Small-cap stocks were the only group to see an increase in liquidity on the HoSE floor today, while the overall market traded down to its lowest level in 30 sessions. The VN30 blue-chip group even recorded the lowest liquidity since the beginning of the year.

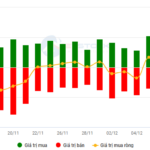

Although this afternoon’s trading session was slightly more vibrant than the morning, with liquidity up 7.7% on the two floors, today was still a dull day overall. The VN-Index challenged the 1260-point mark several times during the session and remained largely resilient thanks to restrained selling.

In reality, the main pressure still came from a few stocks. FPT was the most notable, as its afternoon recovery efforts were wiped out in the ATC session. FPT closed the morning session down 1.13%, but by the end of the continuous matching session, it was only down 0.6%. A large sell-off in the ATC session pushed the stock down 1.27% at the close. FPT alone took 0.7 points off the VN-Index. Another weak stock was MWG, which ended the day down 1.15%.

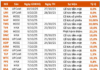

However, the overall VN30 basket was not overly weak. The index closed down 0.31% with 5 gainers and 19 losers, mostly with minor losses. Apart from FPT and MWG, the next biggest loser was VRE, which fell 0.87%. On the upside, the five gainers were VHM, PLX, ACB, HDB, and MBB, with insignificant gains. Only VHM had a slight advantage in terms of market capitalization, and its 0.85% gain contributed less than 0.4 points to the index.

Notably, the VN30 basket’s liquidity today hit a record low for 2024, with nearly VND 3,643 billion. Just five stocks with the highest liquidity—FPT, HPG, MWG, HDB, and SSI—accounted for nearly 49% of the basket’s total value.

Interestingly, there is a clear shift of funds towards small-cap stocks. While the VN30 and Midcap baskets saw an 8% and 12% drop in liquidity, respectively, compared to the previous day, Smallcap liquidity increased by nearly 20%, reaching VND 1,204.5 billion. Of course, with a weight of only 13.8% of the matched orders on the HoSE floor, this is not a significant trade. However, the small-cap group is the only one unaffected by the overall lackluster market sentiment. BAF, PAC, YEG, DBD, GSP, DRC, and TTA are among the small-cap stocks that saw impressive price gains and higher-than-average liquidity.

This afternoon, the market performed significantly worse than the previous day, with no noticeable recovery momentum. The VN-Index hit its intraday low of 1,260.6 points at 2:22 PM and closed slightly higher at 1,261.72 points. At the low, 132 stocks advanced while 255 declined, and at the close, the numbers were 147 gainers and 232 losers. Such price improvements were not significant.

Foreign investors reduced their selling and increased their buying in the afternoon session. Specifically, they poured VND 631.2 billion into new purchases, a 10% increase from the morning session, while net selling was VND 894.4 billion, a 9% decrease. The net balance for the afternoon session was VND 263.2 billion, compared to net selling of VND 406.2 billion in the morning. FPT remained the most sold-off stock, with net outflows of VND 311.8 billion. Other heavily sold stocks included MWG (-VND 80.2 billion), NLG (-VND 62.7 billion), HPG (-VND 56.6 billion), VRE (-VND 50.6 billion), PVD (-VND 41.6 billion), VCB (-VND 28.5 billion), VGC (-VND 28.3 billion), and CMG (-VND 23.6 billion). On the buying side, stocks with net purchases included SIP (VND 35.3 billion), VHM (VND 33.2 billion), HDB (VND 31.9 billion), DXG (VND 28.7 billion), and VIX (VND 28.2 billion).

The Ultimate Headline: “The Looming Threat of Market Correction: Navigating the Storm”

The VN-Index witnessed another day of decline, with a tug-of-war session accompanied by below-average trading volume. This cautious investor sentiment persists following the recent strong rally. Notably, the Stochastic Oscillator is now venturing deeper into overbought territory. Investors are advised to exercise caution in the coming days if the indicator flashes a sell signal once again.

“Unleashing the Power of Words: Vietstock Weekly 16-20/12/2024: Navigating Through Hidden Risks”

The VN-Index stalled after three consecutive weeks of gains, with trading volumes remaining below the 20-week average. This reflects a cautious sentiment among investors. Currently, the index sits above the Middle Bollinger Band. If it can sustain this level in the upcoming sessions, the outlook may not be as pessimistic.

Technical Analysis for the Session on December 12: Risk Signals Persist

The VN-Index and HNX-Index rose in tandem, with trading volume also showing significant improvement during the morning session, indicating a renewed sense of optimism among investors.

The Market Beat: Afternoon Dip Turns All Three Boards Red

The unexpected afternoon slump saw all three market indices close in the red on December 12th. The VN-Index led the decline, falling 1.51 points to 1,267.35, followed by the HNX-Index, which dropped 0.19 points to 227.99. The UPCoM index also slipped, shedding 0.06 points to close at 92.68. Foreign investors offloaded Vietnamese shares for the fourth consecutive session.

“Steering Through the Storm: Navigating Investment Strategies for 2025 and Beyond”

In less than a month, the stock market will close out an unpredictable 2024. As we transition into the new year, investors are seeking answers to the question: What’s in store for 2025? To provide insights and guidance, VPBankS Talk 04, themed “Navigating Through the Storm,” will be held on December 16.