|

Greener production processes have been successfully replicated across Garment Corporation 10. (Photo: Duc Duy/Vietnam+)

|

With only about three weeks left until the end of 2024, many textile and garment businesses have not only surpassed their set plans but are also actively preparing to build production and business plans to embrace new opportunities in 2025.

Embracing year-end market opportunities

After a challenging 2023, the textile and garment industry has witnessed numerous positive signals. The market recovery in 2024 has led to a significant rebound in orders, and production and business results have also recorded many highlights.

Mr. Than Duc Viet, CEO of Garment Corporation 10 JSC, shared that 2024 has been a unique year. Unlike previous years, when the company had to worry about sourcing, especially for export, this year, they have had a complete order book and only needed to focus on producing the highest-quality products to meet the requirements of their import customers.

This is evident in the figures from the early months of the fourth quarter, with export turnover and total revenue of May 10 recording more than a 10% growth compared to the same period in 2023. With these results, May 10 is sure to accomplish its export and revenue plans for 2024.

Regarding the domestic market, according to Mr. Than Duc Viet, May 10 will accomplish its 2024 plan, and the company is highly focused on orders for the upcoming peak season, including Christmas, New Year, and the Lunar New Year.

“Currently, May 10 is receiving many uniform orders, such as men’s shirts, trousers, and vests, so we have to mobilize all resources to increase labor productivity and may have to ask workers to work overtime to achieve and reach our set goals,” said Mr. Than Duc Viet.

Similarly, Mr. Dao Duy Khanh, Deputy General Director of Tien Tien Garment Company, a subsidiary of Vietnam Garment Corporation – May Viet Tien JSC, shared that their company has a relatively abundant order book, unlike 2023, when they lacked orders.

It is expected that in 2024, the average income of Tien Tien Garment workers will be higher than in 2023. This is also the company’s effort to retain workers in the Mekong Delta region.

“Orders have been signed until the end of the first quarter of 2025, and we are continuing negotiations for the whole of 2025. From now until the end of the year is the peak production period for Christmas and the New Year, so garment companies can choose orders that suit their production capacity, unlike 2023, when order sizes were small and scattered,” said Mr. Dao Duy Khanh.

|

Vinatex fashion store in Hanoi. (Photo: Duc Duy/Vietnam+)

|

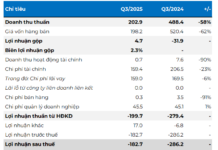

Meanwhile, for fiber enterprises, although the market is still relatively sluggish, with order prices remaining very low, many companies have had positive signals by implementing cost-saving and optimization solutions in production.

For instance, Phu Bai Fiber Joint Stock Company achieved a revenue of 955 billion VND and a pre-tax profit of 9.2 billion VND, equivalent to 91% of the annual plan, by the end of the third quarter of 2024. Vinatex Phu Hung Joint Stock Company also surpassed the breakeven point, with a revenue of 656.23 billion VND and a profit of 4.3 billion VND as of the end of October 2024. Many other fiber companies, such as Vinatex Hong Linh Joint Stock Company, Viet Thang Corporation, and Vinatex Phu Cuong Spinning Mill, have reduced losses compared to the same period last year and are getting closer to the breakeven point.

Adapting to new trends

According to the Vietnam Textile and Apparel Association (Vitas), in 2024, amidst a complex and unpredictable world situation, escalating conflicts in many regions, volatile fuel and freight rates, slow economic and trade recovery, declining global investment, natural disasters, climate change, and complex energy security issues, the Vietnamese textile and garment industry has maintained a fairly good growth rate.

Specifically, Mr. Vu Duc Giang, Chairman of Vitas, informed that this year, the export turnover of the entire textile and garment industry is estimated to reach 44 billion USD as projected at the beginning of the year, up 11.26% compared to 2023. On the other hand, import turnover is estimated at 25 billion USD, up 14.79%. Thus, the textile and garment industry enjoys a trade surplus of about 19 billion USD, up 6.93% compared to 2023.

Among the export markets, the United States remains the largest market, with an estimated turnover of 16.71 billion USD, up 12.33% compared to 2023, accounting for 37.98% of the industry’s total export turnover. Japan is estimated at 4.57 billion USD, up 6.18% and accounting for 10.39%; the EU is estimated at 4.3 billion USD, up 7.66% and accounting for 9.77%; Korea is estimated at 3.93 billion USD, up 10.36% and accounting for 8.93%; China is estimated at 3.65 billion USD, up 1.76% and accounting for 8.3%; and ASEAN is estimated at 2.9 billion USD, up 4.84% and accounting for 6.59%.

Notably, according to the Vitas Chairman, in 2024, there was no significant shift or noticeable growth in the global scale for the textile and garment industry. However, Vietnam achieved growth by successfully riding the wave of order diversification.

|

Taking the initiative from the design stage to increase export value. (Photo: Duc Duy/Vietnam+)

|

Vietnamese textile and garment enterprises have approached new emerging markets such as the Middle East and Africa to expand their market reach. At the same time, domestic enterprises in this sector have been agile and flexible in transitioning to new models and products, taking on small orders with high technical requirements, such as uniforms in Middle Eastern countries, something that Vietnamese textile and garment companies did not have a production advantage in previous years.

“Customers and buyers are increasingly demanding stricter technical standards, social responsibility, and delivery times. Notably, some customers require us to take responsibility until the textile and garment products reach end consumers. These are new requirements that force Vietnamese textile and garment enterprises to adapt and not be left out of the game,” emphasized Mr. Vu Duc Giang.

According to the Vitas Chairman, in 2025, the Vietnamese textile and garment industry sets an export turnover target of 47-48 billion USD. This figure is based on careful calculations and research on order trends. While the fiber industry is not expected to have significant growth or breakthroughs in orders, the garment industry will enjoy a more abundant order book than in 2024. Many textile and garment enterprises have already signed orders until the first quarter of 2025, and some even until the second quarter of 2025.

Regarding the orientation for the fiber industry, Mr. Cao Huu Hieu, Director-General of the Vietnam National Textile and Garment Group (Vinatex), stated that the fiber industry plays a crucial role in the group and utilizes a large portion of its resources. Therefore, it is necessary to define new directions.

Mr. Cao Huu Hieu advised the fiber production and business team to form business groups in the North and Central regions. They should also develop solutions to stabilize raw material sources, proposing methods to obtain raw materials of reasonable quality, delivery time, and prices. Additionally, they should continue implementing solutions to ensure production capacity, develop the management and technical workforce, and establish appropriate mechanisms to encourage dedicated efforts from employees who are redeployed to different positions.

To adapt to the market, Ms. Nguyen Thi To Trang, Director-General of Vinatex Phu Hung Joint Stock Company, shared that, along with focusing on selling products with high sales potential, good efficiency, and large volumes to maintain maximum output, reduce consumption, and increase revenue and profits, Vinatex Phu Hung will focus on introducing and promoting sales of fibers with higher added value than conventional blended fibers, such as recycled fibers, single-component dyed fibers, or fibers with certificates, to increase competitiveness in pricing and improve business performance.

Furthermore, the company will pay attention to training and enhancing the skills and expertise of its sales team to increase professionalism and customer satisfaction, retain loyal customers, closely monitor market trends and respond promptly to unexpected market fluctuations, and strengthen control and management of the production chain to ensure and improve quality, thereby enhancing its reputation among customers.

Duc Duy

“The Hanoi Target: Aiming for 6.5% Growth by 2025”

On December 10th, the Hanoi People’s Council, at its 20th session, passed a resolution on the city’s socio-economic development plan for 2025. The resolution sets an ambitious target of achieving a 6.5% growth rate in the regional gross domestic product (GRDP) while aiming for a per capita GRDP of 172.4 million VND.

‘Breaking’: Ministry Merger Proposal; Eye-Popping Lunar New Year Bonuses Revealed

Supplementing the estimated reform salary cost; details of the plan to organize the apparatus of the Ministry of Finance, the Ministry of Planning and Investment, and the Ministry of Industry and Trade; FDI enterprises defaulting on billions of dong in taxes and leaving the country; enterprises in Binh Duong province offering the highest Tet bonus of up to nearly 400 million VND/person… were notable information last week.