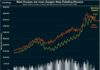

The Vietnamese stock market has just witnessed an impressive acceleration. After a stagnant morning session, VN-Index started receiving positive signals in the afternoon with a strong boost mainly from the Bluechips group. At the same time, several stock groups shone in unison, including Securities, Banking, and Real Estate, propelling the main index to soar and extend its gains.

This unexpected “acceleration” by VN-Index seemed to relieve investors’ anxiety. **At the market close on December 5, VN-Index surged 27.12 points (+2.19%) to 1,267.53, while HNX-Index gained 4.98 points to 229.6**. This was the strongest gain for the index in over three months since August 16.

The over 2% increase even made VN-Index the best-performing index in Asia on December 5. The market capitalization on HoSE also rose by VND 112,000 billion to over VND 5,200,000 billion.

In terms of contributions, the VN30 basket ended the session with 29 codes unanimously rising, including one code that rose to the maximum limit. The focus was on SSI stock, which turned purple and became one of the pillars supporting the overall market’s ascent.

Looking at individual stocks, BID became the market’s biggest “contributor” with a 2.1-point increase for VN-Index. At the close, BID shares rose nearly 2% to VND 46,000 per share.

Following BID, HPG, the leading stock in the steel industry, contributed 1.8 points to the overall market. With a 4.3% gain, HPG shares advanced to VND 27,850 per share, marking the highest level in over four months. Next in line, [FPT] shares once again hit a historical peak at VND 148,500 per share, thereby contributing 1.6 points to the VN-Index.

Additionally, other bank stocks like CTG contributed 1.4 points, VCB contributed 1.4 points, and TCB, VPB, and MBB collectively contributed 2.66 points to the main index.

Another bright spot in today’s session was the positive and proactive participation of cash flow, with bottom-fishing in stocks. The total trading value on HoSE exceeded VND 21,041 billion, of which the matched order value reached nearly VND 19,200 billion, a 60% increase compared to the previous session and the highest level in over two months. The return of foreign investors, who net bought VND 775 billion on HoSE, also bodes well for the market.

On the other hand, stocks that somewhat curbed the rise of VN-Index, apart from HVN, included the Viettel group of stocks, with VTP plunging to the floor price, and CTR, which sank deeply, going against the general market trend and becoming a drag on the market.

Sharing insights on market trends on the December 2 Khớp Lệnh program, Mr. **Tran Hoang Son, Market Strategy Director of VPBankS**, stated that VN-Index has firmly established its bottom around the 1,200-point level. Mr. Son also maintained his view that there would be a “gift” for investors during this Tet holiday. Accordingly, investors who buy stocks around the 1,200-point level and hold them from November to April of the following year are likely to profit from selling at higher prices.

On another note, in a recent sharing, Ms. **Do Hong Van, Head of FiinGroup’s Analysis Department**, opined that in 2024, corporate profits would still grow steadily by 20% year-over-year, driven by exports and rebounding demand in sectors such as retail, entertainment and tourism, and food.

According to the FiinGroup expert, the growth story in 2025 will depend more on domestic factors than external ones, with impetus from accelerating public investment, improving private investment, and the recovering real estate market. Businesses benefiting from these drivers will continue to maintain profit growth in 2025.

The Market Pulse: Is the Risk of Adjustment Rising?

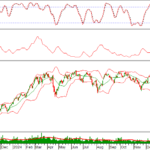

The VN-Index witnessed a significant decline, forming a bearish Falling Window candlestick pattern and dipping below the Middle Bollinger Band. This suggests a potential shift in market sentiment. The volume also spiked above the 20-day average, indicating heightened investor anxiety. The Stochastic Oscillator is firmly in oversold territory and continues to signal a sell-off. If the MACD also turns bearish in the coming days, the likelihood of a more pronounced correction will increase.

A New Vision for Vietnam’s Financial Sector: The Eight Key Tasks for the Capital Markets in 2025

On December 18, 2024, the State Securities Commission of Vietnam (SSC) organized a conference to review its regulatory and supervisory performance in 2024 and outline its objectives for 2025. The event was chaired and directed by Mr. Nguyen Van Thang, the country’s Minister of Finance.

Trump 2.0: Opportunity or Challenge for Stock Investors?

The upcoming livestream, “Trump’s Election Win: Opportunity or Challenge for Stock Investors?” airing at 3:00 PM on December 19, 2024, on the official Fanpage and YouTube channel of DNSE Joint Stock Securities Company, promises to deliver sharp insights and a multifaceted perspective on the 2025 stock market outlook.

The Art of Liquidity: Unveiling the Path to Recovery

The VN-Index returned to positive territory, maintaining its position above the 200-day SMA. To reinforce this upward trend, trading volume needs to surpass the 20-day average. The Stochastic Oscillator has already signaled a sell-off in the overbought region, while the MACD indicator hints at a narrowing gap with the Signal Line.

Technical Analysis for the Session on December 19th: Unexpectedly Gloomy Sentiment

The VN-Index and HNX-Index both witnessed declines, alongside a significant surge in trading volume during the morning session, indicating a prevailing sense of pessimism among investors.