SGT will be borrowing through loans and bank guarantees, with a maximum term of 60 months from the date of the credit contract.

With a loan of over VND 1.6 trillion, SGT intends to invest in, develop, and operate the Dai Dong – Hoan Son Industrial Park Infrastructure Project phase 2 in Tien Du district, Bac Ninh province. The company also stated that it would use assets related to the project itself as collateral for this loan.

|

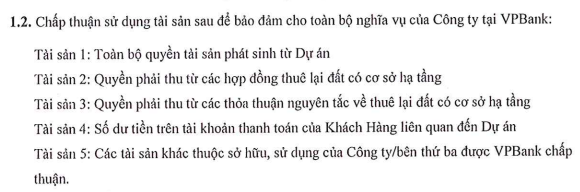

5 assets secured the loan at VPBank

Source: SGT

|

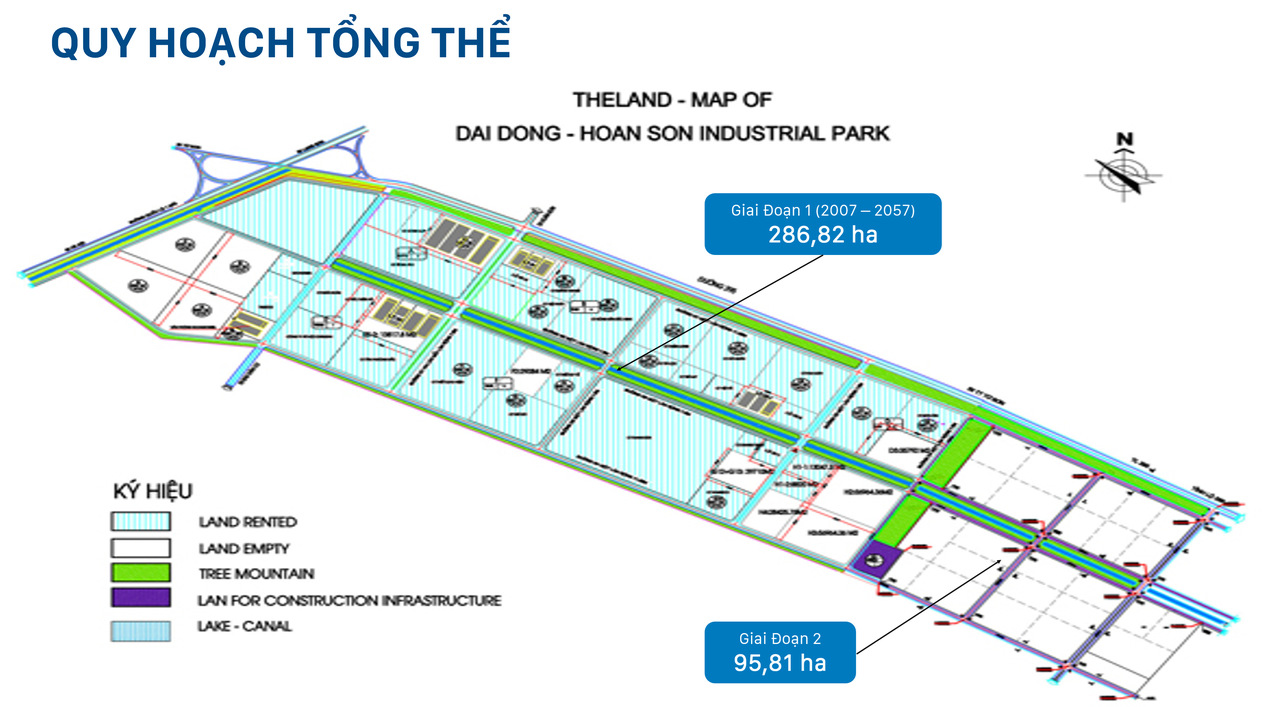

According to our understanding, the Dai Dong – Hoan Son 2 Industrial Park spans 95.8 hectares, adjacent to the Dai Dong – Hoan Son 1 Industrial Park. As per the master plan, the majority of the area is allocated for factories and enterprises (66.8 hectares).

In the 2024 business plan approved by the Annual General Meeting of Shareholders, Dai Dong – Hoan Son 2 was highlighted as one of the seven industrial park projects that SGT will focus on implementing.

At that time, SGT disclosed that the project had achieved 100% land clearance, with the potential to contribute VND 1,000 billion in revenue and VND 300 billion in gross profit to SGT. Sharing with shareholders, Chairman of the Board of Directors, Dang Thanh Tam, revealed that the price per unit area in the project is approximately $150/m2.

Source: SGT

|

As of the end of Q3 2024, SGT recorded a debt scale of over VND 3,680 billion, a 9% increase compared to the beginning of the year, accounting for 50% of total capital sources. The debt structure also witnessed a notable shift, with a decrease in short-term debt and an increase in long-term debt, with VietinBank being the largest partner. This shift aims to supplement working capital and invest in industrial and cluster park projects…

Regarding business operations, in the first nine months of 2024, SGT generated more than VND 847 billion in net revenue, with pre-tax profit reaching nearly VND 53 billion and net profit of nearly VND 32 billion. While these figures are significantly higher than the same period last year, they fall short of the company’s 2024 plan.

Specifically, the company set ambitious targets to achieve record revenue and pre-tax profit of VND 4,000 billion and VND 450 billion, respectively.

| SGT’s 9-month business results for the period 2020 – 2024 |

In the market, SGT’s stock has been witnessing strong upward momentum in recent sessions, particularly with a 7% surge to VND 16,200/share in the December 17 session. Compared to the beginning of 2024, SGT has risen over 40%, with an average daily trading volume of more than 60,000 shares.

| SGT stock has been outperforming since the beginning of 2024 |

The Bitcoin Frenzy and Easy Money Policy

If financial conditions are truly tight, as Fed governors claim, then the markets are yet to get this message.

The Revenue Slump: ThaiBev’s Vietnam Sales Retreat for the Second Year Running

According to Thai Beverage Public Company Limited’s (ThaiBev) 2024 financial statements (covering the period from September 2023 to September 2024), the parent company of Sabeco (HOSE: SAB) experienced growth in both revenue and profit. However, the Vietnamese market saw a second consecutive year of declining revenue.

The Korea Land & Housing Corporation’s Visionary Venture:

“A Grand Urban-Industrial Symphony in Binh Dinh”

On December 4th, at the Provincial People’s Committee office, Chairman Pham Anh Tuan met with a delegation from the Korea Land & Housing Corporation, led by Mr. Lim Hyun Seong, Executive Director and Head of the company’s Hanoi office. The delegation was in Binh Dinh to explore investment opportunities and potential collaboration with the province.