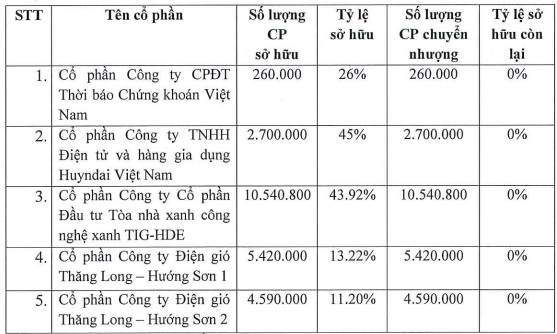

In particular, the TIG Board of Directors approved the plan to transfer all shares in five affiliated companies, including Vietnam Securities Newspaper Investment Joint Stock Company (260,000 shares, equivalent to 26%); Huyndai Vietnam Electronics and Home Appliances Company Limited (2.7 million shares, equivalent to 45%); TIG-HDE Green Building and Green Technology Joint Stock Company (10.54 million shares, equivalent to nearly 44%); Thang Long – Huong Son 1 Wind Power Company (5.42 million shares, equivalent to 13.22%) and Huong Son 2 (4.59 million shares, equivalent to 11.2%).

The transfer price will be based on market conditions but will not be lower than VND 10,000/share. The transferees are investors with needs and who can meet the transfer price. The deadline for implementation is December 31, 2024, at the latest.

|

TIG will divest from 5 affiliated companies

Source: TIG

|

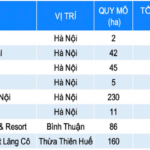

After the divestment, TIG will only have three affiliated units: TIG Holdings Joint Stock Company (47.4%), Kim Lan Investment Joint Stock Company (47.4%), and Son Thuy Vuon Vua Golf Course and Ecological Housing Joint Stock Company (46%).

Vuon Vua Resort Project of TIG

|

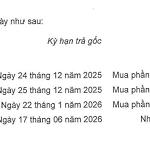

At the same time, the TIG Board of Directors approved the acquisition of shares from its subsidiary, Thang Long Phu Tho Investment Joint Stock Company. Specifically, the enterprise will receive 12.8 million shares, equivalent to 20% of Thang Long Phu Tho’s charter capital, from the shareholders. The transfer price is VND 78,000/share, equivalent to a total value of more than VND 998 billion. The time of implementation is also in December 2024.

After the successful acquisition, TIG’s ownership in Thang Long Phu Tho will increase to 80%.

Notably, the TIG Board of Directors also decided to temporarily suspend the issuance of bonus shares for the year 2023. This plan was approved by the 2024 Annual General Meeting of Shareholders, which involved issuing bonus shares at a ratio of 10% – a total of nearly 19.4 million new shares. However, the company decided to temporarily suspend the plan, citing a more appropriate timing for the issuance.

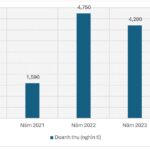

In terms of business results, in the first nine months of 2024, TIG recorded revenue of nearly VND 1,100 billion, up 34% over the same period, and a net profit of VND 179 billion, a slight decrease.

| TIG’s business performance |

Chau An

The SOL E&C Advantage: A Leading Engineering Powerhouse in the Making

In just under 4 years, SOL E&C, a pivotal piece in the ecosystem of Mr. Nguyen Ba Duong’s 6 billion-dollar enterprises, has garnered a remarkable total revenue of over VND 15,300 billion. This feat has solidified its position within the top 5 reputable general contractors in the construction industry, while also being recognized as the fastest-growing contractor in 2022 and 2024.

The Revenue Slump: ThaiBev’s Vietnam Sales Retreat for the Second Year Running

According to Thai Beverage Public Company Limited’s (ThaiBev) 2024 financial statements (covering the period from September 2023 to September 2024), the parent company of Sabeco (HOSE: SAB) experienced growth in both revenue and profit. However, the Vietnamese market saw a second consecutive year of declining revenue.

“Billion-Dollar Deal: Sunshine Homes Acquires Company with Four Luxury High-Rise Apartments in Long Bien”

The upcoming 2024-2025 transfer window promises to be an exciting opportunity for investment. With a strategic mix of loan-based funding and/or equity, we are poised to secure lucrative acquisitions during this period.