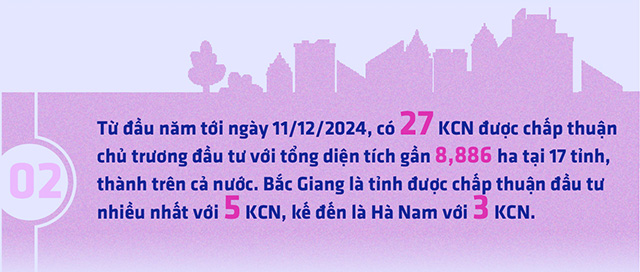

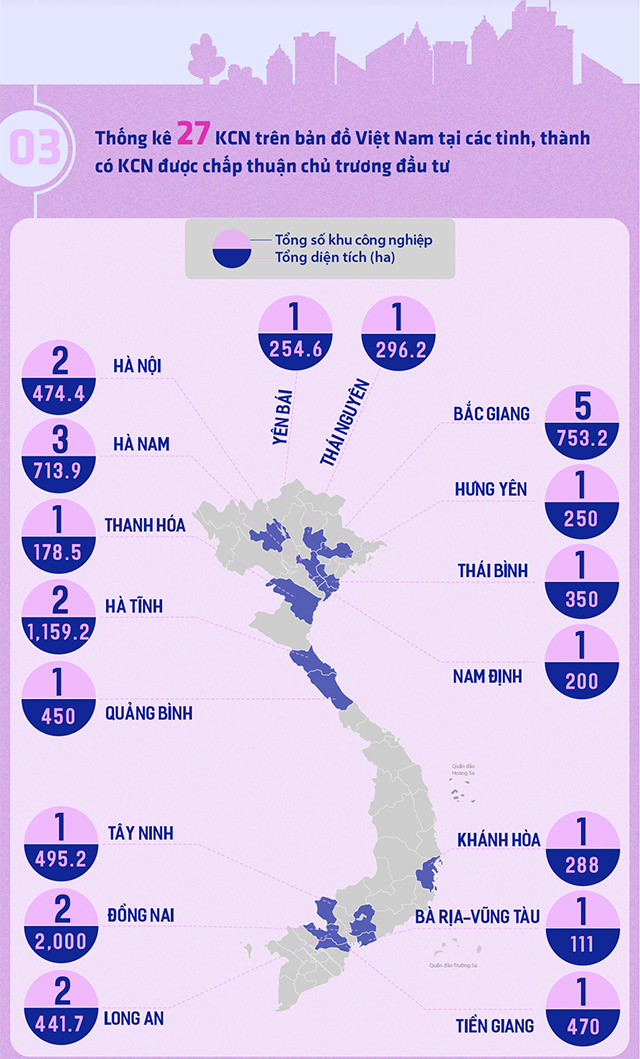

Among the 27 industrial parks (IPs) granted investment licenses, the North leads with 15 projects totaling over 3,292ha; the South has 7 projects with a total area of 3,518ha; and the Central region has 5 projects, spanning nearly 2,076ha.

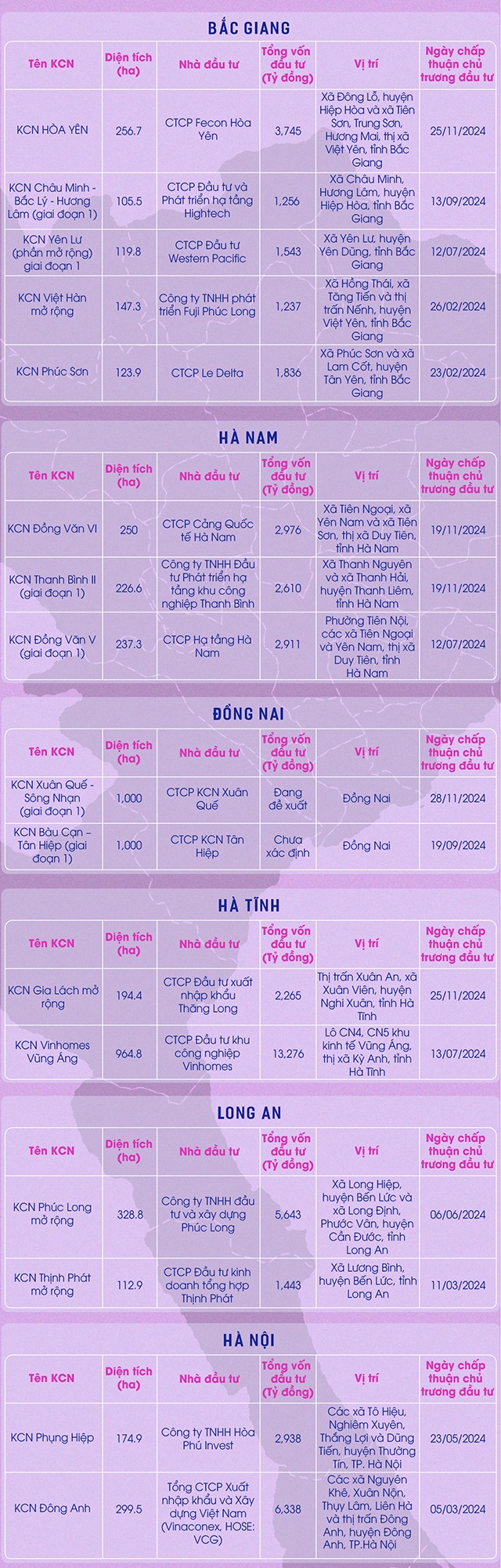

Notably, three IPs with a total investment of more than VND 7.4 trillion were approved for enterprises within the Western Pacific ecosystem of Ms. Pham Thi Bich Hue. These include the 250-hectare Dong Van VI IP with an investment of VND 2,976 billion in Ha Nam province; the 119.8-hectare Yen Lu IP (expansion) phase 1 with an investment of over VND 1,543 billion in Bac Giang province; and the 237.3-hectare Dong Van V IP phase 1 with an investment of over VND 2,911 billion, also in Ha Nam province.

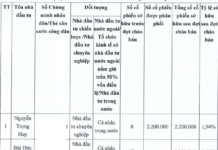

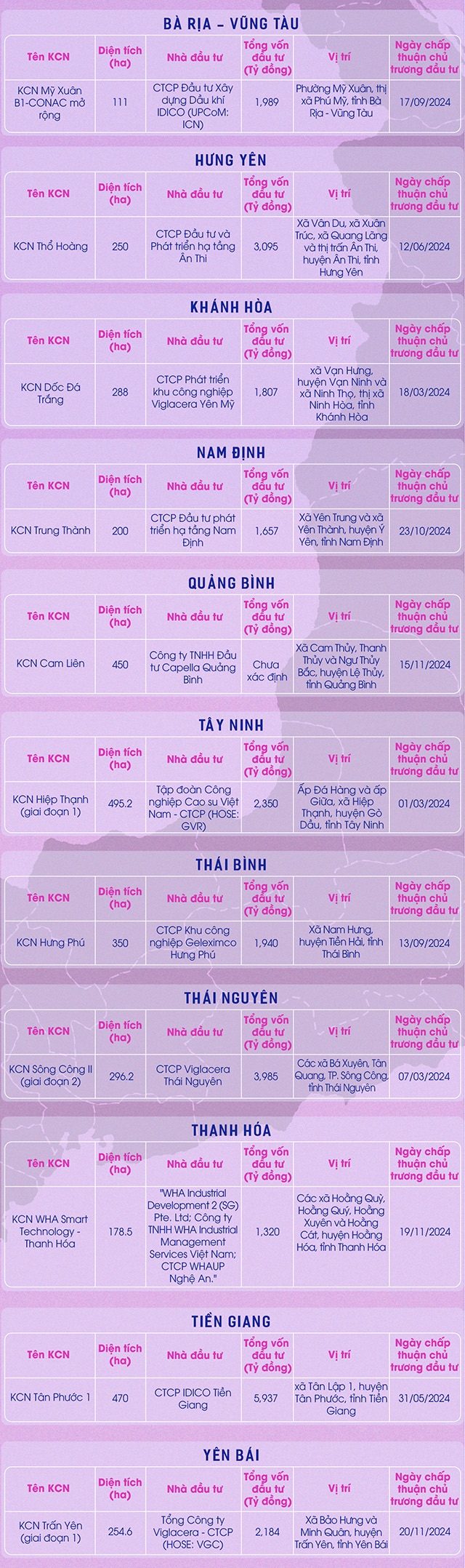

Another enterprise that has been approved for three IPs is Viglacera Corporation (HOSE: VGC). They include the 254.6-hectare Tran Yen IP (phase 1) in Yen Bai province, with a total investment of VND 2,184 billion; the 288-hectare Doc Da Trang IP in Khanh Hoa province, invested by Viglacera Yen My Industrial Park Joint Stock Company (a subsidiary of VGC with a 60% ownership stake) with an investment of VND 1,807 billion; and the 296.2-hectare Song Cong II IP (phase 2) in Thai Nguyen province, invested by Viglacera Thai Nguyen Joint Stock Company (a subsidiary of VGC with a 51% ownership stake) with an investment of VND 3,985 billion.

Meanwhile, the WHA Smart Technology – Thanh Hoa IP with an area of 178.5 hectares and a total investment of VND 1,320 billion is the only project approved for foreign investors from Thailand, including WHA Industrial Development 2 (SG) Pte. Ltd; WHA Industrial Management Services Vietnam Co., Ltd; and WHAUP Nghe An Joint Stock Company.

In terms of size, the Xuan Que – Song Nhan IP (phase 1) and Bau Can – Tan Hiep IP (phase 1), both located in Dong Nai province and spanning 1,000 hectares each, are the largest IPs. The total investment for both projects is pending the investors’ proposals. Following this is the 964.8-hectare Vinhomes Vung Ang IP in Ha Tinh province, with a total investment of VND 13,276 billion, invested by Vinhomes Industrial Park Investment Joint Stock Company – a subsidiary of Vinhomes (HOSE: VHM).

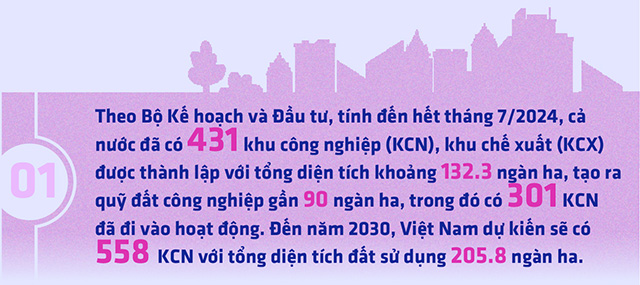

FDI inflows into Vietnam have maintained a growth trajectory over the years, driven by the production shift trend and Vietnam’s competitive advantages, including favorable investment policies, low labor costs, and a stable economy.

Mr. Luu Quang Tien, Deputy Director of Dat Xanh Services Economic-Financial-Real Estate Research Institute (DXS-FERI), stated that FDI has been consistently strong while the growth of industrial land supply has been slow, especially in key provinces that attract FDI in manufacturing and processing industries.

In the first 11 months of 2024, total registered FDI capital reached USD 31.4 billion, a slight increase of 1% compared to the same period last year. The real estate sector ranked second in terms of investment, with a total investment value of nearly USD 5.63 billion, accounting for nearly 18% of the total registered investment capital and an increase of 89% over the same period.

The average occupancy rates in IPs in the North and the South remained stable, with the North achieving 83% and the South reaching 92%.

According to data from Cushman & Wakefield as of Q3 2024, the existing supply of industrial land is approximately 41,000 hectares, with primary asking rents at USD 154/m2/month. The existing supply of built-to-suit factories is 10.3 million m2, with average asking rents of USD 4.8/m2/month. Meanwhile, the existing supply of ready-built warehouses is 7.7 million m2, with average asking rents of USD 4.6/m2/month.

|

|||||||||

|

Thanh Tu

Design: Tuan Tran