As we step into 2025, global stock markets are not only faced with familiar macroeconomic stories such as interest rates and exchange rates but also new uncertainties arising from the next term of US President Donald Trump. Investors are closely monitoring and predicting the changes in economic, financial, and geopolitical policies that Trump 2.0 could bring about.

In this context, Vietnamese investors are no exception, especially given that decisions made in the US can directly impact foreign capital flows and domestic market prospects. Understanding this concern, DNSE Securities organized a livestream program titled “Trump’s Win – Opportunities or Challenges for Stock Investment?”

The program promises to bring the latest updates and in-depth insights into the potential of the stock market during Trump’s second term.

A roundtable discussion with experts will delve into crucial topics to help investors identify opportunities and risks in 2025:

– Can the stock market “revive” as expected?

– VN-Index outlook and key sectors in 2025

– VN-Index review and forecast for 2025

With the participation of experienced analysts, the program is expected to offer sharp insights and diverse perspectives. The analyses and assessments presented at the event will serve as valuable tools for investors to prepare for a new investment cycle, amidst a challenging yet opportunity-laden market landscape.

The livestream will be broadcast live on the official Fanpage and YouTube channel of DNSE Securities Joint Stock Company at 15:00 on December 19, 2024.

SERVICES

The Art of Liquidity: Unveiling the Path to Recovery

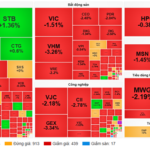

The VN-Index returned to positive territory, maintaining its position above the 200-day SMA. To reinforce this upward trend, trading volume needs to surpass the 20-day average. The Stochastic Oscillator has already signaled a sell-off in the overbought region, while the MACD indicator hints at a narrowing gap with the Signal Line.

“Vietnam’s Strategic Advantage: Prime Minister Vows to Develop Semiconductor Industry”

“Prime Minister Pham Minh Chinh emphasized the development of the semiconductor industry as a strategic breakthrough and a key focus area. He underscored that it is not only a possibility but also a determination, leveraging Vietnam’s unique potential, prominent opportunities, competitive advantages, and strategic direction.”

“Urgent Action Required: Kick-starting the Expansion of the Hochiminh City – Trung Luong – My Thuan Expressway in Q2 2025”

The Government Office has issued Notification No. 558/TB-VPCP dated December 17, 2024, conveying the conclusions of Deputy Prime Minister Tran Hong Ha at the meeting on investing in the expansion of the Ho Chi Minh City – Trung Luong – My Thuan expressway project.