 billion), HDB (+VND72.7 billion), SIP (+VND66.2 billion), and VIX (+VND38.6 billion) saw notable net inflows.

The VN-Index Retreats Near the 1260-Point Mark, Witnessing a Two-Week Low in Trading Liquidity

Selling pressure mounted this afternoon compared to the morning session, and persistent buy orders at lower prices further deteriorated the market. Despite the heightened pressure, the total matched liquidity of the two floors today was just over 10,100 billion dong, the lowest in 12 sessions, indicating that selling demand has not yet surged.

The Flow of Capital: A Week of Healthy Adjustments

Although the VN-Index fell in 4 out of 5 trading sessions last week, experts do not consider this a cause for concern. In fact, a slowdown and a pullback are healthy signals for the market after the initial strong gains and the explosive session on December 5th.