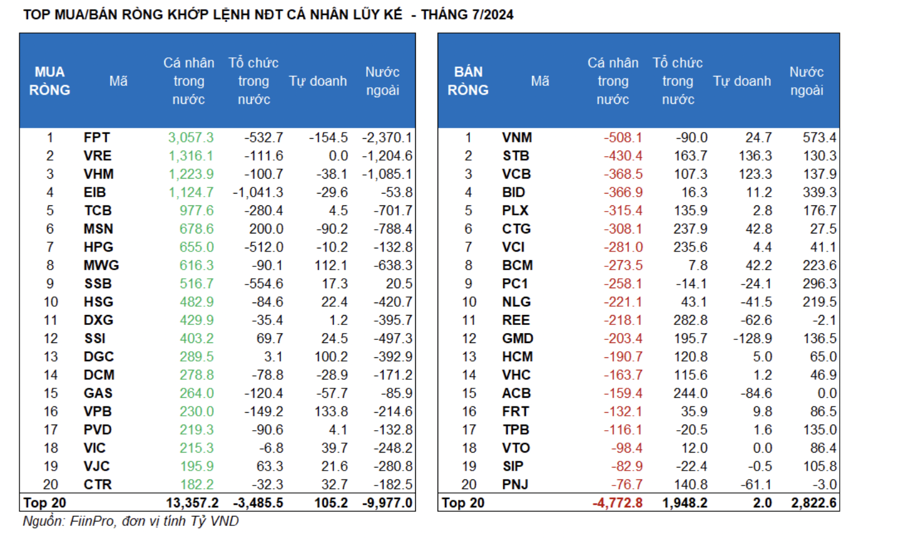

Technical Signals of VN-Index

During the trading session on the morning of December 19, 2024, the VN-Index witnessed a decline, forming a Doji candlestick pattern, while trading volume surged. This indicates a pessimistic sentiment among investors.

At present, the VN-Index is testing the Middle line of the Bollinger Bands, while the Stochastic Oscillator continues its downward trajectory after issuing a sell signal in the overbought zone. If the index falls below this support level, the risk of a correction is likely to increase in the upcoming sessions.

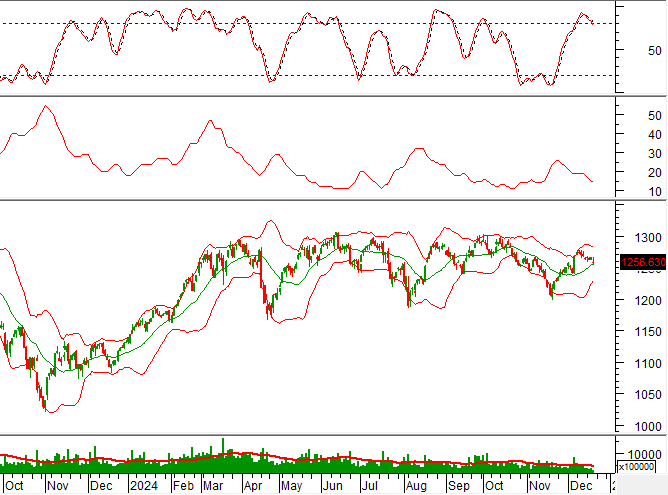

Technical Signals of HNX-Index

On December 19, 2024, the HNX-Index declined, accompanied by a significant increase in trading volume during the morning session, expected to surpass the 20-day average by the end of the day. This reflects the pessimistic sentiment among investors.

Currently, the HNX-Index is retesting the old bottom formed in April 2024 (corresponding to the 220-225 point range) while the Stochastic Oscillator maintains its previous sell signal, indicating a less optimistic short-term outlook.

CMG – CMC Technology Group Joint Stock Company

On the morning of December 19, 2024, CMG witnessed a rise in its share price, along with a significant increase in trading volume, expected to surpass the 20-day average by the end of the session. This indicates a gradual improvement in investor sentiment.

At present, the share price is trending towards testing the short-term downward trendline, while the MACD is narrowing the gap with the Signal line after previously issuing a sell signal. If a buy signal reappears and the share price breaks out of this trendline, a recovery scenario may unfold in the upcoming sessions.

Additionally, the share price is finding support from the group of SMA 50 and SMA 200 day moving averages, suggesting the presence of optimistic mid- and long-term prospects.

CSV – Southern Basic Chemicals Joint Stock Company

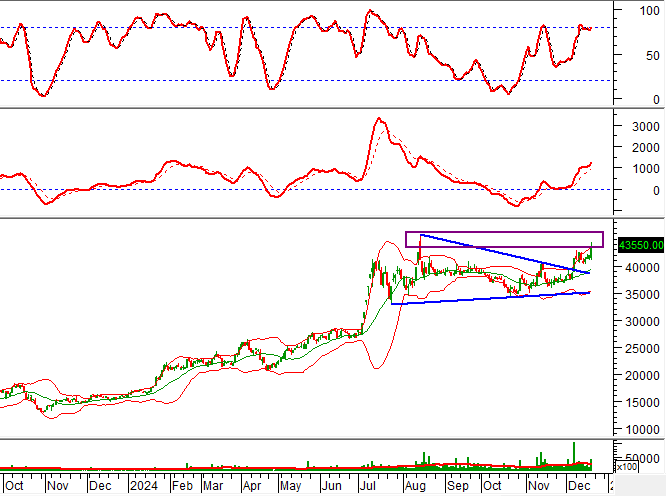

During the morning session of December 19, 2024, CSV witnessed a surge in its share price, forming a candlestick pattern resembling a White Marubozu, accompanied by trading volume surpassing the 20-session average. This indicates active participation from investors.

At present, the share price is bouncing off and closely following the Upper Band of the Bollinger Bands, while the MACD continues to widen the gap with the Signal line after issuing a previous buy signal, reinforcing the strength of the current uptrend.

Furthermore, the share price is retesting the old peak formed in August 2024 (corresponding to the 43,200-46,200 range). If the share price successfully breaks through this resistance zone in the upcoming sessions, a long-term growth scenario is likely to unfold.

Technical Analysis Department, Vietstock Consulting

The Gloomy Outlook: Is the Situation Getting Worse?

The VN-Index declined for the third consecutive session, forming an Inverted Hammer candlestick pattern, with volume lagging below the 20-day average. This indicates a persistent cautious sentiment among investors. Notably, the Stochastic Oscillator is poised to potentially generate a sell signal within the overbought territory. Should this occur, it could exacerbate the negative bias for the index in upcoming sessions.

The Ultimate Headline: “The Looming Threat of Market Correction: Navigating the Storm”

The VN-Index witnessed another day of decline, with a tug-of-war session accompanied by below-average trading volume. This cautious investor sentiment persists following the recent strong rally. Notably, the Stochastic Oscillator is now venturing deeper into overbought territory. Investors are advised to exercise caution in the coming days if the indicator flashes a sell signal once again.

“Unleashing the Power of Words: Vietstock Weekly 16-20/12/2024: Navigating Through Hidden Risks”

The VN-Index stalled after three consecutive weeks of gains, with trading volumes remaining below the 20-week average. This reflects a cautious sentiment among investors. Currently, the index sits above the Middle Bollinger Band. If it can sustain this level in the upcoming sessions, the outlook may not be as pessimistic.

Technical Analysis for the Session on December 12: Risk Signals Persist

The VN-Index and HNX-Index rose in tandem, with trading volume also showing significant improvement during the morning session, indicating a renewed sense of optimism among investors.