Modern Bank of Vietnam Limited (MBV), a leading commercial bank in Vietnam, has announced updates to its website and email domain.

Effective immediately, the bank’s new website will be: www.mbv.com.vn

Email domain: @mbv.com.vn

Customer support remains accessible 24/7 through the unchanged hotline: 1800 58 88 15

Email for customer support: [email protected]

Prior to this update, on December 18th, Ocean Bank officially rebranded itself as Modern Bank of Vietnam Limited (MBV). This change emphasized the bank’s modern approach and alignment with the MB Group.

MBV assures its customers that the name change does not impact the bank’s operations and that all customer rights and transactions are guaranteed.

On October 17, 2024, OceanBank (now MBV) became a part of the MB Group, marking a significant step in the group’s expansion.

Furthermore, on December 10, 2024, MB officially appointed key leadership positions within the MBV management structure.

Mr. Vu Thanh Trung, Vice Chairman of MB’s Board of Directors, will concurrently serve as Chairman of MBV’s Members’ Council. Meanwhile, Mr. Le Xuan Vu, a member of MB’s Executive Committee, has been appointed as a Member of the Members’ Council and General Director of MBV.

Additionally, MB has appointed Mr. Ha Trong Khiem, Mr. Tran Hai Ha, Mr. Luu Hoai Son, and Mr. Ngo Anh Tuan as Members of the Members’ Council. Mr. Khiem is MB’s Vice President, while Mr. Ha, Mr. Son, and Mr. Tuan head the CIB Block, Planning and Marketing Division, and were members of the previous OceanBank Members’ Council, respectively.

The Supervisory Board of MBV has also been strengthened with the appointment of five members. Ms. Hoang Thi Thu Nguyet will lead the board as its Chairwoman, supported by Ms. Hoang Thi My Linh, Ms. Nguyen Thi Hai Yen, Ms. Nguyen Thi Lan, and Ms. Le Hai Yen as members.

As a member of the MB Group ecosystem, which includes three banks (MB, MBCambodia, and MBV) and six member companies (MBS, MBCapital, MIC, MB Ageas, MBAMC, and Mcredit), MBV is committed to offering innovative, flexible, and optimized financial solutions. This approach will empower customers to maximize financial opportunities in the rapidly digitizing landscape of Vietnam.

According to the latest data released by MBV, the bank has a nationwide presence with 21 branches and 80 transaction offices, employing a total of 2,290 staff members.

Prudential Vietnam and HSBC Vietnam: Forging a Dynamic Bancassurance Alliance

Prudential Vietnam and HSBC Vietnam are proud to announce a strategic bancassurance partnership, combining their expertise to offer tailored financial solutions for the country’s burgeoning affluent market. This collaboration marks a significant step forward in providing comprehensive and innovative financial services to Vietnam’s high-net-worth individuals and families.

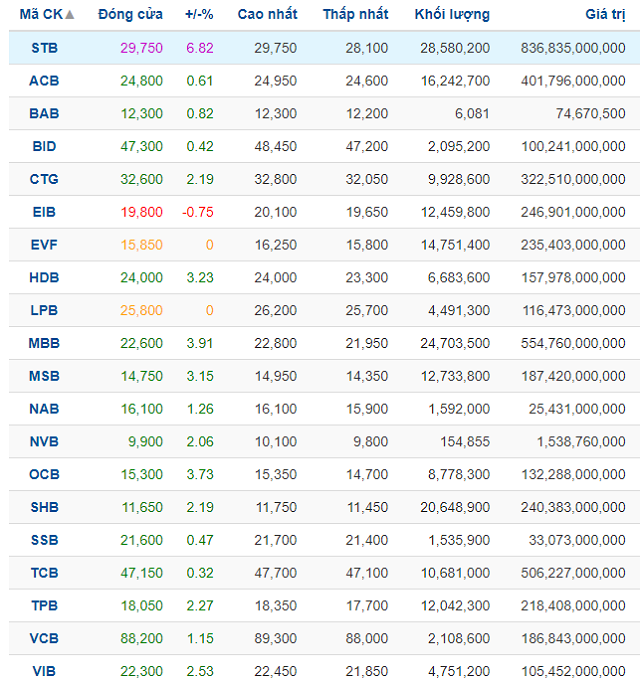

Unlocking the Power of Instant Payments: Eximbank and Visa Introduce Visa Direct

On December 10, 2024, Eximbank, in collaboration with Visa, unveiled Visa Direct, a groundbreaking innovation that transforms the way cross-border financial transactions are conducted. This momentous occasion, held at the Eximbank headquarters, was graced by the presence of the bank’s leadership, representatives from Visa, and esteemed guests, signifying a pivotal milestone in the journey of embracing innovation and transformation.

“Eximbank Receives Approval from State Bank of Vietnam to Amend Chartered Capital to Over VND 18,688 Billion”

On November 25, 2024, the State Bank of Vietnam approved a change in the charter capital of the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank, HOSE: EIB). As a result, Eximbank’s charter capital has been adjusted to VND 18,688,106,070,000 (eighteen thousand six hundred and eighty-eight billion one hundred and six million seventy thousand dong).

Unleash the Festive Cheer and Elevate Your Business with Techcombank: Win a Share of the VND 5 Billion Prize Pool!

“As the year draws to a close, Techcombank is thrilled to announce its new program, ‘Festive Season, Business Boost’, designed to accelerate small and medium-sized enterprises’ success. With a total value of up to 5 billion VND, the program offers an array of enticing benefits. To boost businesses’ luck during this festive season, Techcombank will be awarding monthly grand prizes, including a European tour and three VinFast automobiles. The program, running until January 31, 2025, is sure to bring a boost to businesses as they close out the year.”