Fed Decision Boosts USD, Divides Commodity Markets

Q.L. • 12/19/2024 – 09:35

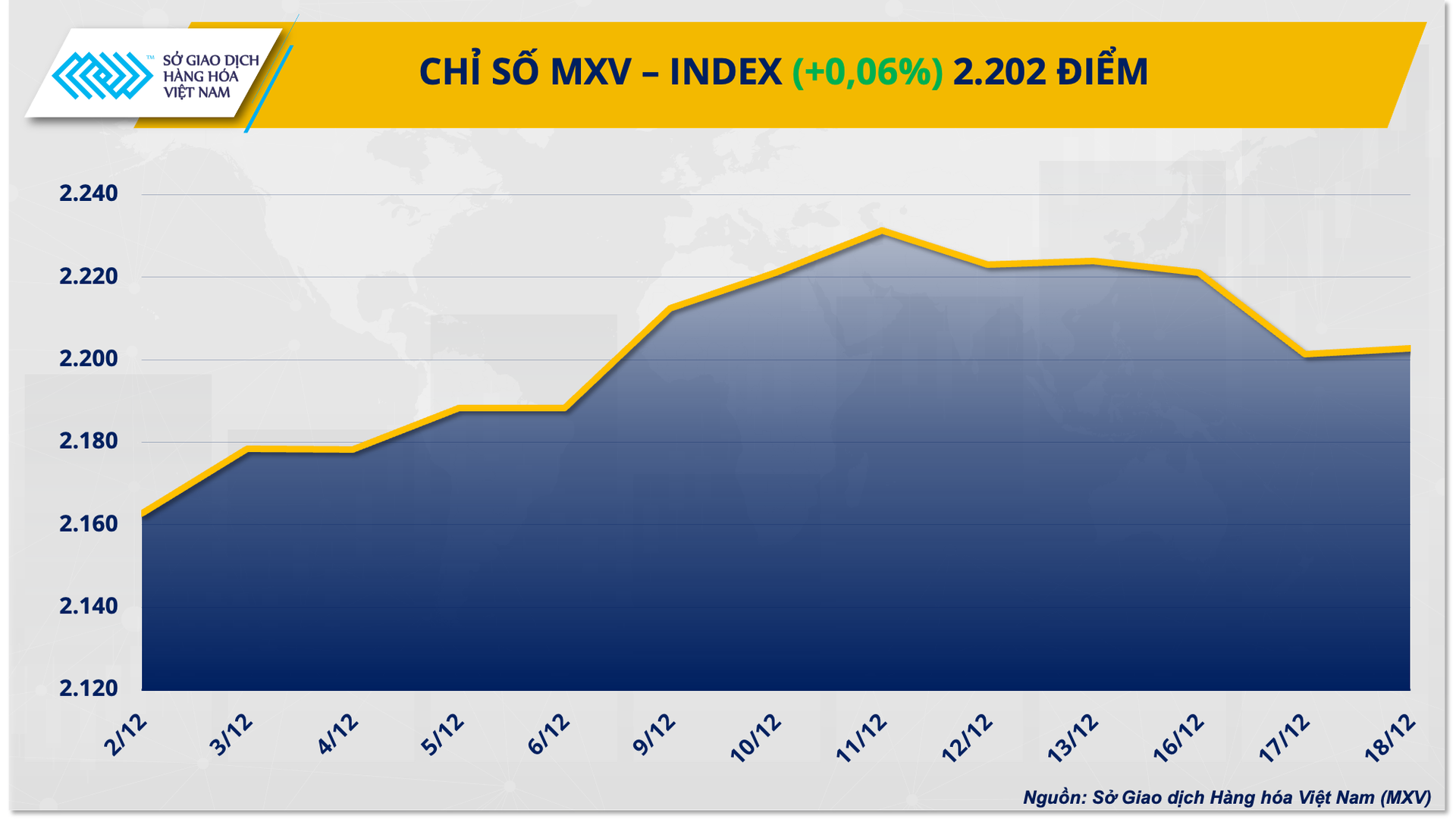

According to the Vietnam Commodity Exchange (MXV), global commodity markets showed mixed performances during yesterday’s trading session (December 18th).

Notably, industrial raw materials led the market’s gains, with cocoa prices surging nearly 7% and setting a new all-time high. The energy sector also witnessed a rebound, with 4 out of 5 commodities posting increases. At the close, buying pressure pushed the MXV-Index slightly higher by 0.06% to 2,202 points.

Energy Markets React Differently to Fed Decision

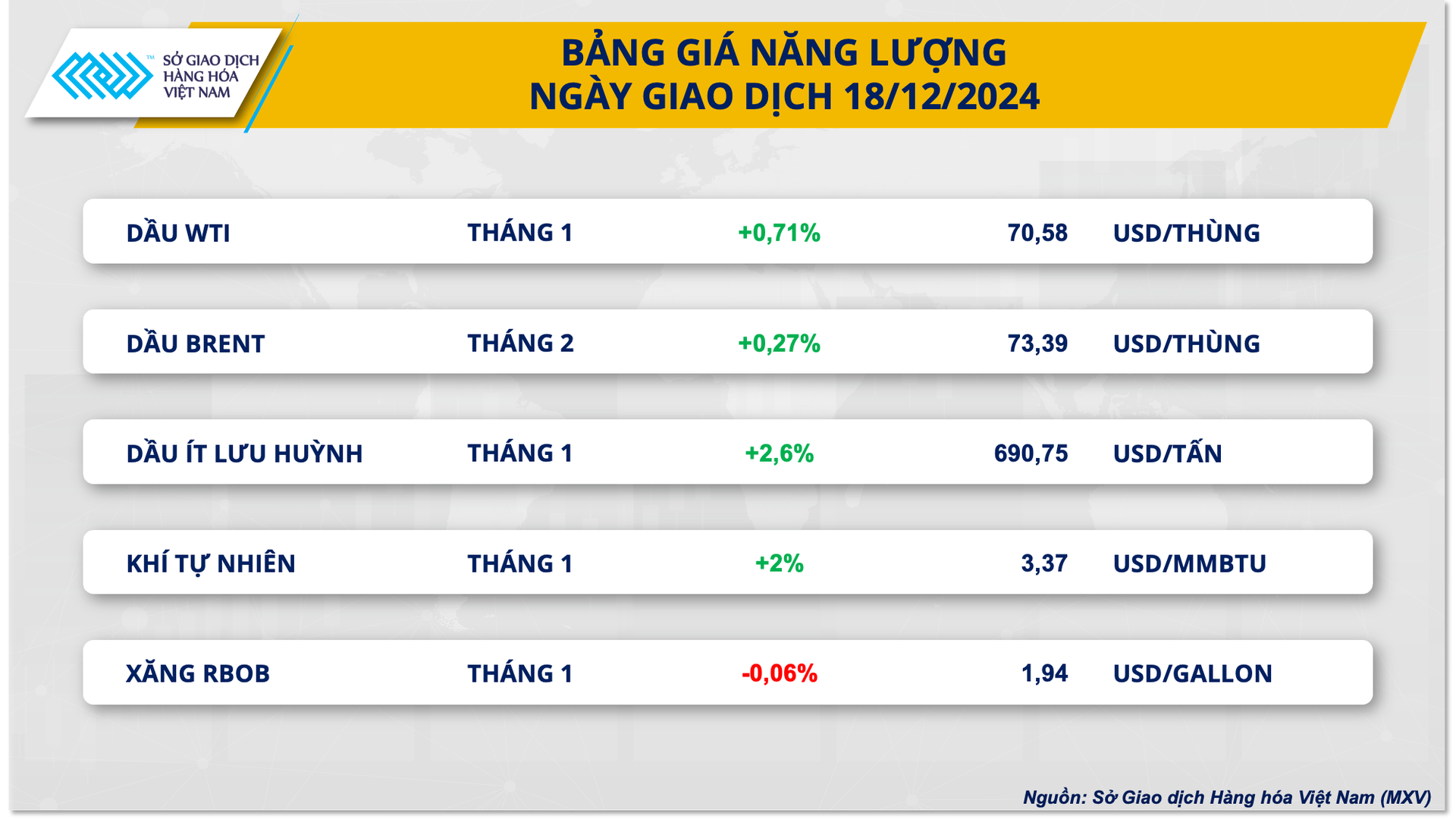

Crude oil prices fluctuated during yesterday’s session as markets reacted differently to the interest rate decision by the US Federal Reserve (Fed) and US crude oil inventory data.

WTI crude oil prices rose 0.71% to $70.58 per barrel, while Brent crude oil prices increased by 0.27% to $73.39 per barrel.

In its weekly Petroleum report, the US Energy Information Administration (EIA) stated that US commercial crude oil inventories decreased by 934,000 barrels from the previous week to just under 421 million barrels. Although the inventory draw reported by the EIA was lower than the 4.7 million barrel decline reported by the American Petroleum Institute a day earlier and fell short of the expected 1.6 million barrel decrease anticipated by analysts, it still had a bullish impact on oil prices during yesterday’s session.

Additionally, Kazakhstan’s decision to delay its planned production increase supported oil prices. Specifically, Kazakhstan announced that it would adhere to the OPEC+ quota and put on hold its plans to boost output by 190,000 barrels per day in 2025.

At its December policy meeting, the Fed cut interest rates by 25 basis points to a range of 4.25-4.50%, in line with market expectations. However, the Fed also signaled that it would slow down the pace of rate cuts in 2025, given the relatively stable unemployment rate in the US and the lack of significant improvement in inflation recently. Fed policymakers projected only two additional 25 basis point rate cuts in the upcoming year. The Fed’s decision boosted the US dollar to its strongest level since late 2022, making commodities priced in dollars, like oil, more expensive for international buyers and hindering price increases.

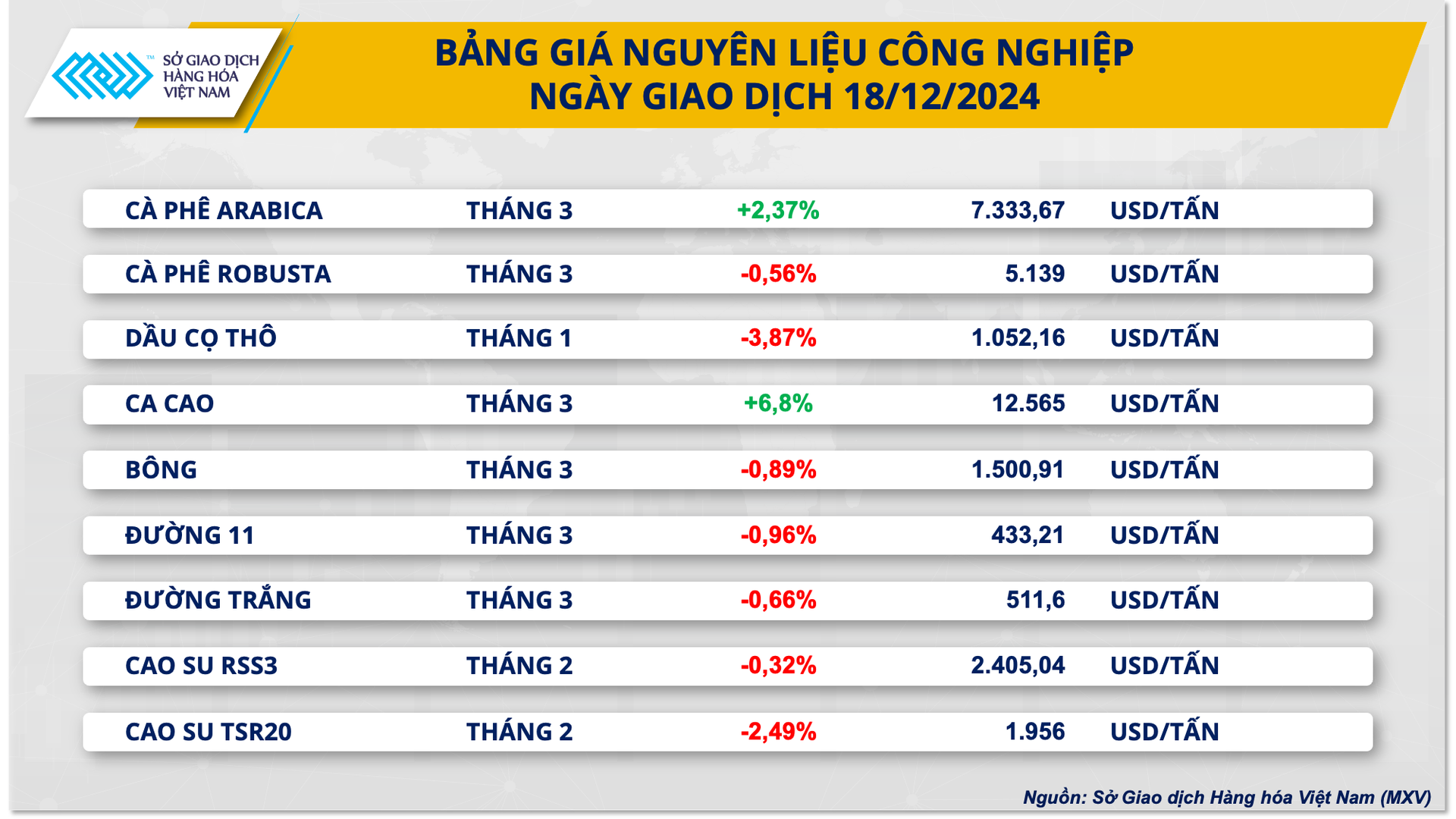

Bearish Sentiment in Industrial Raw Materials Market

At the end of yesterday’s trading session, the industrial raw materials sector was dominated by red figures. Cocoa stood out as it went against the sector’s trend, with prices surging nearly 7% and reaching a new historical peak. The main driver behind cocoa’s continued price rally is the adverse weather conditions and tight supply from West Africa, which accounts for about three-quarters of global production. Additionally, speculative buying towards the end of the year further exacerbated the situation.

In Côte d’Ivoire, farmers in most cocoa-growing regions are concerned about the lack of rainfall and high temperatures, which have hindered the development of the main crop season (October to March). This year, the dry season started earlier than usual, in November, heightening fears of drought and reduced yields.

Previously, cooperatives, buyers, and purchasing agents reported that the majority of the main crop harvest was completed in November, and the shortage is expected to persist until February or March. Meanwhile, multinational exporters worry about the risk of contract defaults as they estimate that farmer supply will not meet demand and could even decrease in the coming months due to crop failures.

Regarding exports, consulting firm StoneX estimates that cocoa arrivals at Côte d’Ivoire’s ports during the 2024-2025 crop year have increased by more than 30% compared to the same period in the previous crop year. However, they have decreased by 10-28% compared to the same period in the previous four crop years. This, coupled with low production in Ghana, the world’s second-largest cocoa producer in recent seasons, has pushed ICE-US inventories down to just over 1.4 million bags, the lowest level on record.

Coffee prices showed a mixed performance in response to contrasting fundamental factors. Specifically, Arabica coffee prices rose by 2.37%, while Robusta coffee prices decreased by 0.56% compared to the reference price.

Concerns about drought in Brazil are pushing prices higher. According to Somar Meteorology, rainfall in Minas Gerais, Brazil’s largest Arabica-producing state, reached only 35.2 mm last week, equivalent to 65% of the state’s historical average. As a result, Brazil’s main coffee-growing regions have consistently recorded low rainfall since April, negatively affecting the development of the 2025-2026 coffee crop and leading to a less optimistic supply outlook.

The Art of Monetary Policy: Navigating the Financial Landscape with a $54 Trillion Twist

The State Bank of Vietnam (SBV) has been reducing liquidity support for the system as interbank interest rates have plummeted in recent sessions.

The Greenback Gallops On: USD Bank Rates Surge to New Highs

Today, the bank has increased its USD selling price to a record high of VND 25,512. This move underscores the bank’s confidence in the strength of the USD and its commitment to offering competitive exchange rates. With this new rate, customers can expect to get even more value for their money when conducting transactions involving the USD.