According to the Vietnam Automobile Manufacturers’ Association (VAMA), domestic sales of domestically produced and assembled cars increased by a modest 1.6% in the first 11 months of 2024, while completely built-up imported cars saw a significant surge of 40% compared to the same period last year.

New Move

German automaker Mercedes-Benz recently established a distribution company in Vietnam with a chartered capital of VND 6.7 billion. Although it has not yet started operations, the establishment of this distribution company is seen as a preparation to withdraw from the assembly joint venture based in Ho Chi Minh City and switch to importing completely built-up cars.

Domestic car companies tend to import completely built-up cars for sale instead of investing more in manufacturing plants, but with low efficiency.

|

Other car brands with factories in Vietnam have also been reducing the number of models assembled locally. For instance, Toyota used to have nearly 20 models assembled domestically, but now only four remain, with the rest being imported from Thailand or Indonesia. Ford announced at the beginning of 2020 that it would invest an additional $82 million to expand its factory in Hai Duong and assemble new car models. However, in reality, they only assemble two models. Even for Ford’s popular pickup trucks in the Vietnamese market, the company only assembles a few versions, importing the rest. Honda, Mitsubishi, and other brands have fewer models assembled or produced in Vietnam compared to imported ones or only assemble one or two versions of a model. Suzuki, on the other hand, has five models sold in the Vietnamese market, all of which are imported.

Mr. Pham Cuong, Chairman of the Vietnam Automobile, Motorcycle, and Bicycle Association (VAMOBA), stated that previously, due to Vietnam’s tariff barriers on imported cars, companies focused on domestic production and assembly. Now that the import tax rates on cars from ASEAN countries have dropped to 0%, it is inevitable for car brands to choose to import to gain more benefits.

Where is the automotive industry heading?

Car brands acknowledge that importing cars for sale is more advantageous than domestic production and assembly. “Imported cars are on the rise, and we have to follow this trend or risk falling behind in competition,” said a representative of a car brand with a manufacturing plant in Vietnam.

According to Toyota, Ford, Honda, Mitsubishi, and Suzuki, the import tax rate on components, ranging from 5% to 20%, has significantly increased the production cost of domestic assembly compared to cars manufactured in other countries. Moreover, the efficiency and effectiveness of domestic production are also lower than those of their competitors’ larger factories, making domestically produced cars 10%-20% more expensive than imported ones in the region.

A representative of a domestic car brand revealed that they are under immense pressure from their parent company to import completely built-up cars to optimize profits. Meanwhile, another significant pressure is convincing the corporation to maintain the production of certain car models in Vietnam to avoid shutting down their factory. “We are in a dilemma. Even if the corporation decides to maintain domestic production, it will be challenging without supportive policies,” the representative expressed.

According to VAMA, without a national program to support the competitiveness of the auxiliary industry, the risk of shrinking domestic car production and assembly is imminent. In reality, the automotive demand in countries like Thailand and Indonesia has saturated, and they are shifting their focus to exports, with Vietnam being one of the targeted markets. “Vietnam is on the defensive, while other countries are on the offensive. The production capacity of domestic automobile factories is about 700,000-800,000 units per year, but the market capacity is only 350,000 units. Moreover, there are also Chinese car brands entering the market to compete,” said a VAMA representative.

Associate Professor Dr. Dam Hoang Phuc, Director of the Automotive Engineering Training Program at Hanoi University of Science and Technology, stated that any enterprise would naturally choose to do what is most beneficial. Therefore, to develop the domestic automotive industry, there should be appropriate policies to encourage production while maintaining a reasonable level of market openness.

According to Associate Professor Dr. Do Van Dung, a lecturer in the automotive engineering industry at Ho Chi Minh City University of Education, the domestic automotive industry has not achieved its goals after many years of development and has failed compared to regional competitors. As a result, if car brands start importing cars for sale, the automotive industry will cease to exist, replaced by the automobile trading industry. “Countries like Japan, Germany, and South Korea have prospered due to their automotive industries. Although China started later, it has recently emerged as a strong player in the automotive industry. In contrast, the Vietnamese automotive industry has not received commensurate investment,” Mr. Dung pointed out.

|

Unfair Policies Ms. Pham Chi Lan, an economic expert and former Vice President of the Vietnam Chamber of Commerce and Industry (VCCI), acknowledged that developing the auxiliary industry in Vietnam is indeed a challenging task. According to Ms. Lan, since the 1990s, Vietnam has opened its doors to 11 foreign car brands, offering them attractive incentives based on commitments to localization rates and technology transfer. However, most foreign investors tend to use auxiliary enterprises within their networks, which enjoy similar incentives as investors. “Vietnam’s auxiliary industry cannot develop when we are subjected to higher corporate income tax rates than foreign investors and their networks,” Ms. Lan stated. |

Nguyen Hai

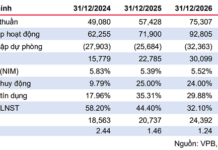

The Only Luxury Car Installer in Vietnam Faces Permit Renewal Issues: 10,000 Billion VND in Revenue, Over 1,000 Billion VND in Annual Profit, and Strange Fluctuations in 2023

The Mercedes-Benz car assembly plant project is a joint venture between Mercedes-Benz Group AG (MBG AG) and Samco, with the local expertise and knowledge of Mercedes-Benz Vietnam Limited. This exciting development promises to deliver a significant boost to the automotive industry in the region, offering new opportunities and an enhanced economic outlook. With the combined strength and heritage of these renowned companies, the project is set to be a landmark initiative, showcasing their commitment to innovation and excellence.