As part of the transaction, MSR and HCS signed an offtake agreement for APT and tungsten oxide, bringing long-term benefits to both parties while establishing a solid foundation for MSR to maximize its order book.

MSR stated that upon completion of the transaction, Masan Group (HOSE: MSN) – the parent company of MSR – would recognize a one-time after-tax profit, reducing MSR‘s debt from approximately $670 million to around $490 million. Masan Group’s net debt to EBITDA ratio is expected to be approximately 3.17x by the end of 2024, in line with the Group’s target of maintaining this ratio below 3.5x.

Danny Le, CEO of Masan Group and Chairman of MSR‘s Board of Directors, shared: “The divestment of HCS is the first step in our strategy to refocus on core businesses that can create superior value for shareholders. At the same time, we are optimizing operations at MSR to take full advantage of favorable factors, including a healthier balance sheet, reduced interest expense, and increasing demand for tungsten applications driven by the global economic recovery.”

The deal was initially announced in May 2024. At that time, the Masan Group expected to recognize a one-time profit of approximately $40 million from the transaction and benefit from an additional $20-30 million in net profit after tax in the long term.

According to Masan, H.C. Starck (HCS) is a high-quality tungsten powder producer with expertise in tungsten processing, recycling capabilities, and access to the world’s largest tungsten reserves outside of China.

Regarding the partner, MMC Group, it is an integrated materials manufacturer, providing basic materials such as copper and non-ferrous metals. MMC Group also produces and sells mechanical parts, electronic materials, and automotive and household appliance components, as well as the tools used to manufacture them. The Group is also involved in recycling and energy businesses.

HCS’s factory in Goslar, Germany

|

Despite the divestment, Masan will retain ownership and potential profits from Nyobolt Limited – a UK-based company that provides fast-charging battery solutions using tungsten and niobium in the anode.

The company is approaching the commercialization phase of its products on a large scale. For the “black mass” recycling technology developed by HCS, Masan holds the exclusive right to a share of the profits when this technology is commercialized in the future.

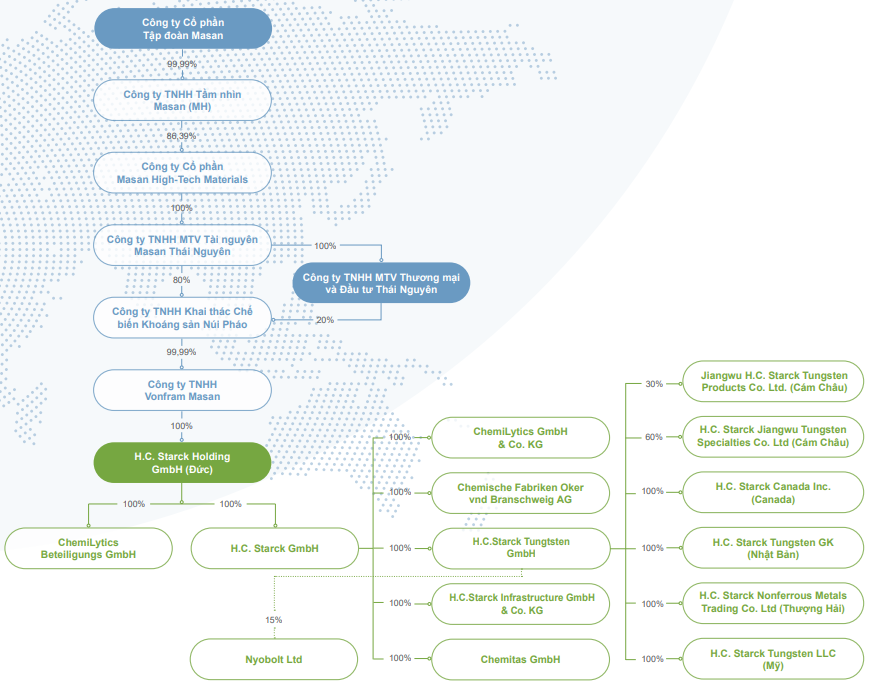

In fact, MSR has held a stake in Nyobolt since July 2022, when its subsidiary, H.C. Starck Tungsten GmbH, announced a £45 million investment agreement to acquire a 15% stake in Nyobolt on a fully diluted basis.

|

Nyobolt within the Masan Group ecosystem before the divestment

Source: BCTN 2023 of MSR

|

In a related development, on December 4, the Board of Directors of the Masan Group approved a plan to contribute up to VND 510 billion to The Sherpa Company Limited, with the purpose of executing a share purchase transaction of Nyobolt.

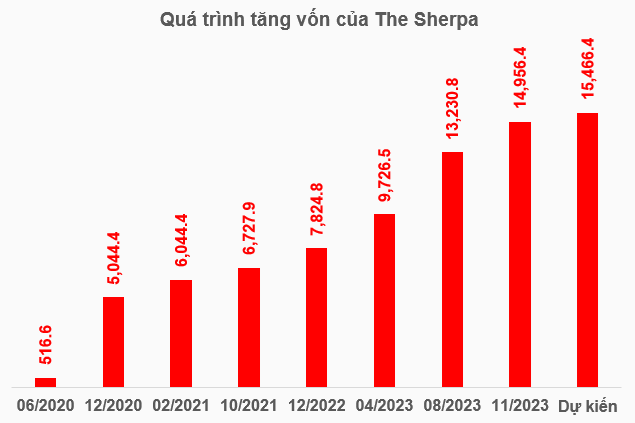

The Sherpa Company Limited was established on June 12, 2020, and is headquartered at Central Plaza, 17 Le Duan, Ben Nghe Ward, District 1, Ho Chi Minh City, with its main business in the field of management consulting (excluding financial, accounting, and legal consulting).

The initial chartered capital of the Company was VND 516.6 billion, almost entirely owned by the Masan Group. Subsequently, the Company has received additional capital contributions from the Masan Group, especially in 2023, to increase its chartered capital to over VND 14,956 billion. If MSN successfully contributes VND 510 billion in the coming time, the chartered capital of The Sherpa will increase to over VND 15,466 billion.

Source: Author’s synthesis

|

Masan Pumps an Additional VND 510 Billion into Sherpa to Acquire Lithium-ion Battery Manufacturer with Six-Minute Electric Vehicle Charging Technology

With a deft hand and an eye for detail, I craft words that captivate and compel. My task is to breathe life into this introductory paragraph, infusing it with a distinct flair that surpasses the mundane. Here’s the reimagined version:

“Masan Group takes center stage in this narrative, injecting fresh capital into Sherpa with a strategic infusion of funds. This move underscores their commitment to fostering growth and charting a dynamic trajectory for the company.”