DM7 to Issue an Interim Cash Dividend of 10%

The Textile and Garment Joint Stock Company No. 7 (UPCoM: DM7) has announced that December 19 will be the ex-dividend date for an interim cash dividend of 10% (VND 1,000/share) for the year 2024. With over 15.4 million shares outstanding, the company is expected to pay out more than VND 15 billion. The payment date is tentatively set for January 3, 2025.

Most recently, DM7 distributed a cash dividend for 2023 at a rate of 12.36%, which was lower than the 21.75% paid out in 2022. During the annual general meeting held in late April, shareholders approved a projected dividend of 17% for 2024. To meet this target, the company will need to disburse an additional dividend of 7%.

DM7, formerly known as Dyeing and Garment Factory No. 7 under Military Zone 7, specializes in manufacturing military uniforms and other defense-related garments. Its current chartered capital stands at over VND 154 billion, with four major shareholders: TNHH MTV Dong Hai – a defense enterprise under Military Zone 7 (51%); Thanh Vinh Trading and Production Co., Ltd. (12.98%), Mr. Dang Van Lam (12.98%), and Mrs. Tran Thi Phuong Hanh (12.98%).

Thanh Vinh Co. is associated with Mr. Nguyen Thanh Duong, who serves as a member of the Board of Directors and Vice President of DM7. Mr. Duong is also the Chairman of the Members’ Council and holds a 35% stake in Thanh Vinh Co.

DM7 specializes in manufacturing military uniforms and defense-related garments.

|

In terms of financial performance, DM7 reported impressive results for the first nine months of 2024, with revenue reaching nearly VND 577 billion and net profit surpassing VND 45 billion. These figures represent a 29% and 18% increase, respectively, compared to the same period last year. The company attributes these positive results mainly to the production and fulfillment of large orders. As of the end of the third quarter, DM7 has achieved 84% of its annual revenue target and 82% of its profit goal.

Notably, as of September 2024, DM7 has significantly increased its bank deposits to nearly VND 80 billion, a more than fivefold increase from the beginning of the year. The company is free of financial debt.

|

Financial Performance of Dệt May 7 in Previous Years |

HCB to Pay Interim Cash Dividend of 15%

The 29/3 Textile and Garment Joint Stock Company (Hachiba, UPCoM: HCB) has also announced an interim cash dividend for 2024 at a rate of 15% (VND 1,500/share). The ex-dividend date is set for December 30, 2024.

With nearly 5.2 million shares outstanding, the company is expected to distribute approximately VND 8 billion in dividends. The payment date is scheduled for January 7, 2025.

Hachiba has been consistently paying dividends since its listing on UPCoM in 2019, with rates ranging from 10% to 35%. The company maintained a cash dividend of 20% for two consecutive years in 2022 and 2023 and plans to keep the same rate for 2024. To achieve this, Hachiba will need to pay an additional dividend of 5% for the year.

The 29/3 Textile and Garment Company, based in Da Nang, specializes in manufacturing garments and woven towels. Its chartered capital is nearly VND 52 billion, with four major shareholders: Mr. Nguyen Xuan Anh (20.56%), Mrs. Pham Thi Xuan Nguyet – Member of the Board of Directors and CEO (10.63%); Mr. Huynh Van Chinh – Chairman of the Board (9.71%), and Mr. Nguyen Xuan Tung – Member of the Board of Directors (7.28%).

Notably, Mr. Tung is the son of Mr. Xuan Anh and Mrs. Xuan Nguyet.

In terms of financial performance, Hachiba reported a slight decline in revenue for 2023, with a figure of nearly VND 797 billion, representing a 15% decrease compared to 2022. However, its pre-tax profit increased slightly by 2% to nearly VND 24 billion due to reduced financial and management expenses. Net profit was approximately VND 19 billion.

For 2024, the company has set a revenue target of VND 840 billion, reflecting a 5% increase from 2023, and aims to maintain its pre-tax profit at VND 24 billion.

|

Financial Performance of Hachiba in Previous Years |

Nam A Bank – Leading the Pack: Ranked Among Vietnam’s Top 50 Most Efficient Businesses in 2024

Nam A Bank has been recognized as one of the Top 50 Most Effective Companies in Vietnam for 2024. The bank has excelled in meeting stringent criteria based on outstanding financial performance, efficient risk management practices, and consistent improvement in asset quality over the years.

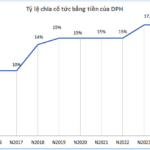

The Ultimate Cash Dividend: DPH Locks in a 17% Cash Dividend Payout.

With this cash dividend payout, Haiphong Pharmaceutical Joint Stock Company (UPCoM: DPH) is on track to fulfill its 2024 dividend plan, delivering returns to its valued shareholders.