Cement Sector Continues to Face Challenges

Mr. Ha Quang Hien, Chairman of the Board of Directors of HTV, stated that amid the economic downturn of the previous year, particularly affecting the construction materials industry and the cement sector in particular, HTV‘s operations, which rely heavily on cement transportation and other construction materials-related activities, were directly impacted by the general economic difficulties.

Furthermore, Logistic Vicem, a subsidiary of the Vietnam Cement Industry Corporation, is facing significant challenges alongside other subsidiaries, private cement companies, and joint ventures in the industry. The majority of cement businesses are operating at a loss, which has repercussions for the company’s production and operations.

“The cement industry has never faced such severe challenges in its 120-year history. Most cement companies are struggling, and the majority are incurring losses,” said Mr. Hien.

The cement sector is projected to remain challenging in 2024. Consequently, Mr. Hien announced that HTV would reduce its total payroll, cut back on vehicles and personnel, and optimize and streamline its workforce during the year.

Mr. Do Van Huan, Member of the Board of Directors and General Director, expressed concern that the year 2024 would continue to present certain difficulties due to the country’s high economic openness and the modest level of domestic economic self-sufficiency and production capacity. The impact of risks and challenges on Vietnam’s economic growth and macroeconomic stability will be substantial.

Additionally, many trading companies have invested in their own inland and seagoing vessels to support their own supply and distribution services, increasing competition for freight and driving down freight rates in the market.

“The shortage of available mariners in the market continues to pose challenges for the company in recruiting additional crew members, particularly experienced and skilled captains and chief engineers, to maintain a stable workforce for vessel operations,” Mr. Huan noted.

The 2024 Annual General Meeting of Shareholders of HTV was held on the morning of April 23 – Photo: Thanh Tú

|

Modest Growth in Business Plan

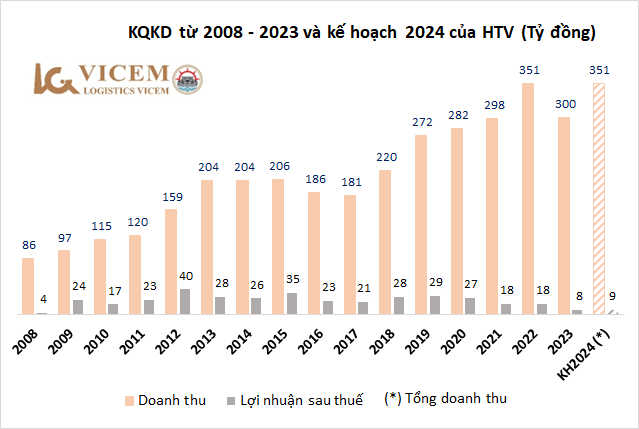

At the meeting, HTV shareholders approved the business plan for 2024, targeting total revenue of nearly 351 billion VND and after-tax profit of nearly 9 billion VND, representing increases of 10% and 6%, respectively, compared to 2023. Dividends for 2024 will be no less than 3%.

The estimated cargo transported in 2024 is over 5.4 million tons, with the majority, over 4.55 million tons, being transported by water.

|

Concluding 2023, Logistics Vicem achieved revenue of over 320 billion VND, a decrease of 14%, and after-tax profit of over 8 billion VND, a decline of 53% compared to the previous year, the lowest level in the company’s 15-year history (since 2009). Discussing the disappointing business performance of the past year, the General Director of Logistics Vicem explained that HTV‘s core business of warehousing and transportation is heavily dependent on the manufacturing industry, with a significant portion of its services catering to the transportation of construction materials.

The company also faced challenges due to an increasing number of vehicles requiring major repairs, as HTV‘s fleet of barges is aging, with some vessels being 13-16 years old. The higher cost of steel and labor in 2023 resulted in elevated repair expenses, reducing the operating hours of HTV-owned vessels. The downtime for repairs impacted the efficiency of vessel operations, resulting in a corresponding decrease in revenue.

“The major commodities that HTV transports, such as coal, iron, and steel, have not experienced significant growth in consumption, which has affected the company’s transportation volume and revenue in the past year,” said Mr. Huan.

First Quarter Still Operating at a Loss

In the first quarter of 2024, HTV‘s total revenue reached 60 billion VND, a 23% decrease year-over-year, while after-tax loss amounted to over 76 million VND, compared to a loss of over 1 billion VND in the same period of the previous year.

According to the Chairman of HTV, the company implemented cost-cutting measures in the final months of 2023, carefully balancing and reorganizing its fleet to optimize repair operations.

This was reflected in the company’s performance in the first quarter of 2024, which showed significant improvement compared to the same period of the previous year, despite the ongoing losses.

Nevertheless, challenges remain, and difficulties are expected to persist throughout 2024. Even Vicem Ha Tien Cement JSC (HOSE: HT1) experienced a 20% decrease in production output in 2023 compared to 2022, along with a substantial decline in profits.

“Transportation revenue from HT1 accounts for 50-60% of HTV‘s revenue. Therefore, if HT1 faces difficulties, so will HTV. However, in 2024, HTV aims to operate as efficiently as possible to preserve the shareholders’ invested capital,” stated the Chairman of HTV.

The meeting concluded with the approval of all resolutions.