(Illustrative image. Dong Thuy/VNA)

|

The latest forecast by Oxford Economics suggests that Vietnam’s economic growth will outpace that of the six largest economies in the Association of Southeast Asian Nations (ASEAN-6) in the coming years.

Oxford Economics has identified several growth drivers for Vietnam and particularly highlighted the potential boost from emerging trends in the semiconductor and Artificial Intelligence (AI) industries.

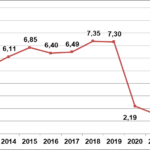

According to the forecast, Vietnam’s GDP is expected to reach 6.7% in 2024 and 6.5% in 2025, supported by a robust manufacturing sector and a quick rebound in domestic demand. The main growth driver for Vietnam in the coming year will continue to be exports of processed and manufactured goods.

Private consumption and domestic business activities are witnessing a strong recovery. Consumption growth has returned to pre-COVID-19 levels, driven by rising wages in 2025, particularly in the foreign direct investment (FDI) sector. In 2022, workers in the FDI sector earned approximately 14% more than those in the non-state sector.

The tourism industry is also a significant contributor, although its impact may be slightly lower in 2024. In 2023, tourism contributed 6.6% to nominal GDP. Vietnam ranked second in Asia, after Japan, in terms of benefiting from the recovery of the tourism industry this year. The spillover effect from tourism-related income will further boost domestic consumption.

Vietnam is also known for its role in the semiconductor industry as a hub for packaging and testing, with prominent factories from Intel and Amkor Technology.

While global semiconductor demand is expected to slow down next year, it will still play a positive role. Stockpiling after supply chain disruptions has led to excess inventories, and demand in the automotive, phone, and computer segments has weakened. Export indices in Asia indicate a slowdown in the volume of semiconductor exports since the beginning of this year.

In Vietnam, this is reflected in the decline in electronic component production since mid-2024, and the output of related electronic accessories is also less prominent.

Oxford Economics predicts that new drivers for the manufacturing sector will emerge in 2025, particularly in AI-related fields, with increased investment in data centers globally. Other major export items, such as machinery and electrical equipment, textiles, and agricultural products, are also forecast to continue growing. Additionally, accelerated export orders next year due to concerns over rising tariffs will compensate for the short-term weakness in electronics demand.

Researchers from Oxford Economics stated, “The US’s loose fiscal policy will also present a good opportunity for Vietnam next year, as the US is Vietnam’s largest export market.”

Oxford Economics observed that FDI inflows are expected to continue, albeit at a slower pace. It forecasts investment growth of 7.2% in 2025, higher than the projected 6.9% for this year.

According to Oxford Economics, FDI inflows into Vietnam may slow down at the beginning of next year due to uncertainties about potential US tariffs on Vietnamese goods. If imposed, a 10% tariff would apply to automobiles, metals, and solar panels. Additionally, there would be no negative impact from US tariffs in 2025 due to a time lag between the announcement and implementation of such measures.

The effects of tariffs may only appear from 2026 onwards, but Vietnam’s strong production foundation will enable a relatively quick recovery.

Oxford Economics’ optimistic forecast aligns with the predictions of other international financial institutions and organizations. Previously, the Asian Development Bank (ADB) upgraded its projections for Vietnam to 6.4% this year and 6.6% in 2025.

HSBC also believes that Vietnam’s GDP growth could reach 7% in 2024 and 6.5% in 2025, the highest among the ASEAN-6 countries. Standard Chartered forecasts a robust expansion of 6.7% for Vietnam in 2025, while UOB predicts a growth rate of 6.6% for the same year, the highest in the ASEAN-6 bloc.

Tho Anh

“Vietnam’s Strategic Advantage: Prime Minister Vows to Develop Semiconductor Industry”

“Prime Minister Pham Minh Chinh emphasized the development of the semiconductor industry as a strategic breakthrough and a key focus area. He underscored that it is not only a possibility but also a determination, leveraging Vietnam’s unique potential, prominent opportunities, competitive advantages, and strategic direction.”

The World Sells 1 Trillion Chips a Year: What’s in It for Vietnam?

The global semiconductor industry took 66 years to reach the $500 billion mark, but it needed just nine more to sprint to the $1 trillion milestone. Meanwhile, foreign-invested enterprises dominate the chip design and packaging industry in Vietnam, leaving us with near-zero ownership of chip products.

The Government Proposes to Legalize Digital Assets to Curb Risks

On November 23rd, the government presented the draft Law on Digital Technology Industry to the National Assembly, as part of its ongoing 8th session.